UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to Section 240.14a-12 |

WPCS INTERNATIONAL INCORPORATED

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy

Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

(1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) Amount previously paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: |

WPCS INTERNATIONAL INCORPORATED

521 Railroad Avenue

Suisun City, California 94585

Telephone: (707) 421-1300

March 2, 2015

Dear Stockholder:

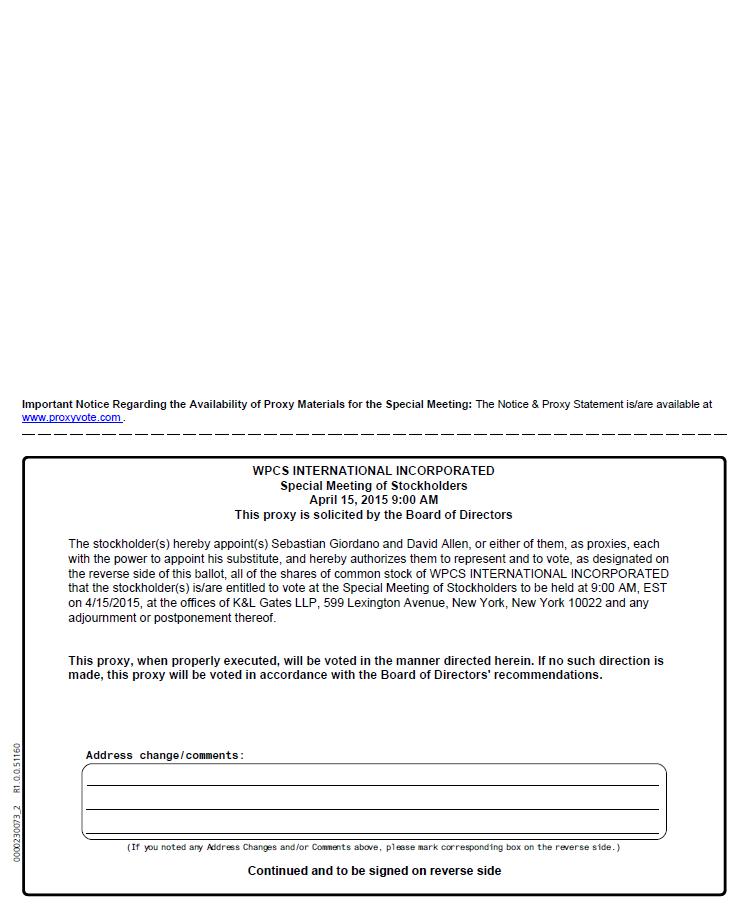

A Special Meeting of Stockholders of WPCS International Incorporated will be held on April 15, 2015, at 9:00 a.m. local time, at the offices of K&L Gates LLP, 599 Lexington Avenue, New York, New York 10022.

Details of the business to be conducted at the Special Meeting are provided in the enclosed Notice of Special Meeting of Stockholders and the Proxy Statement (also available at www.proxyvote.com) which you are urged to read carefully.

On behalf of the Board of Directors, I cordially invite all stockholders to attend the Special Meeting. It is important that your shares be voted on the matters scheduled to come before the Special Meeting. Whether or not you plan to attend the Special Meeting, I urge you to vote your shares. For your convenience, we are providing three ways in which you may vote your shares: (1) by Internet, at www.proxyvote.com and using the control number located on your proxy card; (2) by touch-tone telephone, by dialing the toll-free telephone number located on your notice and following the instructions; or (3) by mail, by returning your executed proxy in the enclosed postage paid envelope. If you attend the Special Meeting, you may revoke such proxy and vote in person if you wish. Even if you do not attend the Special Meeting, you may revoke such proxy at any time prior to the Special Meeting by executing another proxy bearing a later date or providing written notice of such revocation to the Corporate Secretary of the Company.

| WPCS INTERNATIONAL INCORPORATED | |

| /s/ Sebastian Giordano | |

| Sebastian Giordano | |

| Interim Chief Executive Officer |

Important Notice Regarding the Availability of Proxy Materials for the special meeting of stockholders to be held on April 15, 2015: In accordance with rules and regulations adopted by the Securities and Exchange Commission, we are providing access to our proxy materials, including the proxy statement and a form of proxy relating to the special meeting, over the Internet. All stockholders of record and beneficial owners will have the ability to access the proxy materials at www.proxyvote.com. These proxy materials are available free of charge.

WPCS INTERNATIONAL INCORPORATED

521 Railroad Avenue

Suisun City, California 94585

Telephone: (707) 421-1300

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

A special meeting (the “Meeting”) of the stockholders of WPCS International Incorporated (the “Company”) will be held on April 15, 2015, 9:00 a.m. local time, at the offices of K&L Gates LLP, 599 Lexington Avenue, New York, New York 10022, for the following purposes:

