As

filed with the Securities and Exchange Commission on February 7,

2006

Registration

No. 333-

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington

D.C. 20549

________________________

FORM

SB-2

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

_______________________

WPCS

INTERNATIONAL INCORPORATED

(Name

of small business issuer in its charter)

|

Delaware

|

4899

|

98-0204758

|

|

(State

or other Jurisdiction

of

|

(Primary

Standard Industrial

|

(I.R.S.

Employer Identification

No.)

|

|

Incorporation

or

Organization)

|

Classification

Code

Number)

|

One

East Uwchlan Avenue

Suite

301

Exton,

PA 19341

(610)

903-0400

(Address

and telephone number of principal executive offices and principal place

of

business)

Andrew

Hidalgo, Chief Executive Officer

One

East Uwchlan Avenue

Suite

301

Exton,

PA 19341

(610)

903-0400

(Name,

address and telephone number of agent for service)

__________________________

Copies

of all communications, including communications sent to agent for service,

should be sent to:

|

Marc

J. Ross, Esq.

Thomas

A. Rose, Esq.

Sichenzia

Ross Friedman Ference LLP

1065

Avenue of the Americas, 21st

Flr.

New

York, New York 10018

(212)

930-9700

(212)

930-9725 (fax)

|

Merrill

M. Kraines, Esq.

Manuel G.

R. Rivera, Esq.

Fulbright

& Jaworski L.L.P.

666

Fifth Avenue

New

York, New York 10103

(212)

318-3000

(212)

318-3400 (fax)

|

_______________

Approximate

date of proposed sale to the public:

As

soon

as practicable after this Registration Statement becomes effective.

If

this

Form is filed to register additional securities for an offering pursuant

to Rule

462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration

statement for the same offering. o

If

this

Form is a post-effective amendment filed pursuant to Rule 462(c) under

the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the

same

offering. o

If

this

Form is a post-effective amendment filed pursuant to Rule 462(d) under

the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the

same

offering. o

If

delivery of the prospectus is expected to be made pursuant to Rule 434,

please

check the following box. o

CALCULATION

OF REGISTRATION FEE

|

|

|

Proposed

Maximum

|

|

Proposed

Maximum

|

|

|

||

|

Title

of Each Class of

|

|

Amount

|

|

Aggregate

|

|

Aggregate

|

|

Amount

of

|

|

Securities

to be Registered

|

|

to

be Registered

|

|

Price

per Security (1)

|

|

Offering

Price

|

|

Registration

Fee (1)

|

|

Common

stock, $0.0001 par value

|

|

2,300,000 shares

(2)

|

|

$11.915

|

|

$27,404,500

|

|

$2,932.28

|

| (1) |

Estimated

solely for the purpose of calculating the registration fee

pursuant to

Rule 457(c) under the Securities Act of 1933, as amended, based

upon

$11.915, the average of the high and low sale prices of the

registrant’s

common stock as reported on the NASDAQ Capital Market on February

2,

2006.

|

|

(2)

|

Includes

up to 300,000 shares attributable to shares of common stock

that may be

purchased by the underwriters under an option to purchase additional

shares to cover over-allotments, if

any.

|

_________________________________

The

registrant hereby amends this registration statement on such date or dates

as

may be necessary to delay its effective date until the registrant shall

file a

further amendment which specifically states that this registration statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the registration statement shall become

effective on such date as the Commission, acting pursuant to said

Section 8(a), may determine.

|

The

information in this prospectus is not complete and may be changed.

We may

not sell these securities until the registration statement filed

with the

Securities and Exchange Commission is effective. This prospectus

is not an

offer to sell these securities and it is not soliciting an offer

to buy

these securities in any state where the offer or sale is not

permitted.

|

Subject

To Completion, Dated , 2006

Preliminary

Prospectus

2,000,000

Shares

Common

Stock

We

are

offering 2,000,000 shares of our common stock. We have granted the

underwriter a 30-day option to purchase up to an additional 300,000 shares

to cover over-allotments.

Our

common stock is traded on the NASDAQ Capital Market under the symbol “WPCS.” We

will apply to have our common stock approved for quotation on the NASDAQ

National Market under the symbol “WPCS” to be effective upon completion of this

offering. No assurances can be given that our common stock will be approved

for

quotation on the NASDAQ National Market. On February 6, 2006, the last

reported

sale price of our common stock on the NASDAQ Capital Market was $12.05

per

share.

Investing

in these securities involves significant risks. See

“Risk Factors” beginning on page 5.

|

Per

Share

|

|

Total

|

|||||

|

Public

Offering

Price...........................................................................................................................................

|

$

|

$

|

|||||

|

Underwriting

discount.......................................................................................................................................

|

$

|

$

|

|||||

|

Proceeds

to WPCS, before

expenses...............................................................................................................

|

$

|

$

|

The

underwriters expect to deliver the shares on or

about ,

2006.

Neither

the Securities and Exchange Commission nor any state securities commission

has

approved or disapproved of these securities or determined if this prospectus

is

truthful or complete. Any representation to the contrary is a criminal

offense.

PUNK,

ZIEGEL & COMPANY

The

date

of this prospectus is , 2006.

TABLE

OF CONTENTS

|

Page

|

|||

|

Prospectus

Summary......................................................................................................................................................................................................................................................................................................................................

|

1

|

||

|

Risk

Factors.....................................................................................................................................................................................................................................................................................................................................................

|

5

|

||

|

Use

of

Proceeds...............................................................................................................................................................................................................................................................................................................................................

|

|

11

|

|

|

Price

Range of Common

Stock......................................................................................................................................................................................................................................................................................................................

|

12

|

||

|

Dividend

Policy...............................................................................................................................................................................................................................................................................................................................................

|

12

|

||

|

Capitalization...................................................................................................................................................................................................................................................................................................................................................

|

13

|

||

|

Selected

Consolidated Financial

Information.............................................................................................................................................................................................................................................................................................

|

|

14

|

|

|

Management’s

Discussion and Analysis of Financial

Condition and Results of Operations

..........................................................................................................................................................................................................

|

15

|

||

|

Business...........................................................................................................................................................................................................................................................................................................................................................

|

26

|

||

|

Management....................................................................................................................................................................................................................................................................................................................................................

|

33

|

||

|

Executive

Compensation................................................................................................................................................................................................................................................................................................................................

