|

Delaware

|

98-0204758

|

|

(State

or other jurisdiction of incorporation or organization)

|

(IRS

Employer Identification No.)

|

|

Title

of each class

|

Name

of each exchange on which

registered

|

|

Common

Stock, $0.0001 par value

|

The

NASDAQ Stock Market LLC

(NASDAQ

Global Market)

|

|

|

|

|

|

PAGE

|

|

|

PART

I

|

|

||||

|

|

|

|

|

||

|

Item

1.

|

|

Business

|

|

4

|

|

|

Item

1A.

|

|

Risk

Factors

|

|

9

|

|

|

Item

2.

|

|

Properties

|

|

14

|

|

|

Item

3.

|

|

Legal

Proceedings

|

|

14

|

|

|

Item

4.

|

|

Submission

of Matters to a Vote of Security Holders

|

|

14

|

|

|

|

|

|

|

|

|

|

PART

II

|

|

||||

|

|

|

|

|

||

|

Item

5.

|

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of

Equity Securities

|

|

15

|

|

|

Item

6.

|

|

Selected

Financial Data

|

|

17

|

|

|

Item

7.

|

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

|

18

|

|

|

Item

7A.

|

|

Quantitative

and Qualitative Disclosures about Market Risk

|

|

29

|

|

|

Item

8.

|

|

Financial

Statements and Supplementary Data

|

|

F-1-F-31

|

|

|

Item

9.

|

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosures

|

|

30

|

|

|

Item

9A.

|

|

Controls

and Procedures

|

|

30

|

|

|

Item

9B.

|

|

Other

Information

|

|

30

|

|

|

|

|

|

|

|

|

|

PART

III

|

|

||||

|

|

|

|

|

||

|

Item

10.

|

|

Directors,

Executive Officers and Corporate Governance

|

|

31

|

|

|

Item

11.

|

|

Executive

Compensation

|

|

34

|

|

|

Item

12.

|

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

|

39

|

|

|

Item

13.

|

|

Certain

Relationships and Related Transactions, and Director

Independence

|

|

41

|

|

|

Item

14.

|

|

Principal

Accountant Fees and Services

|

|

41

|

|

|

|

|

|

|

|

|

|

PART

IV

|

|

||||

|

|

|

|

|

||

|

Item

15.

|

|

Exhibits

and Financial Statement Schedules

|

|

42

|

|

|

|

|

|

|

|

|

|

|

|

Signatures

|

|

47

|

|

|

•

|

Mobility.

Mobile

communications and computing are among the driving forces behind

the

demand for wireless connectivity. The increased functionality and

declining cost of mobile wireless devices has fueled further growth.

Mobile connectivity has led to greater productivity as organizations

transmit data and gather information from remote staff and locations

where

land line connectivity is unavailable. Such mobile connectivity has

created significant cost savings in data collection, increased

responsiveness, enabled greater access to enterprise resources and

improved controls.

|

|

•

|

Capacity.

Current

technology allows wireless transmission with capacity, quality and

reliability superior to land line and comparable to fiber. For example,

current radio technology is capable of two-way data transfer at rates

up

to 1 gigabits per second, allowing wireless networks to transmit

content

as quickly as over fiber in most

instances.

|

|

•

|

Cost.

Wireless

networks cost less than comparable landline networks both to deploy

and to

operate. Wireless deployment is less expensive because the installation

of

a landline network is more labor-intensive, requires more time and

may

involve substantial right-of-way expenditures. We expect the main

cost

component of wireless networks, equipment, to continue to decline

as

technology advances and production volumes increase. Operating costs

of

wireless networks are also lower because landlines require extensive

troubleshooting to execute repairs. In addition, wireless networks

bypass

local service providers, eliminating recurring monthly

charges.

|

|

•

|

Deployment.

Because

enterprise wireless networks do not require negotiating rights of

way,

substantial infrastructure engineering, time-consuming third party

coordination efforts or additional FCC licensing, they can be deployed

quickly and less expensively. Rapid deployment allows organizations

to

install networks more closely in line with immediate needs rather

than

having to commit to time-consuming engineering projects in anticipation

of

future growth.

|

|

•

|

Increased

security of wireless data

transmission;

|

|

•

|

Introduction

of new technologies;

|

|

•

|

Increasing

accessibility and affordability of wireless mobile devices;

and

|

|

•

|

Increased

capacity of wireless networks, making them a legitimate substitute

for

land line communications.

|

| • | Provide additional services for our customers. Each acquisition we make expands our customer base. We seek to expand these new customer relationships by making them aware of the diverse products and services we offer. We believe that providing these customers the full range of our services will lead to new projects or revenue opportunities and increased profitability. |

|

•

|

Maintain

and expand our focus in vertical markets. We

have deployed successful, innovative wireless solutions for multiple

customers in a number of vertical markets, such as public safety,

healthcare, security and gaming. We will continue to seek additional

customers in these targeted vertical markets who can benefit from

our

expertise and look for new ways in which we can deploy wireless networks

to enhance productivity within these markets. We also look to expand

our

vertical market coverage and include these new markets as

appropriate.

|

|

•

|

Strengthen

our relationships with technology providers. We

will continue to strengthen the relationships we have with technology

providers. These companies rely on us to deploy their technology

products

within their customer base. We have worked with these providers in

testing

new equipment they develop and our personnel maintain certifications

on

our technology providers’ products. We also look for innovative products

that can be of benefit to our customers, and endeavor to establish

similar

relationships with new technology providers as part of our commitment

to

offering the most advanced

solutions.

|

|

•

|

Seek

strategic acquisitions.

We will continue to look for additional acquisitions of compatible

businesses that can be assimilated into our organization, expand

our

geographic coverage and add accretive earnings to our business. Our

preferred acquisition candidates will have experience with specialty

communication systems. Since April 30, 2007, we have signed letters

of

intent to acquire Major Electric, Inc. and Max Engineering LLC. We

expect

these acquisitions to close by August 1, 2007, subject to completion

of

due diligence and the execution of definitive agreements.

|

|

•

|

Asset

tracking, which is a wireless network that monitors the location

of mobile

assets such as vehicles or stationary assets such as

equipment;

|

|

•

|

Telematics,

which are instructions sent through a wireless network that controls

a

device such as a slot machine or traffic signal;

and

|

|

•

|

Telemetry,

which is the acquisition of data from a measuring device, such as

devices

used at a water treatment plant to maintain the integrity of drinking

water.

|

|

•

|

Installation,

testing and commissioning of base station equipment, which is the

installation of radio frequency equipment inside the shelter at a

cell

site, and testing to ensure that the equipment is operating prior

to cell

site activation;

|

|

•

|

Equipment

modification and reconfiguration, which involves replacing old equipment

with new equipment, re-routing cables, and re-locating equipment

at the

cell site;

|

|

•

|

Network

modifications, which refers to work done on existing cell sites to

increase capacity or change the direction of sectors or

antennas;

|

|

•

|

Sectorization,

which is the installation of antennas to existing cell towers to

increase

the capacity of the cell site; and

|

|

•

|

Maintenance,

which includes antenna maintenance to replace damaged antennas, installing

tower lighting control panels or sensors, or repairing damaged

shelters.