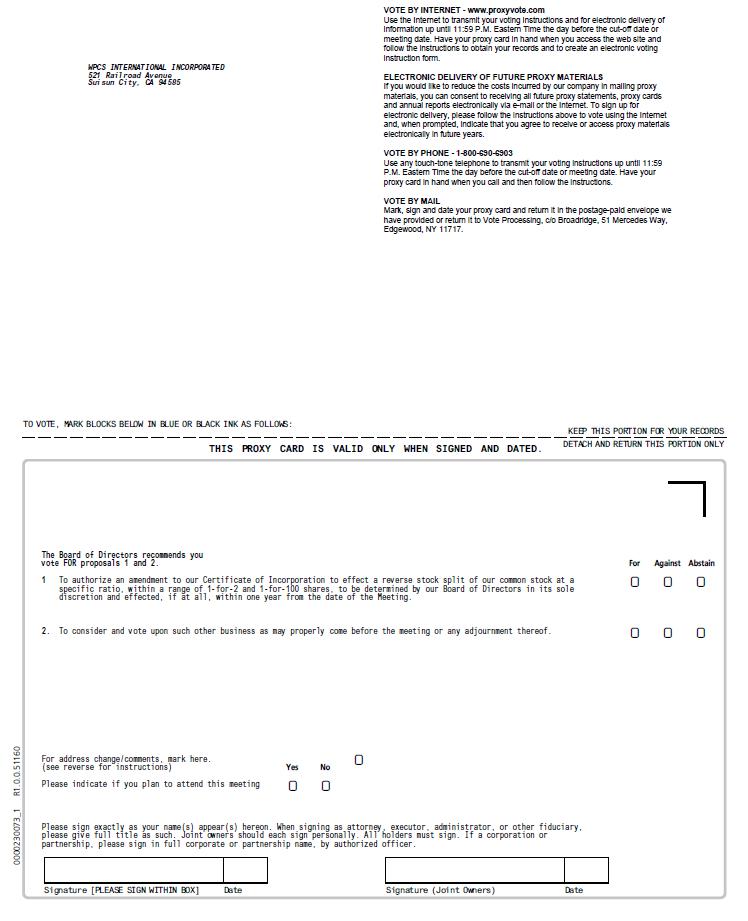

| 1. |

To authorize an amendment to our Certificate of Incorporation to effect a reverse stock split of our common stock at a specific ratio, within a range of 1-for-2 and 1-for-100 shares, to be determined by our Board of Directors in its sole discretion and effected, if at all, within one year from the date of the Meeting;

and

|

| 2. | To transact such other business as may properly be brought before a special meeting of the stockholders of the Company or any adjournment or postponement thereof. |

Stockholders of record at the Record Date (as defined in the Proxy Statement) are entitled to notice of and to vote at the Meeting or any adjournments thereof. Your attention is called to the Proxy Statement on the following pages. Please review it carefully. We hope you will attend the Meeting.

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, you are urged to mark, sign, date, and return the enclosed proxy as promptly as possible in the postage-prepaid envelope enclosed for that purpose TO ASSURE YOUR REPRESENTATION AT THE MEETING, . You also may submit your proxy by calling the toll-free number shown on your proxy card or by visiting the Internet website address shown on your proxy card. If you attend the meeting, you may revoke your proxy and vote in person. PLEASE HAVE YOUR SHARES VOTED:

By Internet. Visit www.proxyvote.com and enter the control number located on your proxy card.

By Touch-Tone Telephone. Dial the toll-free number found on your proxy card and follow the simple instructions.

By Mail. Simply return your executed proxy in the enclosed postage paid envelope.

THE PROXY IS REVOCABLE AT ANY TIME PRIOR TO ITS USE.

For more instructions, please see the Questions and Answers beginning on page 1 of this Proxy Statement and the instructions on the attached proxy card.

By Order of the Board of Directors,

| /s/ Sebastian Giordano | |

| Sebastian Giordano | |

| Interim Chief Executive Officer |

March 2, 2015

PROXY STATEMENT

This Proxy Statement and the accompanying proxy card are being furnished to holders of shares of common stock, par value $0.0001 per share, of WPCS International Incorporated, a Delaware corporation (the “Company”), commencing on or about March 2, 2015, in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board”) for use at a special meeting of the stockholders of the Company (the “Meeting”) to be held at the offices of K&L Gates LLP, 599 Lexington Avenue, New York, New York 10022 on April 15, 2015 at 9:00 a.m. local time. You are invited to attend the Meeting and are requested to vote on the proposal described in this Proxy Statement.

QUESTIONS AND ANSWERS ABOUT THIS

PROXY MATERIAL AND THE MEETING

These questions do not, and are not intended to, address all the questions that may be important to you. You should carefully read the entire Proxy Statement, as well as any documents incorporated by reference in this Proxy Statement.

What information is contained in these materials?

The information included in this Proxy Statement relates to the proposal to be voted on at the Meeting, the voting process, the security ownership of certain beneficial owners and management, and certain other required information.

On what matters am I voting?

Our Board seeks stockholder approval for the proposal to amend our Certificate of Incorporation to effect a reverse stock split of the Company's issued and outstanding common stock at a ratio, within a range of 1-for-2 and 1-for-100 shares, to be determined by the Board in its sole discretion, if and only if, the Board determines that a reverse stock split is appropriate to maintain the listing of its common stock on The Nasdaq Capital Market within one year from the date of the Meeting. The number of shares of common stock which the Company is authorized to issue will not change as a result of a reverse stock split.

The stockholders will also transact any other business that properly comes before the Meeting.

What is our Board’s voting recommendation?

Our Board of Directors has unanimously adopted resolutions approving a proposal to amend the Certificate of Incorporation to effect a reverse stock split of all our issued and outstanding shares of common stock, at a ratio to be determined by the Board of Directors in its sole discretion, but in all cases within a range of 1-for-2 and 1-for-100 shares, and publicly announced by the Company at least ten days prior to the effectiveness of the amendment. If this proposal is approved by the Company’s stockholders, the Board of Directors may decide not to effect the reverse stock split and will make the determination to effect the reverse stock split within one year from the date of the Meeting. The actual ratio for implementation of a reverse stock split would be determined by the Board based upon its evaluation as to what ratio of pre-split shares to post-split shares would be most advantageous to our stockholders and in maintaining the listing of our common stock on The Nasdaq Capital Market. In the event that this proposal is approved by the stockholders and the Board determines to effect a reverse stock split, the Company would file an amendment to the Company’s Certificate of Incorporation with the Secretary of State of the State of Delaware to effect a reverse stock split. Note that in the event that a reverse stock split results in a stockholder holding a fractional share of common stock, such fractional share will be rounded up to the next whole number.

| 1 |

Who can vote at the Meeting?

You are entitled to vote at the Meeting if you owned shares of our common stock at the close of business on February 17, 2015, the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). You will have one vote for each share of our common stock that you owned on the Record Date. As of the Record Date, there were 14,513,164 shares of our common stock outstanding and entitled to vote at the Meeting. The presence in person or by proxy of the holders of thirty-three and one-third percent (33.33%) of the issued and outstanding shares of our common stock entitled to vote at the close of business on the Record Date will constitute a quorum for purposes of conducting business at the Meeting. If you fail both to attend the meeting in person and to submit a proxy, the effect will be that your shares will not be counted for purposes of determining whether a quorum is present at the Meeting.

