UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant | x |

| Filed by a Party other than the Registrant | ¨ |

| Check the appropriate box: | |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

WPCS INTERNATIONAL INCORPORATED

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

WPCS INTERNATIONAL INCORPORATED

521 Railroad Avenue

Suisun City, California 94585

Telephone: (707) 421-1300

August 16, 2016

Dear Stockholders:

You are cordially invited to attend the 2016 Annual Meeting of Stockholders (the “Annual Meeting”) of WPCS International Incorporated (the “Company”). The Annual Meeting will be held at 9:30 a.m., local time, on September 29, 2016, at the offices of K&L Gates LLP at 599 Lexington Avenue, 32nd Floor, New York, New York 10022. Enclosed are the official notice of this Annual Meeting, a proxy statement, a form of proxy and the Annual Report on Form 10-K for the year ended April 30, 2016.

At this Annual Meeting you will be asked to consider the following proposals:

1. To elect the five director nominees named in the Proxy Statement to hold office until the next annual meeting of stockholders;

2. To ratify the appointment of Marcum LLP as the Company’s independent auditors for the fiscal year ending April 30, 2017; and

3. To act on such other matters as may properly come before the Annual Meeting or any adjournment thereof.

Please note that attendance at the Annual Meeting will be limited to stockholders of record at the close of business on August 5, 2016, and to guests of the Company.

If your shares are held by a broker, bank or other nominee and you plan to attend the Annual Meeting, please contact the person responsible for your account regarding your intention to attend the Annual Meeting so they will know how you intend to vote your shares at that time. Stockholders who do not expect to attend the Annual Meeting in person may submit their ballot to the Management of the Company at 521 Railroad Avenue, Suisun City, California 94585.

BY ORDER OF THE BOARD OF DIRECTORS

| /s/ Sebastian Giordano | |

| Sebastian Giordano | |

| Chief Executive Officer |

August 16, 2016

Dear Stockholders:

Re: WPCS Provides Stockholder Update

Expectations High for a Return to Profitability in FYE 2017

While the restructuring plan we began implementing in August 2013 was successfully completed in August 2015, we won’t be satisfied until an absolute turnaround is achieved. For us, that means both the permanent return to profitability and sustainable increases in shareholder value.

The transition from a restructuring plan to a growth plan began during fiscal 2016, as we launched the first wave of organic initiatives targeting revenue enhancement and selected demographic expansion, including:

| · | Establishing Texas Operations in San Antonio and Dallas; |

| · | Strengthening our operations team with proven audio-visual and security systems professionals; |

| · | Hiring an experienced direct sales team; |

| · | Uniformly deploying full-service low voltage capabilities for developing, installing and servicing structured cabling, audio-visual and security systems into both our California and Texas markets; and, |

| · | Introducing new recurring revenue product and service offerings. |

These moves will fundamentally change the Company’s business.

Historically, the Suisun Operations operated primarily as a subcontractor for low-voltage structured cabling systems, which were generally secured through the competitive bidding process. WPCS wasn’t adequately positioned with the resources to deliver a fully integrated offering to include audio-visual and security. As a result, such opportunities had either been lost, or had to be subcontracted to others. However, with the recent additions we have instituted, WPCS is now able to offer a full turnkey service in both our Suisun and Texas Operations that will allow us to be fully engaged with our customers well after an initial installation is completed.

In addition to expanding our geographical presence, broadening our contracting revenue potential and offering higher margin recurring service capabilities, we are also pursuing and securing more corporate affiliations and strategic alliances that will create more direct relationships capable of advancing our business opportunities even further.

Early indications are that this strategy is already working as we recently announced that approximately one-third of new contracts secured during the first quarter 2017 were directly attributable to these new organic initiatives. Moreover, in recent months our sales pipeline now includes many new business opportunities previously unavailable to the Company, such as:

· Direct security systems opportunity with a national rail transportation company;

· Nearly $3 million of pending audio-visual contracts in California; and,

· In the final phases of becoming a sole source vendor for the City of San Francisco.

We have a multi-faceted execution strategy and intend to methodically roll out new initiatives as the fiscal year unfolds. Furthermore, we continue to aggressively explore other viable growth opportunities.