|

36

|

||

|

Certain

Relationships and Related

Transactions.......................................................................................................................................................................................................................................................................................

|

40

|

||

|

Principal

Stockholders....................................................................................................................................................................................................................................................................................................................................

|

41

|

||

|

Description

of

Securities................................................................................................................................................................................................................................................................................................................................

|

42

|

||

|

Shares

Eligible for Future

Sale......................................................................................................................................................................................................................................................................................................................

|

44

|

||

|

Underwriting....................................................................................................................................................................................................................................................................................................................................................

|

45

|

||

|

Disclosure

of Commission Position on Indemnification

for Securities Act

Liabilities.........................................................................................................................................................................................................................

|

46

|

||

|

Legal

Matters...................................................................................................................................................................................................................................................................................................................................................

|

47

|

||

|

Experts...............................................................................................................................................................................................................................................................................................................................................................

|

47

|

||

|

Where

You Can Find Additional

Information.............................................................................................................................................................................................................................................................................................

|

47

|

||

| Index to Financial Statements........................................................................................................................................................................................................................................................................................................................ | F-1 |

You

should rely only on the information contained in this prospectus. We have

not,

and the underwriter has not, authorized anyone to provide you with information

that is different. This prospectus is not an offer to sell, nor is it seeking

an

offer to buy, these securities in any jurisdiction where the offer or sale

of

these securities is not permitted. You should assume that the information

contained in this prospectus is accurate as of the date on the front of

this

prospectus only. Our business, financial condition, results of operations

and

prospects may have changed since that date.

All

information contained herein relating to shares and per share data has

been

adjusted to reflect a 1:12 stock split effected on January 10,

2005.

All

references herein to our fiscal year and our fiscal year end represent

the

twelve months ended April 30 and April 30, respectively, and all references

herein to our fiscal quarters ended refer to July 31, October 31 and January

31,

as appropriate.

This

prospectus includes market and industry data that we obtained from internal

research, publicly available information and industry publications. Our

internal

research is based on management’s understanding of industry conditions and has

not been verified by any independent sources. Industry publications generally

stated that the information they contain has been obtained from sources

believed

to be reliable. Neither we nor the underwriter make any representation

as to the

accuracy of such information.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus.

This

summary does not contain all of the information that you should consider

before

investing in our common stock. You should read the entire prospectus

carefully,

including the section entitled “Risk Factors” and the consolidated financial

statements and accompanying notes included elsewhere in this prospectus,

before

making an investment decision. Unless the context clearly indicates

otherwise,

references in this prospectus to “we,” “us,” “our” and “WPCS” refer to WPCS

International Incorporated and its subsidiaries on a consolidated

basis.

Our

Company

WPCS

International Incorporated designs and deploys wireless networks.

We provide

design-build engineering services for specialty communication systems

and

wireless infrastructure. Specialty communication systems are wireless

networks

designed to improve productivity for a specified application by communicating

data, voice or video information in situations where land line networks

are

non-existent, more difficult to deploy or too expensive. Wireless

infrastructure

services include the engineering, installation, integration and maintenance

of

wireless carrier equipment.

Wireless

technology has advanced substantially to the point where wireless

networks have

proven to be an effective alternative to land line networks, a key

factor in its

broad acceptance. We believe the use of dedicated wireless networks

for

specified applications has improved productivity for individuals

and

organizations alike. Demand for wireless data services is accelerating

the

adoption of new technologies that enable wireless networks to deliver

enhanced

features and capabilities. These new technologies have increased

the complexity

of wireless systems, and created demand for the services of companies

such as

ours with specialized skills to address that complexity.

With

seven offices across the United States, we provide our services to

our customers

nationwide. Because we are technology and vendor independent, we

can integrate

multiple products and services across a variety of communication

requirements,

creating the most appropriate solution for our customers. Wireless

communication

is primarily achieved through radio frequency, or RF, signals. We

have extensive

experience in RF engineering, a necessary skill in designing wireless

networks

free from interference with other signals and amplified sufficiently

to carry

data, voice or video with speed, accuracy and reliability. We believe

the

strength of our experience in the design and deployment of specialty

communication systems gives us a competitive advantage, and has supported

our

rapid growth, both organically and through acquisitions.

Our

goal

is to become a recognized leader in the design and deployment of

wireless

networks for specialty communication systems and wireless infrastructure.

For

the fiscal year ended April 30, 2005, we generated revenues of $40.1

million, an

increase of 81.9% from the fiscal year ended April 30, 2004. For

the six months

ended October 31, 2005, we generated revenues of $26.4 million, an

increase of

50.3% over the comparable period in 2004, and net income of $1.1

million, an

approximate tenfold increase over the comparable period in 2004. Our

backlog at October 31, 2005 was approximately $19 million.

Our

Strategy

Our

strategy focuses on both organic growth and the pursuit of acquisitions

that add

to our engineering capacity and geographic coverage. Specifically,

we will

endeavor to:

|

·

|

Increase

customer awareness by marketing the full range of our

services to our

customers;

|

|

·

|

Maintain

and expand our focus in existing vertical markets such

as public safety

and gaming, and develop expertise in new vertical markets;

|

|

·

|

Strengthen

our relationships with technology providers whose products

offer benefits

to our customers; and

|

|

·

|

Seek

strategic acquisitions of compatible businesses that

can be assimilated

into our organization and that will add accretive earnings

to our

business.

|

1

Our

Customers

Our

customers include corporations, government entities and educational

institutions. In our specialty communication systems segment, we believe

our

design and deployment of innovative wireless networks specific to the

needs of

customers in certain vertical markets has brought us recognition in these

markets. We have worked with public safety customers such as the California

Department of Transportation, or CALTRANS, gaming customers such as Bally’s, and

healthcare customers such as Wake Forest University Baptist Hospital.

In our

wireless infrastructure services segment, our customers are major wireless

service providers such as Sprint Nextel.