How do I vote?

You may vote your shares of common stock either by proxy or in person at the Meeting (please also see the detailed instructions on your proxy card). Each such share is entitled to one vote on each matter submitted to a vote at the Meeting. To vote by proxy, please complete, sign and mail the enclosed proxy card in the envelope provided, which requires no postage for mailing in the United States. If a proxy specifies how your shares are to be voted, it will be voted in the manner specified. If you return a signed proxy card but do not provide voting instructions, your shares will be voted FOR approval of Proposal No. 1 in accordance with the recommendation of our Board or, in the absence of such a recommendation, in accordance with the judgment of the proxy holder, with respect to any other matter that is properly brought before the Meeting for action by stockholders. Proxies in the form enclosed are being solicited by our Board for use at the Meeting.

May I revoke my proxy?

As a holder of record of our shares, you may revoke your proxy and change your vote at any time prior to the Meeting by giving written notice of your revocation to our Secretary, by signing another proxy card with a later date and submitting this later dated proxy to our Secretary before or at the Meeting, or by voting in person at the Meeting. Please note that your attendance at the Meeting will not constitute a revocation of your proxy unless you actually vote at the Meeting. Giving a proxy will not affect your right to change your vote if you attend the Meeting and want to vote in person. We will pass out written ballots to any holder of record of our shares who wants to vote at the Meeting.

Any written notice of revocation or subsequent proxy should be sent to WPCS International Incorporated, Attention: Secretary, 521 Railroad Avenue, Suisun City, California 94585, or hand delivered in person before the voting at the Meeting.

What does it mean if I receive more than one proxy card?

If your shares are registered differently or are held in more than one account, you will receive more than one proxy card. Please sign and return all proxy cards to ensure that all of your shares are voted.

Will my shares be voted if I do not sign and return my proxy card?

If you are the record holder of your shares and do not return your proxy card, your shares will not be voted unless you attend the Meeting in person and vote your shares.

| 2 |

What is a quorum and what constitutes a quorum?

A “quorum” is the number of shares that must be present, in person or by proxy, in order for business to be conducted at the Meeting. The required quorum for the Meeting is the presence in person or by proxy of the holders of thirty-three and one-third percent (33.33%) of the issued and outstanding shares of our common stock entitled to vote thereon at the close of business on the Record Date. Since there was an aggregate of 14,513,164 of common stock issued and outstanding and entitled to vote thereon as of the Record Date, a quorum will be present for the Meeting if an aggregate of at least 4,837,721 of common stock are present in person or by proxy at the Meeting.

Broker “non-votes” are included for the purposes of determining whether a quorum is present at the Meeting. A broker “non-vote” occurs when a nominee holder, such as a brokerage firm, bank or trust company, holding shares of record for a beneficial owner, does not vote on a particular proposal because the nominee holder does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

How many votes are required to approve the proposal?

The approval of Proposal herein requires the affirmative vote of the holders of a majority in voting power of the outstanding shares of common stock, or in other words, the proposal must be approved by the affirmative vote of the holders of 7,256,582 shares of common stock. For purposes of the Proposal, abstentions and broker “non-votes” will have the same effect as a vote "against" the Proposal.

Who is paying for this proxy’s solicitation process?

The enclosed proxy is solicited on behalf of our Board, and we are paying for the entire cost of the proxy solicitation process. Copies of the proxy material will be given to banks, brokerage houses and other institutions that hold shares that are beneficially owned by others. Upon request, we will reimburse these banks, brokerage houses and other institutions for their reasonable out-of-pocket expenses in forwarding these proxy materials to the stockholders who are the beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, facsimile or personal solicitation by our directors, officers, or other employees.

How can I find out the results of the voting at the Meeting?

We will announce preliminary voting results at the Meeting and publish final results in a Current Report on Form 8-K which will be filed with the Securities and Exchange Commission (the “SEC”) within four business days after the Meeting.

How can stockholders communicate with our Board?

Company stockholders who want to communicate with our Board may write to our Corporate Secretary at WPCS International Incorporated, Attention: Secretary, 521 Railroad Avenue, Suisun City, California 94585.

Your letter should indicate that you are a Company stockholder. Depending on the subject matter, our Corporate Secretary will: (i) forward the communication to the appropriate officer of the Company; (ii) attempt to handle the inquiry directly, for example when the request is for information about the Company or is a stock-related matter; or (iii) not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic. At each Board meeting, a member of management will present a summary of all communications received since the last meeting that were not forwarded to the director to whom they were addressed, and shall make those communications available to our Board upon request.

| 3 |

PROPOSAL NO. 1

GRANT OF DISCRETIONARY AUTHORITY TO THE BOARD OF DIRECTORS

TO IMPLEMENT ONE OR MORE REVERSE STOCK SPLITS

Our Board of Directors has unanimously adopted resolutions approving a proposal to amend the Certificate of Incorporation to effect a reverse stock split (“Reverse Split”) of all our outstanding shares of common stock, at a ratio to be determined by the Board of Directors in its sole discretion, but in all cases within a range of 1-for-2 and 1-for-100 shares, and publicly announced by the Company at least ten days prior to the effectiveness of the amendment. If this proposal is approved, the Board of Directors may decide not to effect a Reverse Split. The Board of Directors does not currently intend to seek reapproval of a Reverse Split for any delay in implementing a Reverse Split unless twelve months has passed from the date of the Meeting (the “Authorized Period”). If the Board of Directors determines to implement a Reverse Split, it will become effective upon filing the amendment to the Certificate of Incorporation with the Secretary of State of the State of Delaware or at such later date specified therein. The Board's determination of when, if at all, or at what ratio to effect the split within the range described above will be based upon many factors, including existing and expected marketability and liquidity of our common stock, prevailing market trends and conditions, the listing requirements of Nasdaq, and the likely effect of a Reverse Split on the market price of our common stock.