In addition to the ongoing operational success, corporately we are evaluating and undertaking new measures to enhance our public company profile, attract new long-term minded investors, optimize our capital resources for growth and strengthen our Board of Directors. To start with, we are adding a new member to the Board of Directors, representing the Company’s largest stockholder, who provides an investor’s perspective and experience in helping to build shareholder value in small-cap public companies.

We fully expect that our operational performance and corporate strategies will have a positive impact towards building shareholder value. With the business performing well and demonstrating continued improvement, we do believe that the upside potential in the market valuation of the Company’s stock has yet to be realized.

As previously stated, we are as confident today, about our go-forward goals, as we were back in August 2013 about our ability to execute the restructuring plan. After incurring five consecutive years of aggregate operating losses of more than $80 million, the Company believes that it is now on the verge of returning to profitability. So, we see this as a very exciting time for WPCS.

Finally, on behalf of the entire Company and the Board of Directors, we thank all of our stockholders for their continued long-term support of WPCS and, as always, we will continue to update you on the Company’s progress.

Thank you

Sebastian Giordano

Chief Executive Officer

WPCS INTERNATIONAL INCORPORATED

521 Railroad Avenue

Suisun City, California 94585

Telephone: (707) 421-1300

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

The 2016 Annual Meeting of Stockholders of WPCS International Incorporated (the “Company”) will be held on Thursday, September 29, 2016, at 9:30 a.m. local time at the offices of K&L Gates LLP at 599 Lexington Avenue, 32nd Floor, New York, New York 10022, for the purposes of:

1. Electing the five director nominees named in the Proxy Statement to hold office until the next annual meeting of stockholders;

2. Ratifying the appointment of Marcum LLP as the Company’s independent auditors for the fiscal year ending April 30, 2017; and

3. Acting on such other matters as may properly come before the Annual Meeting or any adjournment thereof.

Only stockholders of record at the close of business on August 5, 2016, will be entitled to attend and vote at the Annual Meeting. A list of all stockholders entitled to vote at the Annual Meeting, arranged in alphabetical order and showing the address of and number of shares held by each stockholder, will be available at the principal office of the Company during usual business hours, for examination by any stockholder for any purpose germane to the Annual Meeting for 10 days prior to the date thereof. The proxy materials will be furnished to stockholders on or about August 16, 2016.

If you need directions to the Annual Meeting please contact the Company at (707) 421-1300.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on September 29, 2016: In accordance with rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), we are now providing access to our proxy materials, including the proxy statement, our Annual Report on Form 10-K for the fiscal year ended April 30, 2016, and a form of proxy relating to the Annual Meeting, over the Internet. All stockholders of record and beneficial owners will have the ability to access the proxy materials at www.proxyvote.com. These proxy materials are available free of charge.

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, PLEASE VOTE YOUR SHARES, SO THAT A QUORUM WILL BE PRESENT AND A MAXIMUM NUMBER OF SHARES MAY BE VOTED. IT IS IMPORTANT AND IN YOUR INTEREST FOR YOU TO VOTE YOUR SHARES. FOR YOUR CONVENIENCE, WE HAVE PROVIDED THREE EASY METHODS BY WHICH YOU CAN VOTE YOUR SHARES:

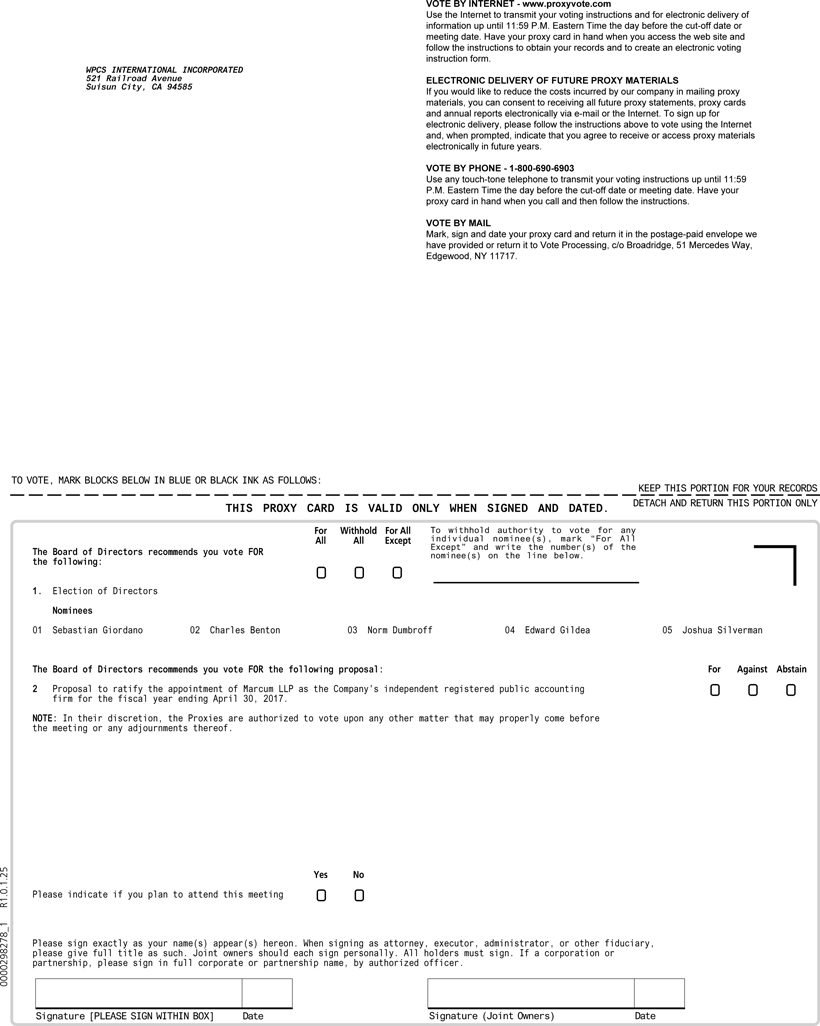

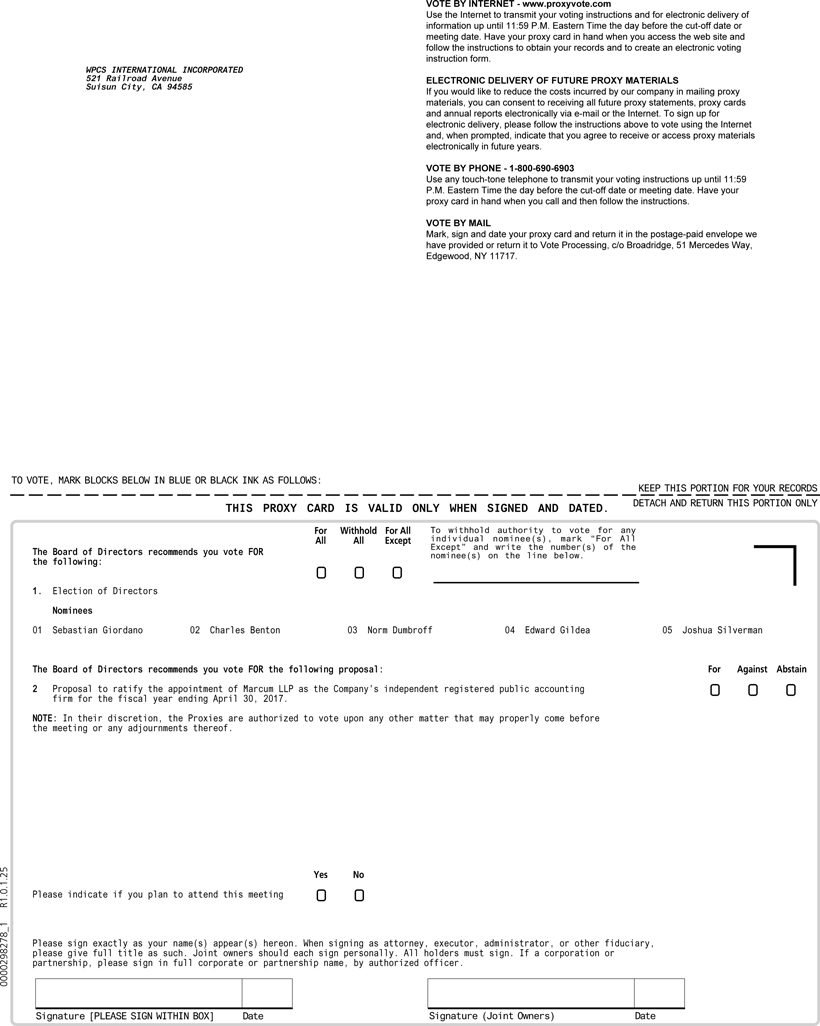

By Internet . Visit www.proxyvote.com and enter the control number located on your notice.