Risks

Affecting Us

Our

business is subject to numerous risks, as discussed more fully in the

section

entitled “Risk Factors” immediately following this prospectus summary,

including:

|

·

|

Our

success is dependent on growth in the deployment of wireless

networks, and

to the extent that such growth slows down, our revenues may

decrease and

our ability to continue operating profitably may be

harmed;

|

|

·

|

We

have a limited history of profitability which may not continue;

|

|

·

|

If

we fail to accurately estimate costs associated with our

fixed-price

contracts using percentage-of-completion, our actual results

may vary from

our assumptions, which may reduce our profitability or impair

our

financial performance;

|

|

·

|

Failure

to properly manage projects may result in unanticipated costs

or claims;

|

|

·

|

The

industry in which we operate has relatively low barriers

to entry and

increased competition could result in margin erosion, which

would make

profitability even more difficult to

sustain;

|

|

·

|

Our

business depends upon our ability to keep pace with the latest

technological changes, the failure to which could make us

less competitive

in our industry;

|

|

·

|

Our

failure to attract and retain engineering personnel or maintain

appropriate staffing levels could adversely affect our business;

|

|

·

|

If

we are unable to identify and complete future acquisitions,

we may be

unable to continue our growth;

|

|

·

|

Future

acquired companies could be difficult to assimilate, disrupt

our business,

diminish stockholder value and adversely affect our operating

results;

|

|

·

|

We

derive a significant portion of our revenues from a limited

number of

customers, the loss of which would significantly reduce our

revenues; and

|

|

·

|

Amounts

included in our backlog may not result in actual revenue

or translate into

profits.

|

Our

Corporate Information

We

have

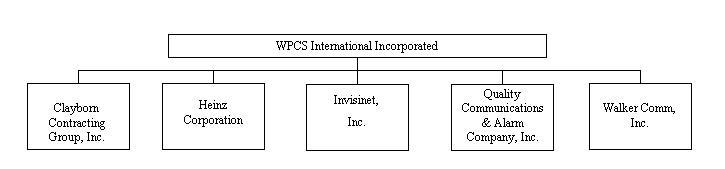

five operating subsidiaries: Clayborn Contracting Group, Inc., a California

corporation; Heinz Corporation, a Missouri corporation; Invisinet, Inc.,

a

Delaware corporation; Quality Communications & Alarm Company, Inc., a New

Jersey corporation; and Walker Comm, Inc., a California corporation.

References

in this prospectus to Clayborn, Heinz, Invisinet, Quality and Walker

Comm refer

to these companies, respectively.

Our

principal executive offices are located at One East

Uwchlan Avenue, Suite 301, Exton, Pennsylvania 19341, and our telephone

number

is (610) 903-0400. We are a Delaware corporation. We maintain a website

at

www.wpcs.com and the information contained on that website is not deemed

to be a

part of this prospectus.

2

The

Offering

|

Common

stock offered by us (1)

|

2,000,000 shares

|

|

|

|

||

|

Shares

outstanding prior to the offering (2)

|

4,251,236 shares

as of February 3, 2006

|

|

|

|

||

|

Shares

to be outstanding after the offering (1) (2)

|

6,251,236 shares

|

|

|

|

||

|

Use

of proceeds

|

We

estimate that our net proceeds from this offering will be approximately

$

million. We intend to use these net proceeds for general corporate

purposes, which may include potential strategic acquisitions

and/or

investments or repayment of all or a portion our existing bank

debt, and

for working capital. We

have not entered into any binding commitments or agreements

with respect

to any potential strategic acquisition or investment and

no assurances can be given that we will be able to identify

a potential

acquisition on terms we deem favorable.

|

|

|

|

||

|

NASDAQ

Capital Market symbol

|

WPCS.

We

will apply to have our common stock approved for quotation

on the NASDAQ

National Market under the symbol “WPCS” to be effective upon completion of

this offering. No assurances can be given that our common stock

will be

approved for quotation on the NASDAQ National Market.

|

|

|

|

|

(1)

|

Assuming

no exercise by the underwriter of its over-allotment option

to purchase an

additional 300,000 shares of common stock from us.

|

|

|

|

|

(2)

|

Excludes

793,704 shares issuable upon the exercise of outstanding stock

options at prices ranging from $4.80 to $19.92 and 2,141,771 shares

issuable upon the exercise of outstanding warrants at prices

ranging from

$8.40 to $10.80.

|

3

Summary

Consolidated Financial Information

The

statements of operations data for the two fiscal years ended April 30,

2004 and

2005 have been derived from our audited consolidated financial statements

included elsewhere in this prospectus. The statements of operations data

for the

six months ended October 31, 2004 and 2005 and the balance sheet data

as of

October 31, 2005 have been derived from our unaudited condensed consolidated

financial statements included elsewhere in this prospectus, and, in the

opinion

of management, have been prepared on a basis consistent with the audited

consolidated financial statements and include all adjustments, which

consist

only of normal recurring adjustments, necessary to present fairly in

all

material respects the information included in those statements. Our

results of operations for the six months ended October 31, 2005 may not

be

indicative of results that may be expected for the fiscal year ending

April 30,

2006. The

data

presented below have been derived from consolidated financial statements

that

have been prepared in accordance with generally accepted accounting principles

and should be read in conjunction with our consolidated financial statements,

including the notes, included elsewhere in this prospectus, and with

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations” in this prospectus.

|

Six

Months

|

|||||||||||||||

|

Year

Ended

|

Ended

|

||||||||||||||

|

April

30,

|

October

31,

|

||||||||||||||

|

2004

|

2005

|

2004

|

2005

|

||||||||||||

|

(Unaudited)

|

|||||||||||||||

|

Revenue

|

$

|

22,076,246

|

$

|

40,148,233

|

$

|

17,574,419

|

$

|

26,421,882

|

|||||||

|

Costs

and expenses:

|

|||||||||||||||

|

Cost

of revenue

|

17,286,099

|

32,445,470

|

14,224,298

|

19,469,223

|

|||||||||||

|

Selling,

general and

administrative expenses

|

4,441,776

|

7,028,850

|

2,911,112

|

4,615,608

|

|||||||||||

|

Depreciation

and amortization

|

382,510

|

682,397

|

246,693

|

421,060

|

|||||||||||

|

Total

costs and expenses

|

22,110,385

|

40,156,717

|

17,382,103

|

24,505,891

|

|||||||||||

|

Operating

(loss) income

|

(34,139

|

)

|

(8,484

|

)

|

192,316

|

1,915,991

|

|||||||||

|

Interest

expense

|

14,048

|

24,702

|

12,763

|

94,800

|

|||||||||||

|

(Loss)

income before income tax provision

|

(48,187

|

)

|

(33,186

|

)