The text of the proposed amendment of our Certificate of Incorporation to effect a Reverse Split is included as Appendix A to this Proxy Statement.

Purpose of a Reverse Split

On November 3, 2014, The Nasdaq Capital Market (“Nasdaq”) notified the Company that it was not in compliance with the minimum bid price rule of Nasdaq, which requires the bid price of the Company’s common stock to be at least $1.00 per share. The Company was granted an initial six month period, or until May 4, 2015, to regain compliance with the minimum bid price rule, unless it was able to obtain an extension of the deadline to regain compliance. The Company can regain compliance if, at any time before May 4, 2015, the closing bid price of shares of the Company’s common stock is at least $1 for at minimum of 10 consecutive business days and generally not more than 20 consecutive business days.

The primary purpose of a Reverse Split would be to increase the market price of our common stock so that we can meet the minimum bid price rule requirements of Nasdaq. As of February 27, 2015, the last reported closing price of the Company’s common stock was $0.25. A delisting of the Company's common stock may materially and adversely affect a holder's ability to dispose of, or to obtain accurate quotations as to the market value, of, the common stock. In addition, any delisting may cause the common stock to be subject to "penny stock" regulations promulgated by the SEC. Under such regulations, broker-dealers are required to, among other things, comply with disclosure and special suitability determinations prior to the sale of shares of common stock. If the Company’s common stock becomes subject to these regulations, the market price of the common stock and the liquidity thereof could be materially and adversely affected. Reducing the number of outstanding shares of our common stock should, absent other factors, increase the per share market price of our common stock, although we cannot provide any assurance that our minimum bid price would remain above the minimum bid price requirement of Nasdaq. Accordingly, we believe that approval of a Reverse Split is in the Company’s and our stockholders’ best interests.

| 4 |

Reducing the number of outstanding shares of our common stock through a Reverse Split is intended, absent other factors, to increase the per share market price of our common stock. However, other factors, such as our financial results, market conditions and the market perception of our business, may adversely affect the market price of our common stock. As a result, there can be no assurance that a Reverse Split, if completed, will result in the intended benefits described above, that the market price of our common stock will increase following a Reverse Split or that the market price of our common stock will not decrease in the future. Additionally, we cannot assure you that the market price per share of our common stock after a Reverse Split will increase in proportion to the reduction in the number of shares of our common stock outstanding before such reverse split. Accordingly, the total market capitalization of our common stock after a Reverse Split may be lower than the total market capitalization before a Reverse Split.

We cannot be sure that our share price will comply with the requirements for continued listing of our shares of common stock on Nasdaq in the future or that we will comply with the other continued listing requirements. If our shares of common stock lose their status on Nasdaq, we believe that our shares of common stock would likely be eligible to be quoted on an inter-dealer electronic quotation and trading system operated by OTC Markets Group. These markets are generally considered to be less efficient than, and not as broad as, Nasdaq. Selling our shares of common stock on these markets could be more difficult because smaller quantities of shares would likely be bought and sold, and transactions could be delayed. In addition, in the event that our shares of common stock are delisted, broker-dealers have certain regulatory burdens imposed upon them, which may discourage them from effecting transactions in our common stock, further limiting the liquidity of our common stock. These factors could result in lower prices and larger spreads in the bid and ask prices for our common stock.

A delisting from Nasdaq and continued or further declines in our share price could also greatly impair our ability to raise additional necessary capital through equity or debt financing, and could significantly increase the ownership dilution to stockholders caused by our issuing equity in financing or other transactions.

There are risks associated with a Reverse Split, including that a Reverse Split may not result in a sustained increase in the per share price of our common stock.

We cannot predict whether a Reverse Split will increase the market price for our common stock on a sustained basis. The history of similar stock split combinations for companies in like circumstances is varied. There is no assurance that:

| · | the market price per share of our common stock after a Reverse Split will rise in proportion to the reduction in the number of shares of our common stock outstanding before a Reverse Split; |

| · | a Reverse Split will result in a per share price that will attract brokers and investors who do not trade in lower priced stocks; and |

| · | the market price per share will either exceed or remain in excess of the $1.00 minimum bid price as required by Nasdaq, or that we will otherwise meet the requirements of Nasdaq for continued inclusion for trading on Nasdaq. |

The market price of our common stock will also be based on our performance and other factors, some of which are unrelated to the number of shares outstanding. If a Reverse Split is effected and the market price of our common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of a Reverse Split. Furthermore, the liquidity of our common stock could be adversely affected by the reduced number of shares that would be outstanding after a Reverse Split.

Board Discretion to Implement a Reverse Split

If this proposal is approved by the Company’s stockholders, the Board will have the authority, in its sole determination without any further action necessary by the stockholders, to effect one or more Reverse Splits during the Authorized Period within the range set forth above, as determined by the Board. The Board may, in its sole determination, choose to not effect a Reverse Split. The Board believes that granting this discretionary authority provides the Board with maximum flexibility to react to prevailing market conditions and future changes to the market price of our common stock, and therefore better enables it to act in the best interests of the Company. In exercising its discretion, the Board may consider the following factors:

| 5 |

| · | the ratio that would result in the greatest overall reduction in administrative costs; |

| · | the historical trading price and trading volume of the Company’s common stock; |

| · | the then-prevailing trading price and trading volume of the Company’s common stock and the anticipated impact of a Reverse Split on the trading market for the Company’s common stock; and |

| · | the prevailing general market and economic conditions. |

At the close of business on February 17, 2015, the Company had 14,513,164 shares of common stock issued and outstanding. For illustrative purposes only, assuming a 1-for-10 ratio, the Company would have approximately 1,451,316 shares of common stock issued and outstanding (without giving effect to the treatment of fractional shares) following a Reverse Split. The actual number of shares of common stock outstanding after giving effect to a Reverse Split will depend on the ratio that is ultimately selected by the Board, and the number of shares of common stock outstanding at the time a Reverse Split is effected. The Company does not expect a Reverse Split to have any economic effect on stockholders, warrant holders, debt holders or holders of options, except to the extent a Reverse Split results in fractional shares as discussed below.