By Touch-Tone Telephone . Dial the toll-free number found on your notice and follow the simple instructions.

By Mail . Return your executed proxy in the enclosed postage paid envelope.

BY ORDER OF THE BOARD OF DIRECTORS

| /s/ Sebastian Giordano | |

| Sebastian Giordano | |

| Chief Executive Officer | |

| August 16, 2016 |

You are cordially invited to attend the Annual Meeting in person. Whether or not you expect to attend the Annual Meeting, please complete, date, sign and return the enclosed proxy as instructed in these materials, as promptly as possible in order to ensure your representation at the Annual Meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder.

WPCS INTERNATIONAL INCORPORATED

521 Railroad Avenue

Suisun City, California 94585

Telephone: (707) 421-1300

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON THURSDAY, SEPTEMBER 29, 2016

SOLICITATION OF PROXIES

The enclosed proxy is solicited by the Board of Directors of WPCS International Incorporated (the “Company”), for use at the 2016 Annual Meeting of the Company’s stockholders to be held at 9:30 a.m., local time, on September 29, 2016, at the offices of K&L Gates LLP at 599 Lexington Avenue, 32nd Floor, New York, New York 10022, and any postponements or adjournments thereof. Whether or not you expect to attend the Annual Meeting in person, please vote your shares as promptly as possible to ensure that your vote is counted. The proxy materials will be furnished to stockholders on or about August 16, 2016.

REVOCABILITY OF PROXY AND SOLICITATION

Any stockholder executing a proxy that is solicited hereby has the power to revoke it prior to the voting of the proxy. Revocation may be made by attending the Annual Meeting and voting the shares of stock in person, or by delivering to the Secretary of the Company at the principal office of the Company prior to the Annual Meeting a written notice of revocation or a later-dated, properly executed proxy. Solicitation of proxies may be made by directors, officers and other employees of the Company by personal interview, telephone, facsimile transmittal or electronic communications. No additional compensation will be paid for any such services. This solicitation of proxies is being made by the Company which will bear all costs associated with the mailing of this proxy statement and the solicitation of proxies.

RECORD DATE

Stockholders of record at the close of business on August 5, 2016, will be entitled to receive notice of, attend and vote at the Annual Meeting.

ACTION TO BE TAKEN UNDER PROXY

Unless otherwise directed by the giver of the proxy, the persons named in the form of proxy, namely, Sebastian Giordano, our Chief Executive Officer, and Charles Benton, one of our directors, or either one of them who acts, will vote:

| · | FOR the election of the five director nominees named in the Proxy Statement to hold office until the next annual meeting of stockholders; |

| · | FOR ratification of the appointment of Marcum LLP as the Company’s independent auditors for the fiscal year ending April 30, 2017; and |

| · | According to their discretion, on the transaction of such other matters as may properly come before the Annual Meeting or any adjournment thereof. |

Should any nominee named herein for election as a director become unavailable for any reason, it is intended that the persons named in the proxy will vote for the election of such other person in his stead as may be designated by the Board of Directors. The Board of Directors is not aware of any reason that might cause any nominee to be unavailable.

WHO IS ENTITLED TO VOTE; VOTE REQUIRED; QUORUM

As of August 5, 2016, there were 2,848,659 shares of common stock issued and outstanding, which constitutes all of the outstanding capital stock of the Company. Stockholders are entitled to one vote for each share of common stock held by them.

Thirty three and one-third percent (33.33%) of the outstanding shares, or 949,458 shares, present in person or represented by proxy, will constitute a quorum at the Annual Meeting. For purposes of the quorum and the discussion below regarding the vote necessary to take stockholder action, stockholders of record who are present at the Annual Meeting in person or by proxy and who abstain, including brokers holding customers’ shares of record who cause abstentions to be recorded at the Annual Meeting, are considered stockholders who are present and entitled to vote and are counted towards the quorum.

Brokers holding shares of record for customers generally are not entitled to vote on “non-routine” matters, unless they receive voting instructions from their customers. As used herein, “uninstructed shares” means shares held by a broker who has not received such instructions from its customers on a proposal. A “broker non-vote” occurs when a nominee holding uninstructed shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that non-routine matter. In connection with the treatment of abstentions and broker non-votes, only the proposal to ratify the independent auditors at this Annual Meeting is considered a “routine” matter, and brokers are entitled to vote uninstructed shares only with respect to this proposal.