|

179,553

|

1,821,191

|

|||||||||

|

Income

tax provision

|

76,000

|

52,096

|

71,895

|

721,108

|

|||||||||||

|

Net

(loss) income

|

$

|

(124,187

|

)

|

$

|

(85,282

|

)

|

$

|

107,658

|

$

|

1,100,083

|

|||||

|

Basic

net (loss) income per common share

|

$

|

(0.08

|

)

|

$

|

(0.03

|

)

|

$

|

0.06

|

$

|

0.29

|

|||||

|

Diluted

net (loss) income per common share

|

$

|

(0.08

|

)

|

$

|

(0.03

|

)

|

$

|

0.06

|

$

|

0.29

|

|||||

|

Shares

used in net (loss) income per share calculation:

|

|||||||||||||||

|

Basic

|

1,521,697

|

2,679,529

|

1,737,498

|

3,837,689

|

|||||||||||

|

Diluted

|

1,521,697

|

2,679,529

|

1,804,162

|

3,846,313

|

|||||||||||

|

As

of

|

|||||||||||||||

|

October

31, 2005

|

|||||||||||||||

|

As

|

|||||||||||||||

|

Actual

|

Adjusted

|

||||||||||||||

|

(Unaudited)

|

|||||||||||||||

|

Balance

sheet data:

|

|||||||||||||||

|

Cash

and cash equivalents

|

$

|

1,800,224

|

$

|

||||||||||||

|

Working

capital

|

9,441,772

|

||||||||||||||

|

Total

assets

|

34,345,110

|

||||||||||||||

|

Total

liabilities

|

12,589,934

|

||||||||||||||

|

Total

shareholders’ equity

|

21,755,176

|

||||||||||||||

|

(1)

|

The

as adjusted balance sheet data as of October 31,

2005 gives effect to the

receipt of net proceeds of $ million from the sale of

2,000,000 shares of common stock offered by this

prospectus, after

deducting the underwriter’s discount and estimated offering expenses

payable by us.

|

4

RISK

FACTORS

This

investment has a high degree of risk. Before you invest you should carefully

consider the risks and uncertainties described below and the other information

in this prospectus. If any of the following risks actually occur, our business,

operating results and financial condition could be harmed and the value

of our

stock could go down. As a result, you could lose all or a part of your

investment.

Our

success is dependent on growth in the deployment of wireless networks,

and to

the extent that such growth slows down, our revenues may decrease and our

ability to continue operating profitably may be harmed.

Customers

are constantly re-evaluating their network deployment plans in response

to

trends in the capital markets, changing perceptions regarding industry

growth,

the adoption of new wireless technologies, increasing pricing competition

and

general economic conditions in the United States and internationally. If

the

rate of network deployment growth slows and customers reduce their capital

investments in wireless technology or fail to expand their networks, our

revenues and profits, if any, could be reduced.

We

have a limited history of profitability which may not

continue.

While

we

had net income of approximately $1.1 million for the six months ended October

31, 2005, we incurred net losses of approximately $85,000 and $124,000

for the

fiscal years ended April 30, 2005 and 2004, respectively. There can be

no

assurance that we will sustain profitability or generate positive cash

flow from

operating activities in the future. If we cannot achieve operating profitability

or positive cash flow from operating activities, we may not be able to

meet our

working capital requirements. If we are unable to meet our working capital

requirements, we may need to reduce or cease all or part of our

operations.

If

we fail to accurately estimate costs associated with our fixed-price contracts

using percentage-of-completion, our actual results may vary from our

assumptions, which may reduce our profitability or impair our financial

performance.

A

substantial portion of our revenue is derived from fixed price

contracts.

Under

these contracts, we set the price of our services on an aggregate basis

and

assume the risk that the costs associated with our performance may be greater

than we anticipated.

We

recognize revenue and profit on these contracts as the work on these projects

progresses on a percentage-of-completion basis. Under the

percentage-of-completion method, contracts in process are valued at cost

plus

accrued profits less earned revenues and progress payments on uncompleted

contracts.

The

percentage-of-completion method therefore relies on estimates of total

expected

contract costs. These

costs may be affected by a variety of factors, such as lower than anticipated

productivity, conditions at work sites differing materially from what was

anticipated at the time we bid on the contract and higher costs of materials

and

labor. Contract

revenue and total cost estimates are reviewed and revised periodically

as the

work progresses, such that adjustments to profit resulting from revisions

are

made cumulative to the date of the revision. Adjustments are reflected

in

contract revenue for the fiscal period affected by these revised estimates.

If

estimates of costs to complete long-term contracts indicate a loss, we

immediately recognize the full amount of the estimated loss. Such adjustments

and accrued losses could result in reduced profitability and

liquidity.

Failure

to properly manage projects may result in unanticipated costs or claims.

Our

wireless network engagements may involve large scale, highly complex projects.

The quality of our performance on such projects depends in large part upon

our

ability to manage the relationship with our customers, and to effectively

manage

the project and deploy appropriate resources, including third-party contractors

and our own personnel, in a timely manner. Any defects or errors or failure

to

meet customers’ expectations could result in claims for substantial damages

against us. Our contracts generally limit our liability for damages that

arise

from negligent acts, errors, mistakes or omissions in rendering services

to our

customers. However, we cannot be sure that these contractual provisions

will

protect us from liability for damages in the event we are sued. In addition,

in

certain instances, we guarantee customers that we will complete a project

by a

scheduled date or that the network will achieve certain performance standards.

If the project or network experiences a performance problem, we may not

be able

to recover the additional costs we would incur, which could exceed revenues

realized from a project.

5

The

industry in which we operate has relatively low barriers to entry and increased

competition could result in margin erosion, which would make profitability

even

more difficult to sustain.

Other

than the technical skills required in our business, the barriers to entry

in our

business are relatively low. We do not have any intellectual property rights

to

protect our business methods and business start-up costs do not pose a

significant barrier to entry. The success of our business is dependent

on our

employees, customer relations and the successful performance of our services.

If

we face increased competition as a result of new entrants in our markets,

we

could experience reduced operating margins and loss of market share and

brand

recognition.

Our

business depends upon our ability to keep pace with the latest technological

changes, the failure to which could make us less competitive in our industry.