Procedure for Effecting a Reverse Split

If the Board decides to implement a Reverse Split, the Board will chose the specific ratio, within a range of 1-for-2 and 1-for-100, and publicly announce the ratio at least ten days prior to the effectiveness of the amendment to our Certificate of Incorporation. We will file a Certificate of Amendment to our Certificate of Incorporation, substantially in the form attached to this Proxy Statement as Appendix A, with the Secretary of State of the State of Delaware to effect a Reverse Split. A Reverse Split would become effective at such time as the Certificate of Amendment is filed with the Secretary of State of the State of Delaware or at such later time as is specified therein. No further action on the part of the Company’s stockholders would be required and all shares of our common stock that were issued and outstanding immediately prior thereto would automatically be converted into new shares of our common stock based on a Reverse Split exchange ratio chosen by the Board. As soon as practicable after the effective date of a Reverse Split, stockholders of record on the Record Date would receive a letter from our transfer agent asking them to return the outstanding certificates representing our pre-split shares, which would be cancelled upon receipt by our transfer agent, and new certificates representing the post-split shares of our common stock would be sent to each of our stockholders. We will bear the costs of the issuance of the new stock certificates.

Effects of a Reverse Split

If a Reverse Split is approved and implemented by the Board, the principal effect will be to proportionately decrease the number of outstanding shares of common stock based on the ratio selected by the Board. The shares of common stock are currently registered under Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Company is thus subject to the periodic reporting and other requirements of the Exchange Act in the United States. A Reverse Split will not affect the registration of our common stock with the SEC or Nasdaq, where the common stock is quoted. Following a Reverse Split, our common stock would continue to be listed on Nasdaq, assuming the Company’s compliance with the other continued listing standards of Nasdaq, although the shares will receive a new CUSIP number.

| 6 |

Proportionate voting rights and other rights of the holders of shares of the Company’s common stock will not be affected by a Reverse Split, other than as a result of the treatment of fractional shares as described below. For example, a holder of 2% of the voting power of the outstanding shares immediately prior to the effectiveness of a Reverse Split will generally continue to hold 2% of the voting power of the outstanding common stock after a Reverse Split. The number of stockholders of record will not be affected by a Reverse Split, other than as a result of the treatment of fractional shares as described below. If approved and implemented, a Reverse Split may result in some stockholders owning "odd lots" of less than 100 shares. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in "round lots" of even multiples of 100 shares. The Board believes, however, that these potential effects are outweighed by the benefits to the Company of a Reverse Split.

Effect of the Reverse Stock Split on the Company’s 2014 Equity Incentive Plan, Options, Restricted Stock Awards and Units, Warrants, and Convertible or Exchangeable Securities

Based upon the split ratio determined by the Board, proportionate adjustments are generally required to be made to the per share exercise price and the number of shares issuable upon the exercise or conversion of all outstanding options, warrants, convertible or exchangeable securities entitling the holders to purchase, exchange for, or convert into, shares of common stock. This would result in approximately the same aggregate price being required to be paid under such options, warrants, convertible or exchangeable securities upon exercise, and approximately the same value of shares of common stock being delivered upon such exercise, exchange or conversion, immediately following a Reverse Split as was the case immediately preceding such split. The number of shares deliverable upon settlement or vesting of restricted stock awards will be similarly adjusted, subject to our treatment of fractional shares. The number of shares reserved for issuance pursuant to these securities will be proportionately based upon the ratio determined by the Board, subject to our treatment of fractional shares.

Accounting Matters

The amendment to the Company’s Certificate of Incorporation will not affect the par value of our common stock per share, which will remain $0.0001 par value per share. As a result, the stated capital attributable to common stock and the additional paid-in capital account on our balance sheet will not change due to a Reverse Split. Reported per share net income or loss will be higher because there will be fewer shares of common stock outstanding.

Effective Date

A Reverse Split would become effective upon the filing of a Certificate of Amendment to our Certificate of Incorporation with the office of the Secretary of State of the State of Delaware or at such later date as is specified in such filing. On the effective date, shares of common stock issued and outstanding, in each case, immediately prior thereto, will be combined and converted, automatically and without any action on the part of the stockholders, into new shares of common stock in accordance with the ratio determined by the Board within the limits set forth in this proposal.

Treatment of Fractional Shares

No fractional shares would be issued if, as a result a Reverse Split, a registered stockholder would otherwise become entitled to a fractional share. Instead, stockholders who otherwise would be entitled to receive fractional shares because they hold a number of shares not evenly divisible by the ratio of a Reverse Split will automatically be entitled to receive an additional share of the Company’s common stock. In other words, any fractional share will be rounded up to the nearest whole number.

| 7 |

Book-Entry Shares

If a Reverse Split is effected, stockholders who hold uncertificated shares (i.e., shares held in book-entry form and not represented by a physical share certificate), either as direct or beneficial owners, will have their holdings electronically adjusted by the Company's transfer agent (and, for beneficial owners, by their brokers or banks that hold in "street name" for their benefit, as the case may be) to give effect to a Reverse Split.

Stockholders who hold uncertificated shares as direct owners will be sent a statement of holding from the Company's transfer agent that indicates the number of shares owned in book-entry form.

Certificated Shares

If a Reverse Split is effected, stockholders holding certificated shares (i.e., shares represented by one or more physical share certificates) will receive a transmittal letter from the Company's transfer agent promptly after the effectiveness of a Reverse Split. The transmittal letter will be accompanied by instructions specifying how stockholders holding certificated shares can exchange certificates representing the pre-split shares for a statement of holding.

Beginning after the effectiveness of a Reverse Split, each certificate representing shares of our pre-split common stock will be deemed for all corporate purposes to evidence ownership of post-split common stock.