Determination of whether a matter specified in the Notice of Annual Meeting of Stockholders has been approved will be determined as follows:

| · | Those persons will be elected directors who receive a plurality of the votes cast at the Annual Meeting in person or by proxy and entitled to vote on the election. Accordingly, directions to withhold authority and broker non-votes will have no effect on the outcome of the vote; and |

| · | For each other matter specified in the Notice of Annual Meeting of Stockholders, the affirmative vote of a majority of the shares of common stock present at the Annual Meeting in person or by proxy and entitled to vote on such matter is required for approval. Abstentions will be considered shares present in person or by proxy and entitled to vote and, therefore, will have the effect of a vote against the matter. Broker non-votes will be considered shares not present for this purpose and will have no effect on the outcome of the vote. |

Directions to withhold authority to vote for directors, abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present for the Meeting.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because the Board of Directors of WPCS International Incorporated (sometimes referred to as the “Company” “WPCS,” “we” or “us”) is soliciting your proxy to vote at the Annual Meeting of Stockholders. According to our records, you were a stockholder of the Company as of the end of business on August 5, 2016.

You are invited to attend the Annual Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card.

The Company intends to mail these proxy materials on or about August 16, 2016 to all stockholders of record on August 5, 2016 (the “Record Date”) entitled to vote at the Annual Meeting.

What is included in these materials?

These materials include:

| · | the Notice of Annual Meeting; |

| · | this proxy statement for the Annual Meeting; |

| · | the proxy card; and |

| · | the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2016, as filed with the Securities and Exchange Commission (the “SEC”) on July 28, 2016 (the “Annual Report”). |

What is the proxy card?

The proxy card enables you to appoint Sebastian Giordano, our Chief Executive Officer, and Charles Benton, one of our directors, as your representative at the Annual Meeting. By completing and returning a proxy card, you are authorizing these individuals to vote your shares at the Annual Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or not you attend the Annual Meeting.

When and where is the Annual Meeting being held?

The Annual Meeting will be held on Thursday, September 29, 2016 commencing at 9:30 a.m., local time, at the offices of K&L Gates LLP at 599 Lexington Avenue, 32nd Floor, New York, New York 10022.

Can I view these proxy materials over the Internet?

Yes. The Notice of Meeting, this Proxy Statement and accompanying proxy card and our Annual Report on Form 10-K for the year ended April 30, 2016 are available at www.proxyvote.com.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on August 5, 2016 will be entitled to vote at the Annual Meeting. On this record date, there were 2,848,659 shares of common stock outstanding and entitled to vote.

The Annual Meeting will begin promptly at 9:30 a.m., local time. Check-in will begin one-half hour prior to the Annual Meeting. Please allow ample time for the check-in procedures.

Stockholder of Record: Shares Registered in Your Name

If on August 5, 2016 your shares were registered directly in your name with the Company’s transfer agent, Interwest Transfer Company, Inc., then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the enclosed proxy.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on August 5, 2016, your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, rather than in your name, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

The following matters are scheduled for a vote:

1. To elect the five director nominees named in the Proxy Statement to hold office until the next annual meeting of stockholders;

2. To ratify the appointment of Marcum LLP as the Company’s independent auditors for the fiscal year ending April 30, 2017; and

3. To act on such other matters as may properly come before the Annual Meeting or any adjournment thereof.

The Board of Directors is not currently aware of any other business that will be brought before the Annual Meeting.

How do I vote?

You may vote “For” all the nominees to the Board of Directors, you may “Withhold” your vote for all nominees or you may vote “For” all nominees except for any nominee(s) you specify. For the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record as of the Record Date, you may vote in person at the Annual Meeting or vote by proxy using the enclosed proxy card. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote in person even if you have already voted by proxy.

| · | To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive. You should be prepared to present photo identification for admittance. A list of stockholders eligible to vote at the Annual Meeting will be available for inspection at the Annual Meeting and for a period of ten days prior to the Annual Meeting during regular business hours at our principal executive offices, which are located at 521 Railroad Avenue, Suisun City, California 94585. |

| · | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your completed and signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail your voting instructions as directed by your broker or bank to ensure that your vote is counted. Alternatively, you may be able to vote by telephone or over the Internet by following instructions provided by your broker or bank. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the Record Date.