The

market for our services is characterized by rapid change and technological

improvements. Failure to respond in a timely and cost-effective way to

these

technological developments may result in serious harm to our business and

operating results. We have derived, and we expect to continue to derive,

a

substantial portion of our revenues from deploying wireless networks that

are

based upon today’s leading technologies and that are capable of adapting to

future technologies. As a result, our success will depend, in part, on

our

ability to develop and market service offerings that respond in a timely

manner

to the technological advances of our customers, evolving industry standards

and

changing preferences.

Our

failure to attract and retain engineering personnel or maintain appropriate

staffing levels could adversely affect our business.

Our

success depends upon our attracting and retaining skilled engineering personnel.

Competition for such skilled personnel in our industry is high and at times

can

be extremely intense, especially for engineers and project managers, and

we

cannot be certain that we will be able to hire sufficiently qualified personnel

in adequate numbers to meet the demand for our services. We also believe

that

our success depends to a significant extent on the ability of our key personnel

to operate effectively, both individually and as a group. Additionally,

we

cannot be certain that we will be able to hire the requisite number of

experienced and skilled personnel when necessary in order to service a

major

contract, particularly if the market for related personnel is competitive.

Conversely, if we maintain or increase our staffing levels in anticipation

of

one or more projects and the projects are delayed, reduced or terminated,

we may

underutilize the additional personnel, which could reduce our operating

margins, reduce our earnings and possibly harm our results of operations.

If we

are unable to obtain major contracts or effectively complete such contracts

due

to staffing deficiencies, our revenues may decline and we may experience

a drop

in net income.

If

we are unable to identify and complete future acquisitions, we may be unable

to

continue our growth.

Since

November 1, 2002, we have acquired five companies and we intend to further

expand our operations through targeted strategic acquisitions. However,

we may not be able to identify suitable acquisition opportunities. Even

if we

identify favorable acquisition targets, there is no guarantee that we can

acquire them on reasonable terms or at all. If we are unable to complete

attractive acquisitions, the growth that we have experienced over the last

three

fiscal years may decline.

Future

acquired companies could be difficult to assimilate, disrupt our business,

diminish stockholder value and adversely affect our operating results.

Completing

acquisitions may require significant management time and financial resources

because we may need to assimilate widely dispersed operations with distinct

corporate cultures. Our failure to manage future acquisitions successfully

could

seriously harm our operating results. Also, acquisitions could cause our

quarterly operating results to vary significantly. Furthermore, our stockholders

would be diluted if we financed the acquisitions by issuing equity securities.

In addition, acquisitions expose us to risks such as undisclosed liabilities,

increased

indebtedness associated with an acquisition and the potential for cash

flow

shortages that may occur if anticipated financial performance is not realized

or

is delayed from such acquired companies.

6

We

derive a significant portion of our revenues from a limited number of customers,

the loss of which would significantly reduce our revenues.

We

have

derived, and believe that we will continue to derive, a significant portion

of

our revenues from a limited number of customers. To the extent that any

significant customer uses less of our services or terminates its relationship

with us, our revenues could decline significantly. As a result, the loss

of any

significant customer could seriously harm our business. For the six months

ended

October 31, 2005, we had two separate customers which accounted for 16.6%

and

12.7% of our revenues. For the fiscal year ended April 30, 2005, we had

one

customer which accounted for 15.5% of our revenues. Other than under existing

contractual obligations, none of our customers is obligated to purchase

additional services from us. As a result, the volume of work that we

perform for a specific customer is likely to vary from period to period,

and a

significant customer in one period may not use our services in a subsequent

period.

Amounts

included in our backlog may not result in actual revenue or translate into

profits.

As

of

October 31, 2005, we had a backlog of unfilled orders of approximately

$19

million. This backlog amount is based on contract values and purchase orders

and

may not result in actual receipt of revenue in the originally anticipated

period

or at all. In addition, contracts included in our backlog may not be profitable.

We have experienced variances in the realization of our backlog because

of

project delays or cancellations resulting from external market factors

and

economic factors beyond our control and we may experience delays or

cancellations in the future. If our backlog fails to materialize, we could

experience a reduction in revenue, profitability and liquidity.

Our

business could be affected by adverse weather conditions, resulting in

variable

quarterly results.

Adverse

weather conditions, particularly during the winter season, could affect

our

ability to perform outdoor services in certain regions of the United States.

As

a result, we might experience reduced revenue in the third and fourth quarters

of our fiscal year. Natural catastrophes such as the recent hurricanes

in the

United States could also have a negative impact on the economy overall

and on

our ability to perform outdoor services in affected regions or utilize

equipment

and crews stationed in those regions, which in turn could significantly

impact

the results of any one or more of our reporting periods.

Our

management will have broad discretion in allocating the net proceeds from

this

offering, and the failure of our management to apply the net proceeds from

this

offering effectively could harm our business.

We

currently intend to use the net proceeds from the sale of the common stock

offered hereby for general corporate purposes, which may include potential

strategic acquisitions and/or investments or repayment of all or a portion

our

existing bank debt, and for working capital. We have not determined the

amount

of net proceeds from the sale of our common stock in this offering that

we will

use for any of these purposes. Accordingly, our management will retain

broad

discretion as to the allocation of the net proceeds of this offering. The

failure of management to apply these funds effectively could negatively

impact

our business.

If

we are unable to retain the services of Messrs. Hidalgo, Schubiger, Heinz

or

Walker, our operations could be disrupted.

Our

success depends to a significant extent upon the continued services of

Mr.

Andrew Hidalgo, our Chief Executive Officer and Messrs. Richard Schubiger,

James

Heinz and Donald Walker, our Executive Vice Presidents. Mr. Hidalgo has

overseen

our company since inception and provides leadership for our growth and

operations strategy. Messrs. Schubiger, Heinz and Walker run the day-to-day

operations of Quality, Heinz and Walker Comm, respectively. Loss of the

services

of Messrs. Hidalgo, Schubiger, Heinz or Walker could disrupt our operations

and

harm our growth, revenues, and prospective business. We do not maintain

key-man

insurance on the lives of Messrs. Hidalgo, Schubiger, Heinz or Walker.

7

Employee

strikes and other labor-related disruptions may adversely affect our

operations.

Our

business is labor intensive, with certain projects requiring large numbers

of

engineers. Over 40% of our workforce is unionized. Strikes or labor disputes

with our unionized

employees may adversely affect our ability to conduct our business.