STOCKHOLDERS SHOULD NOT DESTROY ANY PRE-SPLIT STOCK CERTIFICATE AND SHOULD NOT SUBMIT ANY CERTIFICATES UNTIL THEY ARE REQUESTED TO DO SO.

Possible Effects of Additional Issuances of Common Stock

Following the effective time of a Reverse Split, there will be an increase in the number of authorized but unissued shares of our common stock. Under the General Corporation Law of the State of Delaware (the “DGCL”), the Board can issue additional shares of common stock without stockholder approval, which would have the effect of diluting existing holders of our common stock. On December 29, 2014, the Company received a notification from Nasdaq indicating that the Company’s stockholders’ equity reported for its most recently completed fiscal quarter did not meet the minimum requirement for continued listing as set forth in Nasdaq’s Listing Rules. As a result, as of the date of this Proxy Statement, the Company is actively seeking to increase its stockholders’ equity, which could result in the issuance of shares of its common stock. However, the Company has no current understandings, arrangements, or agreements with respect to any future issuance of shares of its common stock.

Additional shares of common stock, if issued, would have a dilutive effect upon the percentage of equity of the Company owned by our present stockholders. The issuance of such additional shares of common stock might be disadvantageous to current stockholders in that any additional issuances would potentially reduce per share dividends, if any. Stockholders should consider, however, that the possible impact upon dividends is likely to be minimal in view of the fact that the Company does not intend to pay any dividends on its common stock in the foreseeable future. In addition, the issuance of such additional shares of common stock, by reducing the percentage of equity of the Company owned by present stockholders, would reduce such present stockholders' ability to influence the election of directors or any other action taken by the holders of common stock.

| 8 |

In the future the Board could, subject to its fiduciary duties and applicable law, use the increased number of authorized but unissued shares to frustrate persons seeking to take over or otherwise gain control of our Company by, for example, privately placing shares with purchasers who might side with the Board in opposing a hostile takeover bid. Shares of common stock could also be issued to a holder that would thereafter have sufficient voting power to assure that any proposal to amend or repeal the Company’s bylaws or Certificate of Incorporation would not receive the requisite vote. Such uses of the Company’s common stock could render more difficult, or discourage, an attempt to acquire control of the Company if such transactions were opposed by the Board. A result of the anti-takeover effect of the increase in the number of authorized shares could be that stockholders would be denied the opportunity to obtain any advantages of a hostile takeover, including, but not limited to, receiving a premium to the then current market price of our common stock, if the same was so offered by a party attempting a hostile takeover of our company. The Company is not aware of any party's interest in or efforts to engage in a hostile takeover attempt as of the date of this Proxy Statement.

Certain Material U.S. Federal Income Tax Consequences of a Reverse Stock Split

The following discussion summarizes certain material U.S. federal income tax consequences relating to the participation in a reverse stock split by a U.S. stockholder that holds the shares as a capital asset. This discussion is based on the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), final, temporary and proposed U.S. Treasury regulations promulgated thereunder and current administrative rulings and judicial decisions, all as in effect as of the date hereof. All of these authorities may be subject to differing interpretations or repealed, revoked or modified, possibly with retroactive effect, which could materially alter the tax consequences set forth herein.

For purposes of this summary, a “U.S. stockholder” refers to a beneficial owner of common stock who is any of the following for U.S. federal income tax purposes: (i) a citizen or resident of the United States, (ii) a corporation created or organized in or under the laws of the United States, any state thereof, or the District of Columbia, (iii) an estate the income of which is subject to U.S. federal income taxation regardless of its source, or (iv) a trust if (1) its administration is subject to the primary supervision of a court within the United States and one or more U.S. persons have the authority to control all of its substantial decisions, or (2) it has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person. A non-U.S. holder of common stock is a stockholder who is not a U.S. stockholder.

This summary does not represent a detailed description of the U.S. federal income tax consequences to a stockholder in light of his, her or its particular circumstances. In addition, it does not purport to be complete and does not address all aspects of federal income taxation that may be relevant to stockholders in light of their particular circumstances or to any stockholder that may be subject to special tax rules, including, without limitation: (1) stockholders subject to the alternative minimum tax; (2) banks, insurance companies, or other financial institutions; (3) tax-exempt organizations; (4) dealers in securities or commodities; (5) regulated investment companies or real estate investment trusts; (6) traders in securities that elect to use a mark-to-market method of accounting for their securities holdings; (7) U.S. stockholders whose “functional currency” is not the U.S. dollar; (8) persons holding common stock as a position in a hedging transaction, “straddle,” “conversion transaction” or other risk reduction transaction; (9) persons who acquire shares of common stock in connection with employment or other performance of services; (10) dealers and other stockholders that do not own their shares of common stock as capital assets; (11) U.S. expatriates, (12) foreign persons; (13) resident alien individuals; or (14) stockholders who directly or indirectly hold their stock in an entity that is treated as a partnership for U.S. federal tax purposes. Moreover, this description does not address the U.S. federal estate and gift tax, alternative minimum tax, or other tax consequences of a Reverse Split.

There can be no assurance that the Internal Revenue Service (the “IRS”) will not take a contrary position to the tax consequences described herein or that such position will be sustained by a court. In addition, U.S. tax laws are subject to change, possibly with retroactive effect, which may result in U.S. federal income tax considerations different from those summarized below. No opinion of counsel or ruling from the IRS has been obtained with respect to the U.S. federal income tax consequences of a Reverse Split.