|

|

•

|

the

timing and size of network deployments and technology upgrades by

our

customers;

|

|

•

|

fluctuations

in demand for outsourced network

services;

|

|

•

|

the

ability of certain customers to sustain capital resources to pay

their

trade accounts receivable balances and required changes to our allowance

for doubtful accounts based on periodic assessments of the collectibility

of our accounts receivable

balances;

|

|

•

|

reductions

in the prices of services offered by our

competitors;

|

|

•

|

our

success in bidding on and winning new business;

and

|

|

•

|

our

sales, marketing and administrative cost

structure.

|

|

•

|

quarterly

variations in operating results;

|

|

•

|

announcements

of new services by us or our

competitors;

|

|

•

|

the

gain or loss of significant

customers;

|

|

•

|

changes

in analysts’ earnings estimates;

|

|

•

|

rumors

or dissemination of false

information;

|

|

•

|

pricing

pressures;

|

|

•

|

short

selling of our common stock;

|

|

•

|

impact

of litigation;

|

|

•

|

general

conditions in the market;

|

|

•

|

changing

the exchange or quotation system on which we list our common stock

for

trading;

|

|

•

|

political

and/or military events associated with current worldwide conflicts;

and

|

|

•

|

events

affecting other companies that investors deem comparable to

us.

|

|

|

·

|

changes

in the region’s economic, social and political conditions or government

policies;

|

|

|

·

|

changes

in trade laws, tariffs and other trade restrictions or

licenses;

|

|

|

·

|

changes

in foreign exchange regulation in China may limit our ability to

freely

convert currency to make dividends or other payments in U.S.

dollars;

|

|

|

·

|

fluctuation

in the value of the RMB ( Chinese Yuan) could adversely affect the

value

of our investment in China;

|

|

|

·

|

limitations

on the repatriation of earnings or assets, including

cash;

|

|

|

·

|

adverse

changes in tax laws and

regulations;

|

|

|

·

|

difficulties

in managing or overseeing our China operations, including the need

to

implement appropriate systems, policies, benefits and compliance

programs;

and

|

|

|

·

|

different

liability standards and less developed legal systems that may be

less

predictable than those in the United

States.

|

|

|

Minimum

|

||

|

|

Lease

|

Annual

|

|

|

Location

|

Subsidiary

|

Expiration

Date

|

Rent

|

|

Exton,

Pennsylvania

|

WPCS

Corporate headquarters

|

February

1, 2008

|

$51,000

|

|

Auburn,

California (1)

|

Clayborn

|

Month-to-month

|

$64,440

|

|

St.

Louis, Missouri

|

Heinz

|

August

31, 2010

|

$56,142

|

|

Exton,

Pennsylvania

|

Heinz

|

July

31, 2008

|

$8,640

|

|

Windsor,

Connecticut

|

NECS

|

April

30, 2014

|

$80,821

|

|

Chicopee,

Massachusetts

|

NECS

|

August

31, 2007

|

$3,000

|

|

Lakewood,

New Jersey

|

Quality

|

August

31, 2007

|

$118,370

|

|

Sarasota,

Florida (2)

|

SECS

|

July

31, 2011

|

$51,360

|

|

Trenton,

New Jersey (3)

|

Voacolo

|

April

1, 2008

|

$54,000

|

|

Fairfield,

California (4)

|

Walker

Comm

|

February

28, 2011

|

$96,950

|

|

Rocklin,

California

|

Walker

Comm

|

January

31, 2008

|

$27,300

|

|

San

Leandro, California

|

Walker

Comm

|

July

31, 2008

|

$13,824

|

|

Period

|

High

|

Low

|

|||||

|

Fiscal

Year Ended April 30, 2007:

|

|||||||

|

First

Quarter

|

$

|

9.80

|

$

|

6.53

|

|||

|

Second

Quarter

|

10.75

|

6.60

|

|||||

|

Third

Quarter

|

10.58

|

8.64

|

|||||

|

Fourth

Quarter

|

13.74

|

9.30

|

|||||

|

Fiscal

Year Ending April 30, 2006:

|

|||||||

|

First

Quarter

|

$

|

9.18

|

$

|

4.32

|

|||

|

Second

Quarter

|

9.03

|

5.58

|

|||||

|

Third

Quarter

|

12.78

|

6.12

|

|||||

|

Fourth

Quarter

|

12.45

|

7.20

|

|||||

|

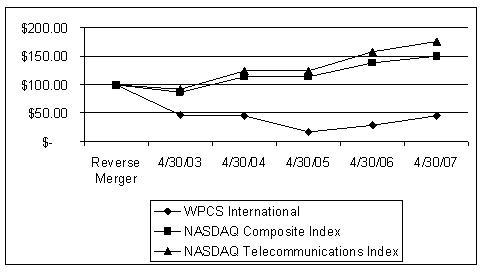

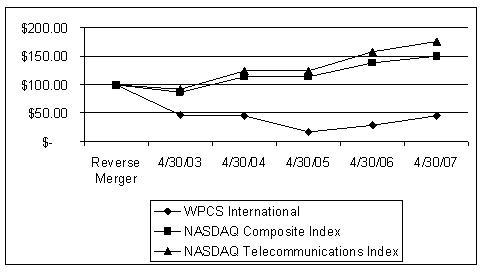

Reverse

Merger

|

4/30/03

|

4/30/04

|

4/30/05

|

4/30/06

|

4/30/07

|

|

|

WPCS

International

|

$

100.00

|

$

46.00

|

$

45.60

|

$

16.50

|

$

28.10

|

$

44.83

|

|

NASDAQ

Composite Index

|

$

100.00

|

$

86.74

|

$

113.74

|

$

113.83

|

$

137.57

|

$

149.57

|

|

NASDAQ

Telecommunications Index

|

$

100.00

|

$

91.94

|

$

124.49

|

$

124.29

|

$

157.46

|

$

175.28

|

|

2007

|

2006

|

2005

|

2004

|

2003

|

||||||||||||

|

REVENUE

|

$

|

70,000,070

|

$

|

52,144,575

|

$

|

40,148,233

|

$

|

22,076,246

|

$

|

5,422,858

|

||||||

|

COSTS

AND EXPENSES:

|

||||||||||||||||

|

Cost

of revenue

|

47,781,351

|

38,010,945

|

32,445,470

|

17,286,099

|

3,768,495

|

|||||||||||

|

Selling,

general and administrative expenses

|

13,244,909

|

9,191,392

|

7,032,504

|

4,441,776

|

1,892,609

|

|||||||||||

|

Depreciation

and amortization

|

1,239,486

|

837,789

|

682,397

|

382,510

|

116,501

|

|||||||||||

|

Total

costs and expenses

|

62,265,746

|

48,040,126

|

40,160,371

|

22,110,385

|

5,777,605

|

|||||||||||

|

OPERATING

INCOME (LOSS)