If

we are

unable to reach agreement with any of our unionized work groups on future

negotiations regarding the terms of their collective bargaining agreements,

or

if additional segments of our workforce become unionized, we may be subject

to

work interruptions or stoppages. Any

of

these events could be disruptive to our operations and could result in

negative

publicity, loss of contracts and a decrease in revenues.

We

may incur goodwill impairment charges in our reporting entities which could

harm

our profitability.

In

accordance with Statement of Financial Accounting Standards, or SFAS,

No. 142, “Goodwill and Other Intangible Assets,” we periodically review the

carrying values of our goodwill to determine whether such carrying values

exceed

the fair market value. All five of our acquired companies, Clayborn, Invisinet,

Heinz, Quality and Walker Comm, each of which is a reporting unit, are

subject

to annual review for goodwill impairment. If impairment testing indicates

that

the fair value of a reporting unit exceeds it carrying value, the goodwill

of

the reporting unit is deemed impaired. Accordingly, an impairment charge

would

be recognized for that reporting unit in the period identified, which could

reduce our profitability.

Our

quarterly results fluctuate and may cause our stock price to decline.

Our

quarterly operating results have fluctuated in the past and will likely

fluctuate in the future. As a result, we believe that period to period

comparisons of our results of operations are not a good indication of our

future

performance. A number of factors, many of which are beyond our control,

are

likely to cause these fluctuations. Some of these factors include:

|

•

|

the

timing and size of network deployments and technology upgrades

by our

customers;

|

|

•

|

fluctuations

in demand for outsourced network services;

|

|

•

|

the

ability of certain customers to sustain capital resources to

pay their

trade accounts receivable balances and required changes to our

allowance

for doubtful accounts based on periodic assessments of the collectibility

of our accounts receivable balances;

|

|

•

|

reductions

in the prices of services offered by our competitors;

|

|

•

|

our

success in bidding on and winning new business;

and

|

|

•

|

our

sales, marketing and administrative cost structure.

|

Because

our operating results may vary significantly from quarter to quarter, our

operating results may not meet the expectations of securities analysts

and

investors, and our common stock could decline significantly which may expose

us

to risks of securities litigation, impair our ability to attract and retain

qualified individuals using equity incentives and make it more difficult

to

complete acquisitions using equity as consideration.

Our

stock price may be volatile, which may result in lawsuits against us and

our

officers and directors.

The

stock

market in general, and the stock prices of technology and telecommunications

companies in particular, have experienced volatility that has often been

unrelated to or disproportionate to the operating performance of those

companies. The market price of our common stock has fluctuated in the past

and

is likely to fluctuate in the future. Between February 1, 2005 and February

1,

2006, our common stock has traded as low as $4.32 and as high as $12.78

per

share, based upon information obtained from inter-dealer

quotations on the OTC Bulletin Board for the period from February 1, 2005

until

March 24, 2005 and

information provided by NASDAQ Capital Market for the period from March

27, 2005

until February 1, 2006. Factors which could have a significant impact on

the

market price of our common stock include, but are not limited to, the following:

8

|

•

|

quarterly

variations in operating results;

|

|

•

|

announcements

of new services by us or our competitors;

|

|

•

|

the

gain or loss of significant customers;

|

|

•

|

changes

in analysts’ earnings estimates;

|

|

•

|

rumors

or dissemination of false information;

|

|

•

|

pricing

pressures;

|

|

•

|

short

selling of our common stock;

|

|

•

|

impact

of litigation;

|

|

•

|

general

conditions in the market;

|

|

•

|

changing

the exchange or quotation system on which we list our common

stock for

trading;

|

|

•

|

political

and/or military events associated with current worldwide conflicts;

and

|

|

•

|

events

affecting other companies that investors deem comparable to

us.

|

Companies

that have experienced volatility in the market price of their stock have

frequently been the object of securities class action litigation. Class

action

and derivative lawsuits could result in substantial costs to us and a diversion

of our management’s attention and resources, which could materially harm our

financial condition and results of operations.

Future

changes in financial accounting standards may adversely affect our reported

results of operations.

A

change

in accounting standards could have a significant effect on our reported

results

and may even affect our reporting of transactions completed before the

change is

effective. For example, in December 2004, the Financial Accounting

Standards Board issued SFAS No. 123(R), “Share-Based Payment,” a revision of

SFAS No. 123, “Accounting for Stock-Based Compensation,” which requires

companies to expense all employee stock options and other share-based payments

over the service period. Implementation of this standard as required

during the first fiscal quarter of our fiscal year 2007 may impair our

ability to use equity compensation to attract and retain skilled personnel.

It

is likely that we will have to recognize additional compensation expense

in the

periods after adoption of this standard.

New

pronouncements and varying interpretations of pronouncements have occurred

and

may occur in the future. Changes to existing rules or the questioning of

current practices may adversely affect our reported financial results or

the way

we conduct our business.

Compliance

with changing regulation of corporate governance and public disclosure

may

result in additional expenses.

Changing

laws, regulations and standards relating to corporate governance and public

disclosure, including the Sarbanes-Oxley Act of 2002, newly enacted SEC

regulations and NASDAQ Stock Market rules, have created additional burdens

for

companies such as ours. We are committed to maintaining high standards

of

corporate governance and public disclosure. As a result, we intend to invest

appropriate resources to comply with evolving standards. This investment

will result in increased general and administrative costs and a diversion

of

management time and attention from revenue-generating activities to compliance

activities.

9

We

can issue shares of preferred stock without stockholder approval, which

could

adversely affect the rights of common stockholders.

Our

certificate of incorporation permits us to establish the rights, privileges,

preferences and restrictions, including voting rights, of future series

of our

preferred stock and to issue such stock without approval from our stockholders.

The rights of holders of our common stock may suffer as a result of the

rights

granted to holders of preferred stock that we may issue in the future.

In

addition, we could issue preferred stock to prevent a change in control

of our

company, depriving common stockholders of an opportunity to sell their

stock at

a price in excess of the prevailing market price.

There

may be an adverse effect on the market price of our shares as a result

of shares

being available for sale in the future.

As

of

February 3, 2006, holders of our outstanding options and warrants have

the right

to acquire 2,935,475 shares of common stock issuable upon the exercise

of stock

options and warrants, at exercise prices ranging from $4.80 to $19.92 per

share,

with a weighted average exercise price of $8.37. The sale or availability

for

sale in the market of the shares underlying these options and warrants

could

depress our stock price. We have registered substantially all of the underlying

shares described above for resale. Holders of registered underlying shares

may

resell the shares immediately upon issuance upon exercise of an option

or

warrant.