This discussion is for general information only and is not tax advice. All stockholders should consult their own tax advisors with respect to the U.S. federal, state, local and non-U.S. tax consequences of a Reverse Split.

| 9 |

Based on the assumption that a Reverse Split will constitute a tax-free reorganization within the meaning of Section 368(a)(1)(E) of the Code, and subject to the limitations and qualifications set forth in this discussion, the following U.S. federal income tax consequences should result from a Reverse Split:

| · | A stockholder should not recognize gain or loss in a Reverse Split; |

| · | the aggregate tax basis of the post-Reverse Split shares should be equal to the aggregate tax basis of the pre-Reverse Split shares ; and |

| · | the holding period of the post-Reverse Split shares should include the holding period of the pre-Reverse Split shares. |

THE PRECEDING DISCUSSION IS INTENDED ONLY AS A SUMMARY OF CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF A REVERSE SPLIT AND DOES NOT PURPORT TO BE A COMPLETE ANALYSIS OR DISCUSSION OF ALL POTENTIAL TAX EFFECTS RELEVANT THERETO. YOU SHOULD CONSULT YOUR OWN TAX ADVISORS AS TO THE PARTICULAR FEDERAL, STATE, LOCAL, FOREIGN AND OTHER TAX CONSEQUENCES OF A REVERSE SPLIT IN LIGHT OF YOUR SPECIFIC CIRCUMSTANCES.

No Appraisal Rights

Under the DGCL, stockholders are not entitled to rights of appraisal with respect to the proposed amendment to our Certificate of Incorporation to effect a Reverse Split, and we will not independently provide our stockholders with any such right.

Vote Required for Approval

The affirmative vote of the holders of a majority of the outstanding shares of our common stock entitled to vote thereon as of the Record Date is required to approve this proposal. Abstentions and broker non-votes will have the same effect as shares voted against this proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THIS PROPOSAL ONE

| 10 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of the Record Date, information with respect to the securities holdings of all persons that we, pursuant to filings with the SEC and our stock transfer records, have reason to believe may be deemed the beneficial owner of more than five percent (5%) of our common stock. The following table also sets forth, as of such date, the beneficial ownership of our common stock by all of our current officers and directors, both individually and as a group.

The beneficial owners and amount of securities beneficially owned have been determined in accordance with Rule 13d-3 under the Exchange Act, and, in accordance therewith, includes all shares of our common stock that may be acquired by such beneficial owners within 60 days of February 17, 2015 upon the exercise or conversion of any options, warrants or other convertible securities. This table has been prepared based on 14,513,164 shares of common stock outstanding as of February 17, 2015.

| Name of Beneficial Owner | Amount of Beneficial Ownership | Percent of Class | Position | |||||||

| Sebastian Giordano | 552,857 | (1) | 3.67 | % | Interim Chief Executive Officer and Director | |||||

| David Allen | 0 | 0.00 | % | Chief Financial Officer | ||||||

| Charles Benton | 108,571 | (1) | 0.74 | % | Director | |||||

| Kevin Coyle | 108,571 | (1) | 0.74 | % | Director | |||||

| Norm Dumbroff | 57,571 | (1) | 0.40 | % | Director | |||||

| Edward Gildea | 102,857 | (1) | 0.70 | % | Director | |||||

| Neil Hebenton | 57,571 | (1) | 0.40 | % | Director | |||||

| All Officers and Directors as a Group(2) | 987,998 | (1) | 6.37 | % | — | |||||

| Hudson Bay Master Fund Ltd.(3) | 1,610,782 | (4) | 9.99 | % | 5% owner | |||||

| Hudson Bay Capital Management, L.P.(3) | 1,610,782 | (4) | 9.99 | % | 5% owner | |||||

| Iroquois Master Fund Ltd.(5) | 1,609,195 | (6) | 9.99 | % | 5% owner | |||||

| Iroquois Capital Management L.L.C.(5) | 1,609,195 | (6) | 9.99 | % | 5% owner | |||||

| HS Contraian Investments(7) | 1,610,782 | (8) | 9.99 | % | 5% owner | |||||

| Alpha Capital AG(9) | 1,544,190 | (10) | 9.99 | % | 5% owner | |||||

| BlackRock, Inc.(11) | 829,089 | 5.52 | % | 5% owner | ||||||

(1) Includes the following number of shares of common stock which may be acquired by certain officers and directors through the exercise of stock options which were exercisable as of February 17, 2015, or which will or may become exercisable within 60 days of that date: Sebastian Giordano, 552,857 shares; Charles Benton, 108,571 shares; Kevin Coyle, 108,571 shares; Norm Dumbroff, 57,571 shares; Edward Gildea, 102,857 shares; Neil Hebenton, 57,571 shares; and all officers and directors as a group, 987,998 shares.

(2) The address for each of our officers and directors is 521 Railroad Avenue, Suisun City, California 94585.

(3) The principal business address of the beneficial owner is 777 Third Avenue, 30th Floor, New York, New York 10017. Mr. Sander Gerber serves as the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management, L.P. (“HBCM”). HBCM serves as the investment manager to Hudson Bay Master Fund Ltd., in whose names the reported securities are held. Thus, HBCM and Mr. Gerber may be deemed to be the beneficial owners of the reported securities. Mr. Gerber disclaims beneficial ownership of these securities.

(4) Includes shares of common stock issuable upon conversion of outstanding series F-1 convertible preferred stock (“Series F-1 Shares”) and series G-1 convertible preferred stock (“Series G-1 Shares”) and represents the maximum beneficial ownership percentage pursuant to exercise limitations contained within the Certificates of Designation of the Series F-1 Shares and the Series G-1 Shares owned by this beneficial owner.

| 11 |

(5) The principal business address of the beneficial owner is 641 Lexington Avenue, 26th Floor, New York, New York 10022. Iroquois Capital Management L.L.C. is the investment manager of Iroquois Master Fund (“IMF”). Richard Abbe and Joshua Silverman have voting control and investment discretion over securities held by IMF, in whose name the securities are held. As such, Mr. Abbe and Mr. Silverman may be deemed to be the beneficial owner of all shares of common stock, including those shares underlying any convertible preferred stock, held for the account of IMF. Each of Mr. Abbe and Mr. Silverman disclaims beneficial ownership of the shares of common stock held by IMF, except to the extent of their pecuniary interest therein.

(6) Includes 14,303 shares of common stock and 1,594,892 shares of common stock issuable upon conversion of outstanding Series F-1 Shares and Series G-1 Shares. This number represents the maximum beneficial ownership percentage pursuant to exercise limitations contained within the Series F-1 Shares and Series G-1 Shares owned by this beneficial owner.