|

7,734,324

|

4,104,449

|

(12,138

|

) |

(34,139

|

) |

(354,747

|

) | ||||||||

|

OTHER

EXPENSE (INCOME):

|

||||||||||||||||

|

Interest

expense

|

496,330

|

256,022

|

31,865

|

14,048

|

6,997

|

|||||||||||

|

Interest

income

|

(525,524

|

) |

(121,720

|

) |

(10,817

|

) | - | - | ||||||||

|

Minority

interest

|

23,099

|

-

|

- | - | - | |||||||||||

|

Loss

(gain) on change in fair value of warrants

|

-

|

4,078,494

|

(1,414,263

|

) | - | - | ||||||||||

|

INCOME

(LOSS) BEFORE INCOME TAX PROVISION

|

7,740,419

|

(108,347

|

) |

1,381,077

|

(48,187

|

) |

(361,744

|

) | ||||||||

|

Income

tax provision

|

3,146,818

|

1,515,773

|

52,096

|

76,000

|

19,550

|

|||||||||||

|

NET

INCOME (LOSS)

|

$

|

4,593,601

|

($1,624,120

|

)

|

$

|

1,328,981

|

($124,187

|

)

|

($381,294

|

)

|

||||||

|

Basic

net income (loss) per common share

|

$

|

0.80

|

($0.40

|

)

|

$

|

0.50

|

($0.01

|

)

|

($0.05

|

)

|

||||||

|

Diluted

net income (loss) per common share

|

$

|

0.72

|

($0.40

|

)

|

$

|

0.49

|

($0.01

|

)

|

($0.05

|

)

|

||||||

|

BALANCE

SHEET DATA:

|

||||||||||||||||

|

CASH

AND CASH EQUIVALENTS

|

$ |

21,558,739

|

$ |

12,279,646

|

$ |

989,252

|

$ |

1,984,636

|

$ |

167,547

|

||||||

|

TOTAL

ASSETS

|

71,691,670

|

44,122,318

|

30,176,711

|

20,882,097

|

9,821,226

|

|||||||||||

|

LONG-TERM

DEBT

|

7,337,105

|

3,487,757

|

831,156

|

815,418

|

-

|

|||||||||||

|

WORKING

CAPITAL ( Current Assets less

|

30,319,951

|

20,175,844

|

5,095,320

|

2,396,169

|

1,435,134

|

|||||||||||

|

Current

Liabilities)

|

||||||||||||||||

|

SHAREHOLDERS'

EQUITY

|

$ |

51,531,983

|

$ |

32,563,270

|

12,628,407

|

$ |

11,287,755

|

$ |

7,460,887

|

|||||||

|

|

·

|

For

the year ended April 30, 2007, the specialty communication systems

segment

represented approximately 81% of total revenue, and the wireless

infrastructure services segment represented approximately 19% of

total

revenue, which remains consistent with our historical services revenue

mix.

|

|

|

·

|

As

we continue to search for acquisitions, our primary goal is to identify

companies which are performing well financially and are compatible

with

the services that we perform in the specialty communication systems

segment. This trend could lead to a further shift in our revenue

composition towards the specialty communication systems segment.

We

believe that the strength of our experience in the design and

deployment of specialty communication systems gives us a competitive

advantage.

|

|

|

·

|

We

also seek to achieve organic growth in our existing business by maximizing

the value of our existing customer base, maintaining and expanding

our

focus in vertical markets and developing our relationships with technology

providers.

|

|

|

·

|

We

believe that the emergence of new and improved technologies such

as WiMAX

will create additional opportunities for us to design and deploy

solutions

through the use of the latest technologies and assisting existing

customers in enhancing the efficiency of their existing wireless

networks

using new technologies.

|

|

|

·

|

We

believe that the wireless carriers will continue to make expenditures

to

build and upgrade their networks, increase existing capacity, upgrade

their networks with new technologies and maintain their existing

infrastructure. In response to this trend, we will continue to provide

network deployment services that address wireless carrier

needs.

|

|

|

·

|

In

connection with the sale of our common stock and warrants to certain

investors during the third quarter ended January 31, 2005, we granted

certain registration rights that provided for liquidated damages

in the

event of failure to timely perform under the agreements. During the

third

quarter of fiscal 2006, we became aware that the SEC had recently

announced its preferred interpretation of the accounting for common

stock

and warrants with registration rights under Emerging Issues Task

Force

(EITF) 00-19, “Accounting for Derivative Financial Instruments Indexed To,

and Potentially Settled in the Company’s Own Stock,” and EITF 05-04, “The

Effect of a Liquidated Damages Clause on a Freestanding Financial

Instrument Subject to EITF 00-19.” Although the EITF was still reviewing

the guidance in EITF 05-04, the SEC concluded that under EITF 00-19,

the

common stock and warrants subject to registration rights where significant

liquidated damages could be required to be paid to the holder of

the

instrument in the event the issuer fails to maintain the effectiveness

of

a registration statement for a preset time period does not meet the

tests

required for shareholders’ equity classification and accordingly, must be

reflected as temporary equity in the balance sheet until the conditions

are eliminated. Additionally, the fair value of warrants should be

recorded as a liability, with an offsetting reduction to shareholders’

equity, adjusted to market value at the end of each period. In analyzing

instruments under EITF 00-19, the SEC concluded that the likelihood

or

probability related to the failure to maintain an effective registration

statement was not a factor at that time. During fiscal 2006, the

warrant

liability increased by $4,078,494, due to the increase in the market

value

of our common stock, resulting in a net non-cash loss on fair value

of

warrants for the fiscal year ended April 30, 2006. The non-cash loss

on

warrants had no effect on our cash flows or liquidity. On April 11,

2006,

we entered into a waiver agreement with the institutional investors

related to this private placement. Under the waiver, the parties

agreed to

modify the registration rights agreement associated with the common

stock

and warrants issued in November 2004 affected by EITF 00-19, thereby

eliminating the penalty provisions that could have resulted from

not

maintaining an effective registration statement related to these

common

shares and shares underlying the warrants, and eliminating any similar

non-cash charges in subsequent fiscal

years.