What is a quorum for purposes of conducting the Annual Meeting?

The presence, in person or by proxy, of the holders of thirty-three and one-third percent (33.33%) of the issued and outstanding common stock, or 949,458 shares, entitled to vote at the Annual Meeting is necessary to constitute a quorum to transact business. If a quorum is not present or represented at the Annual Meeting, the stockholders entitled to vote thereat, present in person or by proxy, may adjourn the Annual Meeting from time to time without notice or other announcement until a quorum is present or represented.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “FOR” the election of each of the five (5) nominees for director and “FOR” the ratification of the appointment of Marcum LLP as our independent auditors for the fiscal year ending April 30, 2017.

How does the Board of Directors recommend that I vote?

Our Board of Directors recommends that you vote your shares “FOR” each of the five (5) nominees to the Board of Directors and “FOR” the ratification of the appointment of Marcum LLP as our independent auditors for the fiscal year ending April 30, 2017.

Unless you provide other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Company's Board of Directors as set forth in this Proxy Statement.

Who is paying for this proxy solicitation?

We will bear the cost of solicitation of proxies. Proxies may be solicited by mail or personally by our Directors, officers or employees, none of whom will receive additional compensation for such solicitation. Those holding shares as of record for the benefit of others, or nominee holders, are being asked to distribute proxy soliciting materials to, and request voting instructions from, the beneficial owners of such shares. We will reimburse nominee holders for their reasonable out-of-pocket expenses.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

I share the same address with another WPCS International Incorporated stockholder. Why has our household only received one set of proxy materials?

The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This practice, known as “householding,” is intended to reduce the Company’s printing and postage costs. We have delivered only one set of proxy materials to stockholders who hold their shares through a bank, broker or other holder of record and share a single address, unless we received contrary instructions from any stockholder at that address. However, any such street name holder residing at the same address who wishes to receive a separate copy of the proxy materials may make such a request by contacting the bank, broker or other holder of record, or Broadridge Financial Solutions, Inc. at (800) 542-1061 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, NY 11717. Street name holders residing at the same address who would like to request householding of Company materials may do so by contacting the bank, broker or other holder of record or Broadridge at the phone number or address listed above.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

| · | You may submit another properly completed proxy card with a later date; |

| · | You may send a timely written notice that you are revoking your proxy to the Company at 521 Railroad Avenue, Suisun City, California 94585, Attn: Corporate Secretary; or |

| · | You may attend the Annual Meeting, notify the secretary of the Annual Meeting that you are revoking your proxy prior to the voting of that proxy, and then vote in person. |

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

What are “broker non-votes”?

Broker “non-votes” are included for the purposes of determining whether a quorum is present at the Annual Meeting. A broker “non-vote” occurs when a nominee holder, such as a brokerage firm, bank or trust company, holding shares of record for a beneficial owner, does not vote on a particular proposal because the nominee holder does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

The election of directors is considered to be a “non-routine” matter and as a result, brokers or nominees cannot vote your shares on this proposal in the absence of your direction.

How are votes counted?

Votes will be counted by the inspector of elections appointed for the Annual Meeting, who will separately count “For,” “Withhold,” and “Against” votes, abstentions and broker non-votes.

With respect to the election of nominees to the Board of Directors, stockholders may vote “For” all of the nominees, “Withhold” their votes for all of the nominees, or vote “For” all of the nominees except for any specified nominee(s). Directions to withhold authority will have no effect on the outcome of this vote. The election of directors is considered a “non-routine” matter and as a result, brokers or nominees cannot vote uninstructed shares on this proposal. Broker non-votes will have no effect on the outcome of this vote.

With respect to the ratification of the Company’s auditors, stockholders may vote “For” or “Against,” or abstain from voting. Abstentions will be considered shares present in person or by proxy and entitled to vote and, therefore, will have the effect of a vote “Against” the matter. The ratification of the Company’s auditors is considered a “routine” proposal on which the Company expects that brokers or other nominees will be entitled to vote without receiving instructions from the beneficial owner of the applicable shares of common stock. Accordingly, no broker non-votes will result from this proposal.

How many votes are needed to approve each proposal?

For the election of directors, the five (5) persons receiving the highest number of affirmative “For” votes at the Annual Meeting in person or by proxy will be elected as directors to serve until the next annual meeting of stockholders and until their successors are duly elected and qualified. Votes withheld shall have no legal effect.