If

our

stockholders sell substantial amounts of our shares of common stock, including

shares issued upon the exercise of outstanding options and warrants, the

market

price of our common stock may decline. These sales also might make it more

difficult for us to sell equity or equity-related securities in the future

at a

time and price that we deem appropriate.

10

USE

OF

PROCEEDS

We

estimate that we will receive net proceeds of approximately

$ million from the sale of

2,000,000 shares in this offering (based upon the last reported sale price

of our common stock on ,

2006), after deducting the underwriting discount and estimated offering

expenses. If the underwriter’s over-allotment option is exercised in full, we

estimate that we will receive an additional

$

million in net proceeds. We intend to use the net proceeds for

general corporate purposes, which may include potential strategic acquisitions

and/or investments or repayment of all or a portion our existing bank debt,

and

for working capital. We have not entered into any binding commitments or

agreements with respect to any potential strategic acquisition or investment

and

no assurances can be given that we will be able to identify a potential

acquisition on terms we deem favorable. Pending these uses, the net proceeds

will be invested in investment-grade, interest-bearing securities.

On

June

3, 2005, we entered into a credit agreement with Bank Leumi USA under which

we

borrowed $3,000,000 under a $5,000,000 revolving line of credit. As of

January 31, 2006, we had outstanding $3,000,000 in loans under the credit

agreement, which mature on August 31, 2008. Loans under the credit agreement

bear interest at a rate equal to either the bank’s reference rate plus one half

(0.5%) percent, or LIBOR plus two and three-quarters (2.75%) percent, as

we may

request. As of January 31, 2006, the interest rate was 7.1875%. We used

the

initial funds provided by the loan to repay existing bank debt at Walker

Comm of

approximately $672,000, for the payment of approximately $758,000 to the

former

stockholders of our Quality subsidiary for monies due to them under the

terms of

the purchase of their company, and for working capital.

11

PRICE

RANGE OF COMMON STOCK

Our

common stock is currently traded on the NASDAQ Capital Market under the

symbol

“WPCS.” Between January 10, 2005 and March 24, 2005, our stock traded on the OTC

Bulletin Board under the symbol “WPCI.” Prior to January 10, 2005, our stock

traded on the OTC Bulletin Board under the symbol “WPCS.”

For

the

period from May 1, 2003 to March 24, 2005, the table sets forth prices

based

upon information obtained from inter-dealer

quotations on the OTC Bulletin Board without retail markup, markdown, or

commission and may not necessarily represent actual transactions. For

the

period from March 27, 2005 to date, the following table sets forth the

high and

low closing sale prices of our common stock as reported by the NASDAQ Capital

Market.

|

Period

|

High

|

Low

|

|||||

| Fiscal Year Ended April 30, 2004: | |||||||

|

First

Quarter

|

$

|

22.56

|

$

|

4.68

|

|||

|

Second

Quarter

|

|

20.76

|

|

12.24

|

|||

|

Third

Quarter

|

|

20.40

|

|

10.92

|

|||

|

Fourth

Quarter

|

|

17.28

|

|

10.80

|

|||

|

Fiscal

Year Ended April 30, 2005:

|

|

|

|||||

|

First

Quarter

|

$

|

14.88

|

$

|

7.80

|

|||

|

Second

Quarter

|

|

11.28

|

|

5.76

|

|||

|

Third

Quarter

|

|

8.28

|

|

4.32

|

|||

|

Fourth

Quarter

|

|

7.80

|

|

4.50

|

|||

|

Fiscal

Year Ending April 30, 2006:

|

|

|

|||||

|

First

Quarter

|

$

|

9.18

|

$

|

4.32

|

|||

|

Second

Quarter

|

|

9.03

|

|

5.58

|

|||

|

Third

Quarter

|

|

12.78

|

|

6.12

|

|||

|

Fourth

Quarter, through February

6, 2006

|

|

12.50

|

|

11.33

|

On

February 6, 2006, the closing sale price of our common stock, as reported

by the

NASDAQ Capital Market, was $12.05 per share. On February 3, 2006, there

were 65 holders of record of our common stock.

DIVIDEND

POLICY

We

have

never paid any cash dividends on our capital stock and do not anticipate

paying

any cash dividends on our common stock in the foreseeable future. Under

our

credit agreement dated June 3, 2005, we are prohibited from declaring or

paying

dividends, except stock dividends, or making any other distribution. We

intend

to retain future earnings to fund ongoing operations and future capital

requirements of our business. Any future determination to pay cash dividends

will be at the discretion of the Board and will be dependent upon our financial

condition, results of operations, capital requirements and such other factors

as

the Board deems relevant.

12

CAPITALIZATION

The

following table sets forth our unaudited actual and as adjusted capitalization

at October 31, 2005. The as adjusted column gives effect to the sale of

2,000,000 newly issued shares of common stock in this offering, based on

an

offering price of $ per

share (based upon the last reported sale price of our common stock

on , 2006) and the receipt of net

proceeds of approximately $

after deducting the underwriting discount and estimated offering expenses

payable by us.

|

October

31, 2005

|

|||||||

|

Actual

|

As

Adjusted

|

||||||

|

(Unaudited)

|

|||||||

|

Cash

and cash equivalents

|

$

|

1,800,224

|

$

|

||||

|

Debt:

|

|||||||

|

Loans

payable (1)

|

$

|

497,550

|

$

|

497,550

|

|||

|

Borrowings

under line of credit

|

3,000,000

|

3,000,000

|

|||||

|

Total

debt

|

3,497,550

|

3,497,550

|

|||||

|

Shareholders’

equity:

|

|||||||

|

Preferred

stock, $0.0001 par value: 5,000,000 shares authorized; none

issued

|

—

|

—

|

|||||

|

Common

stock, $0.0001 par value: 75,000,000 shares authorized;

3,883,885 shares issued and outstanding (actual); and 5,883,885

shares issued and outstanding

(as

adjusted)

|

|

388

|

|

||||

|

Additional

paid-in capital

|

21,407,234

|

||||||

|

Retained

earnings

|

347,554

|

347,554

|

|||||

|

Total

shareholders’ equity

|

|

21,755,176

|

|||||

|

Total

capitalization

|

$

|

25,252,726

|

$

|

||||

|

(1)

|

Loans

payable represent the current and long term portion of vehicle

loans.