|

|

Year

Ended

|

|||||||||||||

|

April

30,

|

|||||||||||||

|

2007

|

2006

|

||||||||||||

|

REVENUE

|

$

|

70,000,070

|

100.0

|

%

|

$

|

52,144,575

|

100.0

|

%

|

|||||

|

COSTS

AND EXPENSES:

|

|||||||||||||

|

Cost

of revenue

|

47,781,351

|

68.3

|

%

|

38,010,945

|

72.9

|

%

|

|||||||

|

Selling,

general and administrative expenses

|

13,244,909

|

18.9

|

%

|

9,191,392

|

17.6

|

%

|

|||||||

|

Depreciation

and amortization

|

1,239,486

|

1.8

|

%

|

837,789

|

1.6

|

%

|

|||||||

|

Total

costs and expenses

|

62,265,746

|

89.0

|

%

|

48,040,126

|

92.1

|

%

|

|||||||

|

OPERATING

INCOME

|

7,734,324

|

11.0

|

%

|

4,104,449

|

7.9

|

%

|

|||||||

|

OTHER

EXPENSE (INCOME):

|

|||||||||||||

|

Interest

expense

|

496,330

|

0.7

|

%

|

256,022

|

0.5

|

%

|

|||||||

|

Interest

income

|

(525,524

|

)

|

(0.8

|

%)

|

(121,720

|

)

|

(0.2

|

%)

|

|||||

|

Minority

interest

|

23,099

|

0.0

|

%

|

-

|

0.0

|

%

|

|||||||

|

Loss

on change in fair value of warrants

|

-

|

0.0

|

%

|

4,078,494

|

7.8

|

%

|

|||||||

|

INCOME

(LOSS) BEFORE INCOME TAX PROVISION

|

7,740,419

|

11.1

|

%

|

(108,347

|

)

|

(0.2

|

%)

|

||||||

|

Income

tax provision

|

3,146,818

|

4.5

|

%

|

1,515,773

|

2.9

|

%

|

|||||||

|

NET

INCOME (LOSS)

|

$

|

4,593,601

|

6.6

|

%

|

($1,624,120

|

)

|

(3.1

|

%)

|

|||||

|

Year

Ended

|

|||||||||||||

|

April

30,

|

|||||||||||||

|

2006

|

2005

|

||||||||||||

|

REVENUE

|

$

|

52,144,575

|

100.0

|

%

|

$

|

40,148,233

|

100.0

|

%

|

|||||

|

COSTS

AND EXPENSES:

|

|||||||||||||

|

Cost

of revenue

|

38,010,945

|

72.9

|

%

|

32,445,470

|

80.8

|

%

|

|||||||

|

Selling,

general and administrative expenses

|

9,191,392

|

17.6

|

%

|

7,032,504

|

17.5

|

%

|

|||||||

|

Depreciation

and amortization

|

837,789

|

1.6

|

%

|

682,397

|

1.7

|

%

|

|||||||

|

Total

costs and expenses

|

48,040,126

|

92.1

|

%

|

40,160,371

|

100.0

|

%

|

|||||||

|

OPERATING

INCOME (LOSS)

|

4,104,449

|

7.9

|

%

|

(12,138

|

)

|

0.0

|

%

|

||||||

|

OTHER

EXPENSE (INCOME):

|

|||||||||||||

|

Interest

expense

|

256,022

|

0.5

|

%

|

31,865

|

0.1

|

%

|

|||||||

|

Interest

income

|

(121,720

|

)

|

(0.2

|

%)

|

(10,817

|

)

|

0.0

|

%

|

|||||

|

Loss

(gain) on change in fair value of warrants

|

4,078,494

|

7.8

|

%

|

(1,414,263

|

)

|

(3.5

|

%)

|

||||||

|

INCOME

(LOSS) BEFORE INCOME TAX PROVISION

|

(108,347

|

)

|

(0.2

|

%)

|

1,381,077

|

3.4

|

%

|

||||||

|

Income

tax provision

|

1,515,773

|

2.9

|

%

|

52,096

|

0.1

|

%

|

|||||||

|

NET

INCOME (LOSS)

|

($1,624,120

|

)

|

(3.1

|

%)

|

$

|

1,328,981

|

3.3

|

%

|

|||||

|

Less

than

|

1-2

|

3-5

|

More

than

|

|||||||||||||

|

Total

|

1

Year

|

Years

|

Years

|

5

Years

|

||||||||||||

|

Borrowings

under line of credit

|

$

|

4,454,217

|

$

|

-

|

$ |

-

|

$

|

4,454,217

|

$ |

-

|

||||||

|

Loans

payable

|

2,882,888

|

2,598,872

|

227,381

|

47,115

|

9,520

|

|||||||||||

|

Operating

leases

|

2,242,566

|

759,245

|

837,736

|

544,870

|

100,715

|

|||||||||||

|

Employment

agreements

|

5,494,583

|

2,612,800

|

2,881,783

|

-

|

-

|

|||||||||||

|

Total

obligations

|

$

|

15,074,254

|

$

|

5,970,917

|

$

|

3,946,900

|

$

|

5,046,202

|

$

|

110,235

|

||||||

|

Page

|

||||

|

Report

of Independent Registered Public Accounting Firm

|

F-2

|

|||

|

Consolidated

Balance Sheets as of April 30, 2007 and 2006

|

F-3

- F-4

|

|||

|

Consolidated

Statements of Operations for the years ended April

30, 2007, 2006 and 2005

|

F-5

|

|||

|

Consolidated

Statements of Shareholders' Equity for the years ended April 30,

2007,

2006 and 2005

|

F-6

- F-8

|

|||

|

Consolidated

Statements of Cash Flows for the years ended April

30, 2007, 2006 and 2005

|

F-9

- F-11

|

|||

|

Notes

to Consolidated Financial Statements

|

F-12

- F-31

|

|||

|

April

30,

|

April

30,

|

||||||

|

ASSETS

|

2007

|

2006

|

|||||

|

CURRENT

ASSETS:

|

|||||||

|

Cash

and cash equivalents

|

$

|

21,558,739

|

$

|

12,279,646

|

|||

|

Accounts

receivable, net of allowance of $98,786 and $104,786 at April 30,

2007 and

2006, respectively

|

16,560,636

|

12,141,789

|

|||||

|

Costs

and estimated earnings in excess of billings on uncompleted

contracts

|

2,499,940

|

1,441,977

|

|||||

|

Inventory

|

2,260,082

|

1,204,540

|

|||||

|

Prepaid

expenses and other current assets

|

732,043

|

286,625

|

|||||

|

Deferred

tax assets

|

54,000

|

78,000

|

|||||

|

Total

current assets

|

43,665,440

|

27,432,577

|

|||||

|

PROPERTY

AND EQUIPMENT, net

|

5,488,920

|

1,352,216

|

|||||

|

OTHER

INTANGIBLE ASSETS, net

|

1,683,349

|

864,388

|

|||||

|

GOODWILL

|

20,469,608

|

14,239,918

|

|||||

|

DEBT

ISSUANCE COSTS, net

|

10,000

|

111,091

|

|||||

|

DEFERRED

TAX ASSETS

|

111,000

|

51,000

|

|||||

|

OTHER

ASSETS

|

263,353

|

71,128

|

|||||

|

Total

assets

|

$

|

71,691,670

|

$

|

44,122,318

|

|||

|

April

30,

|

April

30,

|

||||||

|

LIABILITIES

AND SHAREHOLDERS' EQUITY

|

2007

|

2006

|

|||||

|

CURRENT

LIABILITIES:

|

|||||||

|

Current

portion of loans payable

|

$

|

2,598,872

|

$

|

231,065

|

|||

|

Accounts

payable and accrued expenses

|

6,802,110

|

4,989,861

|

|||||

|

Billings

in excess of costs and estimated earnings on uncompleted

contracts

|

2,272,688

|

1,085,312

|

|||||

|

Deferred

revenue

|

504,458

|

128,052

|

|||||

|

Due

to shareholders

|

707,000

|

381,377

|

|||||

|

Income

taxes payable

|

433,361

|

420,066

|

|||||

|

Deferred

tax liabilities

|

27,000

|

21,000

|

|||||

|

Total

current liabilities

|

13,345,489

|

7,256,733

|

|||||

|

Borrowings

under line of credit

|

4,454,217

|

3,000,000

|

|||||

|

Loans

payable, net of current portion

|

284,016

|

256,692

|

|||||

|

Due

to shareholders, net of current portion

|

-

|

514,623

|

|||||

|

Deferred

tax liabilities

|

722,000

|

531,000

|

|||||

|

Total

liabilities

|

18,805,722

|

11,559,048

|

|||||

|

Minority

interest in subsidiary

|

1,353,965

|

-

|

|||||

|

COMMITMENTS

AND CONTINGENCIES

|

|||||||

|

SHAREHOLDERS'

EQUITY:

|

|||||||

|

Preferred

stock - $0.0001 par value, 5,000,000 shares authorized, none

issued

|

-

|

-

|

|||||

|

Common

stock - $0.0001 par value, 75,000,000 shares authorized, 6,971,698

and

5,264,284 shares issued and outstanding at April 30, 2007 and 2006,

respectively

|

696

|

526

|

|||||

|

Additional

paid-in capital

|

47,901,160

|

33,525,130

|

|||||

|

Retained

earnings (accumulated deficit)

|

3,631,215

|

(962,386

|

)

|

||||

|

Accumulated

other comprehensive loss on translation of currency

exchange

|

(1,088

|

)

|

-

|

||||

|

Total

shareholders' equity

|

51,531,983

|

32,563,270

|

|||||

|

Total

liabilities and shareholders' equity

|

$

|

71,691,670

|

$

|

44,122,318

|

|||

|

Year

Ended

|

||||||||||

|

April

30,

|

||||||||||

|

2007

|

2006

|

2005

|

||||||||

|

REVENUE

|

$

|

70,000,070

|

$

|

52,144,575

|

$

|

40,148,233

|

||||

|

COSTS

AND EXPENSES:

|

||||||||||

|

Cost

of revenue

|

47,781,351

|

38,010,945

|

32,445,470

|

|||||||

|

Selling,

general and administrative expenses

|

13,244,909

|

9,191,392

|

7,032,504

|

|||||||

|

Depreciation

and amortization

|

1,239,486

|

837,789

|

682,397

|

|||||||

|

Total

costs and expenses

|

62,265,746

|

48,040,126

|

40,160,371

|

|||||||

|

OPERATING

INCOME (LOSS)

|

7,734,324

|

4,104,449

|

(12,138

|

)

|

||||||

|

OTHER

EXPENSE (INCOME):

|

||||||||||

|

Interest

expense

|

496,330

|

256,022

|

31,865

|

|||||||

|

Interest

income

|

(525,524

|

)

|

(121,720

|

)

|

(10,817

|

)

|

||||

|

Minority

interest

|

23,099

|

-

|

- | |||||||

|

Loss

(gain) on change in fair value of warrants

|

-

|

4,078,494

|

(1,414,263

|

)

|

||||||

|

INCOME

(LOSS) BEFORE INCOME TAX PROVISION

|

7,740,419

|

(108,347

|

)

|

1,381,077

|

||||||

|

Income

tax provision

|

3,146,818

|

1,515,773

|

52,096

|

|||||||

|

NET

INCOME (LOSS)

|

$

|

4,593,601

|

($1,624,120

|

)

|

$

|

1,328,981

|

||||

|

Basic

net income (loss) per common share

|

$

|

0.80

|

($0.40

|

)

|

$

|

0.50

|

||||

|

Diluted

net income (loss) per common share

|

$

|

0.72

|

($0.40

|

)

|

$

|

0.49

|

||||

|

Basic

weighted average number of common shares outstanding

|

5,772,423

|

4,057,940

|

2,679,529

|

|||||||

|

Diluted

weighted average number of common shares outstanding

|

6,409,333

|

4,057,940

|

2,729,866

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retained

|

||||

|

Additional

|

Unearned

|

Earnings

|

Total

|

||||||||||||||||||||||

|

Preferred

Stock

|

Common

Stock

|

Paid-In

|

Consulting

|

(Accumulated

|

Shareholders' | ||||||||||||||||||||

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Capital

|

Services

|

Deficit)

|

Equity

|

|||||||

|

BALANCE,

MAY 1, 2004

|

-

|

$

|

-

|

1,737,498

|

$

|

174

|

$

|

11,993,387

|

$

|

(38,559

|

)

|

($667,247

|

)

|

$

|

11,287,755

|

||||||||||

|

Common

stock issuance costs

|

-

|

-

|

-

|

-

|

(26,888

|

)

|

-

|

-

|

(26,888

|

)

|

|||||||||||||||

|

Amortization

of unearned consulting services

|

-

|

-

|

-

|

-

|

-

|

38,559

|

-

|

38,559

|

|||||||||||||||||

|

Net

income

|

-

|

-

|

-

|

-

|

-

|

-

|

1,328,981

|

1,328,981

|

|||||||||||||||||

|

BALANCE,

APRIL 30, 2005

|

-

|

-

|

1,737,498

|

174

|

11,966,499

|

-

|

661,734

|

12,628,407

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional

|

|

|

|

|

|

Total

|

|

|

Preferred

Stock

|

Common

Stock

|

Paid-In

|

(Accumulated

|

Shareholders'

|

||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

Capital

|

Deficit)