(7) The principal business address of the beneficial owner is 347 N New River Dr. East #809, Fort Lauderdale, FL 33301.

(8) Includes shares of common stock issuable upon conversion of outstanding Series F-1 Shares and Series G-1 Shares and represents the maximum beneficial ownership percentage pursuant to exercise limitations contained within the Certificates of Designation of the Series F-1 Shares and the Series G-1 Shares owned by this beneficial owner.

(9) The principal business address of the beneficial owner is Pradafant 7, Furstentums 9490, Vaduz, Liechtenstein.

(10) Includes 600,000 shares of common stock and 944,190 shares of common stock issuable upon conversion of outstanding Series F-1 Shares and Series G-1 Shares. This number represents the maximum beneficial ownership percentage pursuant to exercise limitations contained within the Certificates of Designation of the Series F-1 Shares and the Series G-1 Shares s owned by this beneficial owner.

(11) The principal business address of the beneficial owner is 55 East 52nd Street, New York, NY 10022.

STOCKHOLDER PROPOSALS

The Board has not yet determined the date on which the next Annual Meeting of Stockholders will be held. Stockholders may submit proposals on matters appropriate for stockholder action at annual meetings in accordance with the rules and regulations adopted by the SEC. Any proposal that an eligible stockholder desires to have included in our proxy statement and presented at our next Annual Meeting of Stockholders will be included in our proxy statement and related proxy card if it is received by us a reasonable time before we begin to print and send our proxy materials and if it complies with SEC rules regarding inclusion of proposals in proxy statements. In order to avoid controversy as to the date on which we receive a proposal, it is suggested that any stockholder who wishes to submit a proposal submit such proposal by Certified Mail, Return Receipt Requested.

Other deadlines apply to the submission of stockholder proposals for our next Annual Meeting of Stockholders that are not required to be included in our proxy statement under SEC rules. With respect to these stockholder proposals, a stockholder’s notice must be received by us a reasonable time before we begin to print and send our proxy materials. The form of proxy distributed by the Board of Directors for such meeting will confer discretionary authority to vote on any such proposal not received by such date. If any such proposal is received by such date, the proxy statement for the meeting will provide advice on the nature of the matter and how we intend to exercise our discretion to vote on each such matter if it is presented at that meeting.

OTHER INFORMATION

Delivery of Documents to Stockholders Sharing an Address

Only one Proxy Statement is being delivered to two or more security holders who share an address, unless the Company has received contrary instruction from one or more of the security holders. The Company will promptly deliver, upon written or oral request, a separate copy of the Proxy Statement to a security holder at a shared address to which a single copy of the document was delivered. If you would like to request additional copies of the Proxy Statement, or if in the future you would like to receive multiple copies of information or proxy statements, or annual reports, or, if you are currently receiving multiple copies of these documents and would, in the future, like to receive only a single copy, please so instruct the Company, by writing to us at: WPCS International Incorporated, Attention: Secretary, 521 Railroad Avenue, Suisun City, California 94585.

| 12 |

Other Matters

We do not know of any matters to be presented at the meeting other than those set forth in this Proxy Statement. However, if any other matters come before the meeting, the proxy holders will vote the shares represented by any proxy granted in their favor in such manner as the Board of Directors may recommend or, in absence of such a recommendation, in the proxy holders’ discretion.

Additional Information

We are subject to the information and reporting requirements of the Exchange Act, and in accordance therewith, we file annual, quarterly and special reports, proxy statements and other information with the SEC. The public may read and copy any materials that we have filed with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains the reports, proxy and information statements and other information regarding the Company that we have filed electronically with the SEC. The address of the SEC’s Internet site is http://www.sec.gov.

| By Order of the Board of Directors | |

| /s/ Sebastian Giordano | |

| Sebastian Giordano | |

| Interim Chief Executive Officer | |

| March 2, 2015 |

| 13 |

APPENDIX A

CERTIFICATE OF AMENDMENT

TO THE CERTIFICATE OF INCORPORATION

OF

WPCS INTERNATIONAL INCORPORATED

WPCS International Incorporated, organized and existing under and by virtue of the General Corporation Law of the State of Delaware, does hereby certify:

FIRST: That the Board of Directors of WPCS International Incorporated adopted a proposed amendment of the Certificate of Incorporation of said corporation to effect a reverse stock split, declaring said amendment to be advisable.

The proposed amendment reads as follows:

Article Fourth is hereby amended by striking the third paragraph in its entirety and replacing it with the following:

Upon the effectiveness (the “Effective Time”) of this Certificate of Amendment to the Certificate of Incorporation of the Corporation, each share of Common Stock issued and outstanding immediately prior to the Effective Time will be automatically combined and converted into that fraction of a share of Common Stock of the Corporation as has been determined by the board of directors in its sole discretion within the range of 1-for-2 and 1-for-100 shares and publicly announced by the Corporation at least 3 days prior to effectiveness of this Certificate of Amendment (the “Consolidation”). Notwithstanding the foregoing, no fractional shares shall be issued in connection with the Consolidation. Shares shall be rounded up to the nearest whole share. Each certificate that immediately prior to the Effective Time represented shares of common stock (“Old Certificates”), shall thereafter and without the necessity for presenting the same represent that number of shares of common stock into which the shares of common stock represented by the Old Certificate shall have been combined, subject to the rounding up of any fractional share interests as described above.

SECOND: That, pursuant to a resolution of its Board of Directors, a special meeting of the stockholders of WPCS International Incorporated was duly called and held upon notice in accordance with Section 222 of the General Corporation Law of the State of Delaware at which meeting the necessary number of shares as required by statute were voted in favor of granting the Board of Directors the authority to amend the Certificate of Incorporation to provide for a reverse stock split and the Board of Directors subsequently approved a ratio of ____.

THIRD: That said amendment was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF, said corporation has caused this certificate to be signed this __ day of ________________, 2015.

| By: | ||

| Title: | ||

| Name: |