|

The

number of shares of common stock immediately outstanding after this offering

is

based on 3,883,885 shares issued and outstanding as of October 31, 2005 on

an actual basis and excludes:

|

•

|

800,154 shares

of common stock issuable upon exercise of stock options at

a weighted

average exercise price of $7.15 per share;

|

|

•

|

20,000 shares

available for grant under our 2006 incentive stock plan; and

|

|

•

|

2,509,671

shares of common stock issuable upon exercise of warrants at

a weighted

average exercise price of $8.77 per share.

|

13

SELECTED

CONSOLIDATED FINANCIAL

INFORMATION

The

statements of operations data for the two fiscal years ended April 30,

2004 and

2005 and the balance sheet data as of April 30, 2004 and 2005 have been

derived

from our audited consolidated financial statements included elsewhere in

this

prospectus. The condensed consolidated statements of operations data for

the six

months ended October 31, 2004 and 2005 and the balance sheet data as of

October

31, 2005 have been derived from our unaudited condensed consolidated financial

statements included elsewhere in this prospectus, and, in the opinion of

management, have been prepared on a basis consistent with the audited

consolidated financial statements and include all adjustments, which consist

only of normal recurring adjustments, necessary to present fairly in all

material respects the information included in those statements. Our

results of operations for the six months ended October 31, 2005, may not

be

indicative of results that may be expected for the fiscal year ending April

30,

2006. The

data

presented below have been derived from consolidated financial statements

that

have been prepared in accordance with generally accepted accounting principles

and should be read in conjunction with our consolidated financial statements,

including the notes, included elsewhere in the prospectus, and with

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations” in this prospectus.

|

Six

Months

|

|||||||||||||||

|

Year

Ended

|

Ended

|

||||||||||||||

|

April

30,

|

October

31,

|

||||||||||||||

|

2004

|

2005

|

2004

|

2005

|

||||||||||||

|

(Unaudited)

|

|||||||||||||||

|

Revenue

|

$

|

22,076,246

|

$

|

40,148,233

|

$

|

17,574,419

|

$

|

26,421,882

|

|||||||

|

Costs

and expenses:

|

|||||||||||||||

|

Cost

of revenue

|

17,286,099

|

32,445,470

|

14,224,298

|

19,469,223

|

|||||||||||

|

Selling,

general and

administrative expenses

|

4,441,776

|

7,028,850

|

2,911,112

|

4,615,608

|

|||||||||||

|

Depreciation

and amortization

|

382,510

|

682,397

|

246,693

|

421,060

|

|||||||||||

|

Total

costs and expenses

|

22,110,385

|

40,156,717

|

17,382,103

|

24,505,891

|

|||||||||||

|

Operating

(loss) income

|

(34,139

|

)

|

(8,484

|

)

|

192,316

|

1,915,991

|

|||||||||

|

Interest

expense

|

14,048

|

24,702

|

12,763

|

94,800

|

|||||||||||

|

(Loss)

income before income tax provision

|

(48,187

|

)

|

(33,186

|

)

|

179,553

|

1,821,191

|

|||||||||

|

Income

tax provision

|

76,000

|

52,096

|

71,895

|

721,108

|

|||||||||||

|

Net

(loss) income

|

$

|

(124,187

|

)

|

$

|

(85,282

|

)

|

$

|

107,658

|

$

|

1,100,083

|

|||||

|

Basic

net (loss) income per common share

|

$

|

(0.08

|

)

|

$

|

(0.03

|

)

|

$

|

0.06

|

$

|

0.29

|

|||||

|

Diluted

net (loss) income per common share

|

$

|

(0.08

|

)

|

$

|

(0.03

|

)

|

$

|

0.06

|

$

|

0.29

|

|||||

|

Shares

used in net (loss) income per share calculation:

|

|||||||||||||||

|

Basic

|

1,521,697

|

2,679,529

|

1,737,498

|

3,837,689

|

|||||||||||

|

Diluted

|

1,521,697

|

2,679,529

|

1,804,162

|

3,846,313

|

|||||||||||

|

As

of April 30,

|

As

of

|

|||||||||||||

|

2004

|

2005

|

October

31, 2005

|

||||||||||||

|

|

|

(Unaudited)

|

||||||||||||

| Balance sheet data: | ||||||||||||||

|

Cash

and cash equivalents

|

$

|

1,984,636

|

$

|

989,252

|

|

$

|

1,800,224

|

|||||||

|

Working

capital

|

2,396,169

|

5,145,320

|

9,441,772

|

|||||||||||

|

Total

assets

|

20,882,097

|

30,176,711

|

34,345,110

|

|||||||||||

|

Total

liabilities

|

9,594,342

|

9,821,618

|

12,589,934

|

|||||||||||

|

Total

shareholders’ equity

|

11,287,755

|

20,355,093

|

21,755,176

|

14

MANAGEMENT’S

DISCUSSION AND ANALYSIS

OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Some

of

the information in this prospectus contains forward-looking statements

that

involve substantial risks and uncertainties. You can identify these statements

by forward-looking words such as “may,” “will,” “expect,” “anticipate,”

“believe,” “estimate” and “continue,” or similar words. You should read

statements that contain these words carefully because they:

|

·

|

discuss

our future expectations;

|

|

·

|

contain

projections of our future results of operations or of our

financial

condition; and

|

|

·

|

state

other “forward-looking”

information.

|

We

believe it is important to communicate our expectations. However, there

may be

events in the future that we are not able to accurately predict or over

which we

have no control. The risk factors contained within this prospectus, as

well as

any cautionary language in this prospectus, provide examples of risks,

uncertainties and events that may cause our actual results to differ

materially

from the expectations we describe in our forward-looking statements.

You should

be aware that the occurrence of the events described in these risk factors

could

have an adverse effect on our business, results of operations and financial

condition.

Business

Overview

We

respond to the growing demand in wireless communications by providing

engineering services for the design and deployment of wireless networks.

We

operate in two segments that we define as specialty communication systems

and

wireless infrastructure services.

We

generate our revenue by providing a range of services including the design,

deployment and maintenance of:

|

·

|

two-way

radio communication systems, which are used primarily for

emergency

dispatching;

|

|

·

|

Wi-Fi

networks, which are wireless local area networks that operate

on a set of