|

Equity

|

||||||||||||||||

|

Reclassification

of proceeds from sales of common stock

|

||||||||||||||||||||||

|

with

registration rights to additional paid-in capital

|

-

|

-

|

2,083,887

|

208

|

5,731,908

|

-

|

5,732,116

|

|||||||||||||||

|

Net

proceeds from exercise of warrants

|

-

|

-

|

554,717

|

55

|

4,167,092

|

-

|

4,167,147

|

|||||||||||||||

|

Reclassification

of fair value of warrant liability to additional

|

||||||||||||||||||||||

|

paid-in

capital from exercise of warrants

|

-

|

-

|

-

|

-

|

2,849,302

|

-

|

2,849,302

|

|||||||||||||||

|

Reclassification

of fair value of warrant liability to additional

|

||||||||||||||||||||||

|

paid-in

capital from the termination of liquidated

|

||||||||||||||||||||||

|

damages

provision under registration rights agreement

|

-

|

-

|

-

|

-

|

3,223,760

|

-

|

3,223,760

|

|||||||||||||||

|

Net

proceeds from issuance of common stock

|

-

|

-

|

876,931

|

88

|

5,528,078

|

-

|

5,528,166

|

|||||||||||||||

|

Net

proceeds from exercise of stock options

|

-

|

-

|

11,251

|

1

|

58,491

|

-

|

58,492

|

|||||||||||||||

|

Net

loss

|

-

|

-

|

-

|

-

|

-

|

(1,624,120

|

)

|

(1,624,120

|

)

|

|||||||||||||

|

BALANCE,

APRIL 30, 2006

|

-

|

-

|

5,264,284

|

526

|

33,525,130

|

(962,386

|

)

|

32,563,270

|

||||||||||||||

|

Accumulated

|

|||||||||||||||||||||||||

|

|

Other

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Additional

|

|

|

|

Compre-

|

Total

|

|||||||||||

|

Preferred

Stock

|

Common

Stock

|

Paid-In

|

Retained

|

hensive

|

Shareholders' | ||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

Capital

|

Earnings

|

|

Loss

|

Equity

|

|||||||||||||||||

|

Net

issuance of common stock, acquisition of

|

|||||||||||||||||||||||||

|

Southeastern

Communication Service, Inc.

|

-

|

-

|

200,288

|

20

|

1,349,631

|

- | - |

1,349,651

|

|||||||||||||||||

|

Net

issuance of common stock, acquisition of

|

|||||||||||||||||||||||||

|

Voacolo

Eletric Inc

|

113,534

|

11

|

1,249,869

|

- | - |

1,249,880

|

|||||||||||||||||||

|

Net

issuance of common stock, acquisition of

|

|||||||||||||||||||||||||

|

TAGS

|

61,277

|

6

|

719,864

|

- | - |

719,870

|

|||||||||||||||||||

|

Net

issuance of common stock

|

-

|

-

|

1,109,023

|

111

|

9,337,780

|

- | - |

9,337,891

|

|||||||||||||||||

|

Net

proceeds from exercise of warrants

|

-

|

-

|

30,281

|

3

|

197,873

|

- | - |

197,876

|

|||||||||||||||||

|

Fair

value of stock options granted to employees

|

-

|

-

|

-

|

-

|

37,526

|

- | - |

37,526

|

|||||||||||||||||

|

Net

proceeds from exercise of stock options

|

-

|

-

|

193,011

|

19

|

1,225,487

|

- | - |

1,225,506

|

|||||||||||||||||

|

Excess

tax benefit from exercise of stock options

|

- | - | - | - |

258,000

|

- | - |

258,000

|

|||||||||||||||||

|

Accumulated

other comprehensive loss

|

- | - | - | - |

-

|

- |

($1,088

|

) |

(1,088

|

) | |||||||||||||||

|

Net

income

|

-

|

-

|

-

|

-

|

-

|

$

|

4,593,601

|

- |

4,593,601

|

||||||||||||||||

|

BALANCE,

APRIL 30, 2007

|

-

|

$

|

-

|

6,971,698

|

$

|

696

|

$

|

47,901,160

|

$

|

3,631,215

|

($1,088

|

)

|

$

|

51,531,983

|

|||||||||||

|

Year

Ended

|

||||||||||

|

April

30,

|

||||||||||

|

2007

|

2006

|

2005

|

||||||||

|

OPERATING

ACTIVITIES:

|

||||||||||

|

Net

income (loss)

|

$

|

4,593,601

|

$

|

(1,624,120

|

)

|

$

|

1,328,981

|

|||

|

Adjustments

to reconcile net income (loss) to net cash provided by (used in)

operating

activities:

|

||||||||||

|

Depreciation

and amortization

|

1,239,486

|

837,789

|

682,397

|

|||||||

|

Fair

value of stock options granted to employees

|

37,526

|

-

|

-

|

|||||||

|

Change

in fair value of warrant liability

|

-

|

4,078,494

|

(1,414,263

|

)

|

||||||

|

(Recovery

of) provision for doubtful accounts

|

(6,000

|

)

|

29,000

|

14,007

|

||||||

|

Amortization

of debt issuance costs

|

111,091

|

47,696

|

-

|

|||||||

|

Amortization

of unearned consulting services

|

-

|

-

|

38,559

|

|||||||

|

Fair

value of stock options granted

|

-

|

-

|

||||||||

|

Excess

tax benefit from exercise of stock options

|

(258,000

|

)

|

-

|

-

|

||||||

|

Minority

interest

|

23,099

|

-

|

-

|

|||||||

|

Gain

on sale of fixed assets

|

(13,675

|

)

|

-

|

-

|

||||||

|

Deferred

income taxes

|

161,000

|

(43,000

|

)

|

(134,000

|

)

|

|||||

|

Changes

in operating assets and liabilities, net of effects of

acquisitions:

|

||||||||||

|

Accounts

receivable

|

2,320,439

|

(2,265,623

|

)

|

(1,898,625

|

)

|

|||||

|

Costs

and estimated earnings in excess of billings on uncompleted

contracts

|

(421,204

|

)

|

(533,022

|

)

|

1,214,076

|

|||||

|

Inventory

|

229,358

|

(318,916

|

)

|

(536,772

|

)

|

|||||

|

Prepaid

expenses and other current assets

|

89,273

|

249,706

|

(14,306

|

)

|

||||||

|

Other

assets

|

(180,187

|

)

|

37,001

|

(148,596

|

)

|

|||||

|

Accounts

payable and accrued expenses

|

(2,345,468

|

)

|

(376,943

|

)

|

(337,355

|

)

|

||||

|

Billings

in excess of costs and estimated earnings on uncompleted

contracts

|

329,544

|

8,873

|

(1,146,930

|

)

|

||||||

|

Deferred

revenue

|

222,092

|

-

|

-

|

|||||||

|

Income

taxes payable

|

37,244

|

381,758

|

(328,751

|

)

|

||||||

|

NET

CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES

|

6,169,219

|

508,693

|

(2,681,578

|

)

|

||||||

|

INVESTING

ACTIVITIES:

|

||||||||||

|

Acquisition

of property and equipment, net

|

(673,237

|

) |

(234,792

|

) |

(215,844

|

) | ||||

|

Acquisition

of Quality, net of cash received

|

-

|

-

|

(6,708,904

|

) | ||||||

|

Acquisition

of Heinz, net of cash received

|

-

|

-

|

(82,283

|

) | ||||||

|

Acquisition

transaction costs

|

-

|

(4,304

|

) |

(17,553

|

) | |||||

|

Acquisition

of NECS, net of cash received

|

(4,607,268

|

) |

-

|

-

|

||||||

|

Acquisition

of SECS, net of cash received

|

(1,882,321

|

) |

-

|

-

|

||||||

|

Acquisition

of Voacolo, net of cash received

|

(627,694

|

) |

-

|

-

|

||||||

|

Acquisition

of TAGS, net of cash received

|

(841,252

|

) |

-

|

-

|

||||||

|

NET

CASH USED IN INVESTING ACTIVITIES

|

(8,631,772

|

) |

(239,096

|

) |

(7,024,584

|

) | ||||

|

FINANCING

ACTIVITIES:

|

||||||||||

|

Net

proceeds from exercise of warrants

|

197,876

|

4,167,147

|

-

|

|||||||

|

Net

proceeds from issuance of common stock

|

9,337,891

|

5,528,166

|

-

|

|||||||

|

Net

proceeds from exercise of stock options

|

1,225,506

|

58,492

|

-

|

|||||||

|

Net

proceeds from issuance of common stock with continuing registration

rights

|

-

|

-

|

9,140,949

|

|||||||

|

Excess

tax benefit from exercise of stock options

|

258,000

|

-

|

-

|

|||||||

|

Equity

issuance costs

|

(50,613

|

) |

-

|

(26,888

|

) | |||||

|

Debt

issuance costs

|

(10,000

|

) |

(158,787

|

) |

-

|

|||||

|

Borrowings

(repayments) under lines of credit, net

|

1,454,217

|

2,617,719

|

(303,848

|

) | ||||||

|

Repayments

of loans payable

|

(456,405

|

) |

(227,952

|

) |

(96,901

|

) | ||||

|

Payments

of amounts due to shareholders

|

(189,000

|

) |

(961,915

|

) |

-

|

|||||

|

Payments

of capital lease obligations

|

(24,738

|

) |

(2,073

|

) |

(2,534

|

) | ||||

|

NET

CASH PROVIDED BY FINANCING ACTIVITIES

|

11,742,734

|

11,020,797

|

8,710,778

|

|||||||

|

Effect

of exchange rate changes on cash

|

(1,088

|

) |

-

|

-

|

||||||

|

NET

INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS

|

9,279,093

|

11,290,394

|

(995,384

|

) | ||||||

|

CASH

AND CASH EQUIVALENTS, BEGINNING OF YEAR

|

12,279,646

|

989,252

|

1,984,636

|

|||||||

|

CASH

AND CASH EQUIVALENTS, END OF YEAR

|

$

|

21,558,739

|

$

|

12,279,646

|

$

|

989,252

|

||||

|

Year

Ended

|

|||||||||||||

|

April

30,

|

|||||||||||||

|

2007

|

2006

|

2005

|

|||||||||||

|

SUPPLEMENTAL

DISCLOSURE OF CASH FLOW INFORMATION:

|

|||||||||||||

|

Cash

paid during the period for:

|

|

||||||||||||

|

Interest

|

$

|

433,742

|

$

|

189,435

|

$

|

32,196

|

|||||||

|

Income

taxes

|

$

|

2,897,944

|

$

|

1,187,556

|

$

|

434,289

|

|||||||

|

SCHEDULE

OF NON CASH INVESTING AND FINANCING ACTIVITIES:

|

|||||||||||||

|

Issuance

of common stock for net non-cash assets received in acquisition

|

$

|

3,370,011

|

$

|

-

|

$

|

-

|

|||||||

|

Unpaid

purchase price adjustments related to acquisition

|

$

|

-

|

$

|

-

|

$

|

742,295

|

|||||||

|

Reversal

of accruals established in purchase accounting

|

$

|

-

|

$

|

2,150

|

$

|

40,022

|

|||||||

|

Issuance

of notes for property and equipment

|

$

|

74,382

|

$

|

266,834

|

$

|

192,210

|

|||||||

|

Reclassification

of proceeds from sales of common stock with registration

rights,

|

|||||||||||||

|

to

additional paid-in capital

|

$

|

-

|

$

|

5,732,116

|

$

|

-

|

|||||||

|

Reclassification

of fair value of warrant liability to additional paid-in capital

|

|||||||||||||

|

from

the exercise of warrants

|

$

|

-

|

$

|

2,849,302

|

$

|

-

|

|||||||

|

Reclassification

of fair value of warrant liability to additional paid-in capital

from

the

|

|||||||||||||

|

termination

of liquidated damages provision under registration rights

agreement

|

$

|

-

|

$

|

3,223,760

|

$

|

-

|

|||||||

|

Beginning

balance, May 1, 2005

|

$

|

13,961,642

|

||

|

Additional

transaction costs for prior acquisitions

|

2,675

|

|||

|

Clayborn

acquisition purchase price adjustment

|

48,803

|

|||

|

Quality

acquisition purchase price adjustment

|

226,798

|

|||

|

Ending

balance, April 30, 2006

|

14,239,918

|

|||

|

Additional

transaction costs for prior acquisitions

|

13,781

|

|||

|

NECS

acquisition

|

3,380,111

|

|||

|

SECS

acquisition

|

1,823,205

|

|||

|

Voacolo

acqusition

|

1,012,593

|

|||

|

Ending

balance, April 30, 2007

|

$

|

20,469,608

|

||

|

Estimated

useful life (years)

|

2007

|

2006

|

||||||||

|

Customer

lists

|

5

- 8

|

$

|

2,607,000

|

$

|

1,585,000

|

|||||

|

Contract

backlog

|

1-3

|

325,200

|

65,000

|

|||||||

|

2,932,200

|

1,650,000

|

|||||||||

|

Less

accumulated amortization expense

|

1,248,851

|

785,612

|

||||||||

|

$

|

1,683,349

|

$

|

864,388

|

|||||||

|

Year

ending April 30,

|

||||

|

2008

|

$

|

472,599

|

||

|

2009

|

352,665

|

|||

|

2010

|

301,831

|

|||

|

2011

|

195,353

|

|||

|

2012

|

138,965

|

|||

|

Thereafter

|

221,936

|

|||

|

Total

|

$

|

1,683,349

|

||

|

Risk-free

interest rate

|

4.73%

to 4.96%

|

|

Expected

volatility

|

61.0%

to 62.4%

|

|

Expected

dividend yield

|

0.0%

|

|

Expected

term ( in years)

|

3.5

|

|

2006

|

2005

|

||||||

|

Net

income (loss), as reported

|

($1,624,120

|

)

|

$

|

1,328,981

|

|||

|

Deduct

total stock-based employee compensation expense determined under

fair

value based method for all awards, net of tax

|

(453,092

|

)

|

(452,820

|

)

|

|||

|

Pro

forma net income (loss)

|

($2,077,212

|

)

|

$

|

876,161

|

|||

|

Basic

net income (loss) per share

|

|||||||

|

As

reported

|

($0.40

|

)

|

|

$0.50

|

|||

|

Pro

forma

|

($0.51

|

)

|

|

$0.33

|

|||

|

Diluted

net income (loss) per share

|

|||||||

|

As

reported

|

($0.40

|

)

|

|

$0.49

|

|||

|

Pro

forma

|

($0.51

|

)

|

|

$0.32

|

|||

|

Assets

purchased:

|

|

||||||

|

Cash

|

$

|

129,749

|

|||||

|

Accounts

receivable

|

968,982

|

||||||

|

Inventory

|

348,579

|

||||||

|

Prepaid

expenses

|

33,237

|

||||||

|

Fixed

assets

|

244,740

|

||||||

|

Other

assets

|

3,455

|

||||||

|

Customer

list

|

570,000

|

||||||

|

Goodwill

|

3,380,111

|

||||||

|

5,678,853

|

|||||||

|

Liabilities

assumed:

|

|||||||

|

Accounts

payable

|

(611,862

|

)

|

|||||

|

Accrued

expenses

|

(199,681

|

)

|

|||||

|

Deferred

revenue

|

(94,802

|

)

|

|||||

|

Capital

lease obligations

|

(24,738

|

)

|

|||||

|

Accrued

property taxes

|

(10,753

|

)

|

|||||

|

(941,836

|

)

|

||||||

|

Purchase

price

|

$

|

4,737,017

|

|||||

|

Assets

purchased:

|

|

||||||

|

Cash

|

$

|

200,012

|

|||||

|

Accounts

receivable

|

1,945,618

|

||||||

|

Inventory

|

97,096

|

||||||

|

Prepaid

expenses

|

54,186

|

||||||

|

Costs

in excess of billings

|

421,616

|

||||||

|

Fixed

assets

|

273,980

|

||||||

|

Other

assets

|

400

|

||||||

|

Backlog

|

60,000

|

||||||

|

Customer

list

|

320,000

|

||||||

|

Goodwill

|

1,823,205

|

||||||

|

5,196,113

|

|||||||

|

Liabilities

assumed:

|

|||||||

|

Accounts

payable

|

(727,612

|

)

|

|||||

|

Accrued

expenses

|

(323,497

|

)

|

|||||

|

Pension

plan payable

|

(75,000

|

)

|

|||||

|

Profit

sharing

|

(40,056

|

)

|

|||||

|

Notes

payable

|

(378,103

|

)

|

|||||

|

Billings

in excess of costs

|

(169,499

|

)

|

|||||

|

(1,713,767

|

)

|

||||||

|

Purchase

price

|

$

|

3,482,346

|

|

Assets

purchased:

|

||||

|

Cash

|

$

|

584,094

|

||

|

Accounts

receivable

|

2,119,362

|

|||

|

Inventory

|

217,500

|

|||

|

Prepaid

expenses

|

55,788

|

|||

|

Costs

in excess of billings

|

215,143

|

|||

|

Fixed

assets

|

217,899

|

|||

|

Backlog

|

200,200

|

|||

|

Customer

list

|

132,000

|

|||

|

Goodwill

|

1,012,593

|

|||

|

4,754,579

|

||||

|

Liabilities

assumed:

|

||||

|

Accounts

payable

|

(732,252

|

)

|

||

|

Accrued

expenses

|

(90,120

|

)

|

||

|

Payroll

and other payable

|

(80,672

|

)

|

||

|

Loan

payable

|

(602,984

|

)

|

||

|

Notes

payable

|

(100,436

|

)

|

||

|

Billings

in excess of costs

|

(686,327

|

)

|

||

|

|

(2,292,791

|

)

|

||

|

Purchase

price

|

$

|

2,461,788

|

||

|

Assets

purchased:

|

|

||||||

|

Cash

|

$

|

141,564

|

|||||

|

Accounts

receivable

|

1,699,320

|

||||||

|

Inventory

|

621,725

|

||||||

|

Other

current assets

|

399,664

|

||||||

|

Fixed

assets

|

3,415,035

|

||||||

|

6,277,308

|

|||||||

|

Liabilities

assumed:

|

|||||||

|

Accounts

payable

|

(72,710

|

)

|

|||||

|

Accrued

expenses and other payable

|

(714,126

|

)

|

|||||

|

Payroll

and other payable

|

(165,423

|

)

|

|||||

|

Dividends

payable

|

(312,724

|

)

|

|||||

|

Income

tax payable

|

(235,279

|

)

|

|||||

|

Notes

payable

|

(1,681,846

|

)

|

|||||

|

Deferred

Revenue

|

(61,519

|

)

|

|||||

|

Minority

Interest

|

(1,330,865

|

)

|

|||||

|

(4,574,492

|

)

|

||||||

|

Purchase

price

|

$

|

1,702,816

|

|||||

|

|

Consolidated

Pro Forma

|

|||||||||

|

2007

|

2006

|

2005

|

||||||||

|

Revenues

|

$

|

81,176,137

|

$

|

76,551,105

|

$

|

68,248,366

|

||||

|

Net

income (loss)

|

5,167,349

|

(567,876

|

)

|

2,071,474

|

||||||

|

Basic

weighted shares

|

5,983,074

|

4,439,847

|

3,061,436

|

|||||||

|

Diluted

weighted shares

|

6,620,059

|

4,439,847

|

3,111,774

|

|||||||

|

Basic

net income (loss) per share

|

|

$0.86

|

($0.13

|

)

|

|

$0.68

|

||||

|

Diluted

net income (loss) per share

|

|

$0.78

|

($0.13

|

)

|

|

$0.67

|

||||

|

2007

|

2006

|

||||||

|

Costs

incurred on uncompleted contracts

|

$

|

39,431,006

|

$

|

24,694,056

|

|||

|

Estimated

contract profit

|

12,513,277

|

6,593,218

|

|||||

|

51,944,283

|

31,287,274

|

||||||

|

Less:

billings to date

|

51,717,031

|

30,930,609

|

|||||

|

Net

excess of costs

|

$

|

227,252

|

$

|

356,665

|

|||

|

Costs

and estimated earnings in excess of billings

|

$

|

2,499,940

|

$

|

1,441,977

|

|||

|

Billings

in excess of costs and estimated earnings

|

|||||||

|

on

uncompleted contracts

|

(2,272,688

|

)

|

(1,085,312

|

)

|

|||

|

Net

excess of costs

|

$

|

227,252

|

$

|

356,665

|

|||

|

Estimated

useful life (years)

|

2007

|

2006

|

||||||||

|

Furniture

and fixtures

|

5

- 7

|

$

|

222,963

|

$

|

135,383

|

|||||

|

Computers

and software

|

2-3

|

722,072

|

476,342

|

|||||||

|

Office

equipment

|

5-7

|

92,337

|

55,612

|

|||||||

|

Vehicles

|

5

- 7

|

1,903,142

|

1,256,568

|

|||||||

|

Machinery

and equipment

|

5

|

4,231,918

|

393,436