Approval of all other matters requires the affirmative vote of a majority of the shares of common stock present at the Annual Meeting in person or by proxy and entitled to vote on such matter.

Is my vote kept confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except:

| · | as necessary to meet applicable legal requirements; |

| · | to allow for the tabulation and certification of votes; and |

| · | to facilitate a successful proxy solicitation. |

Occasionally, stockholders provide written comments on their proxy cards, which may be forwarded to the Company’s management and the Board.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. The Company will publish the final voting results in a Current Report on Form 8-K, which the Company is required to file with the SEC within four business days following the Annual Meeting.

Who can help answer my questions?

If you need assistance with voting or have questions regarding the Annual Meeting, please contact:

Broadridge

51 Mercedes Way

Edgewood, NY 11717

1-800-540-7095

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Information about the Nominees

At the Annual Meeting, the stockholders will elect five directors to serve until the next annual meeting of Stockholders or until their respective successors are elected and qualified. In the event any nominee is unable or unwilling to serve as a director at the time of the Annual Meeting, the proxies may be voted for the balance of those nominees named and for any substitute nominee designated by the present Board or the proxy holders to fill such vacancy, or for the balance of the nominees named without nomination of a substitute, or the size of the Board may be reduced in accordance with the Bylaws of the Company. The Board has no reason to believe that any of the persons named below will be unable or unwilling to serve as a nominee or as a director if elected.

Assuming a quorum is present, the five nominees receiving the highest number of affirmative votes of shares entitled to be voted for them will be elected as directors of the Company for the ensuing fiscal year. The proxy holders intend to vote the shares represented by proxies for all of the board's nominees, except to the extent authority to vote for the nominees is withheld, and unless marked otherwise, proxies received will be voted "FOR" the election of each of the five nominees named below. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner as will ensure the election of as many of the nominees listed below as possible, and, in such event, the specific nominees to be voted for will be determined by the proxy holders. Each of Messrs. Giordano, Benton, Dumbroff, and Gildea currently serve as directors, and, having been elected to the Board at last year’s meeting are standing for re-election. Mr. Silverman was appointed as a director of the Company effective as of August 15, 2016 pursuant to a Nomination, Standstill and Voting Agreement between the Company and Mr. Silverman, Iroquois Master Fund, Ltd. (“IMF”), and certain persons and entities affiliated with IMF.

| NAME | AGE | CURRENT POSITION | ||

| Sebastian Giordano | 59 | Chief Executive Officer and Director | ||

| Charles Benton | 66 | Director | ||

| Norm Dumbroff | 55 | Director | ||

| Edward Gildea | 64 | Director | ||

| Joshua Silverman | 46 | Director |

The following information with respect to the principal occupation or employment of each nominee for director, the principal business of the corporation or other organization in which such occupation or employment is carried on, and such nominee's business experience during the past five years, as well as the specific experiences, qualifications, attributes and skills that have led the Board to determine that such Board members should serve on the Board of Directors, has been furnished to the Company by the respective director nominees:

Sebastian Giordano, Chief Executive Officer and Director

Mr. Giordano served as the Interim Chief Executive Officer of the Company from August 2013 until April 25, 2016, when the interim label was removed from his title. He has served as the Chief Executive Officer of the Company since such time. Mr. Giordano has served as a director of WPCS since February 2013. Since 2002, Mr. Giordano has been Chief Executive Officer of Ascentaur, LLC, a business consulting firm providing comprehensive strategic, financial and business development services to start-up, turnaround and emerging growth companies. From 1998 to 2002, Mr. Giordano was Chief Executive Officer of Drive One, Inc., a safety training and education business. From 1992 to 1998, Mr. Giordano was Chief Financial Officer of Sterling Vision, Inc., a retail optical chain. Mr. Giordano received B.B.A. and M.B.A. degrees from Iona College. Mr. Giordano’s executive business experience was instrumental in his selection as a member of our Board of Directors.

Charles Benton, Director

Mr. Benton has been a director of WPCS since July 2012. Since February 2008, Mr. Benton has served as the Director of Distribution Services – Supply Chain for Charming Shoppes, Inc., a leading national specialty retailer of women’s apparel operating more than 1,800 retail stores throughout the United States. Prior to that, from March 2006 to January 2008, he served as Director of Finance – Supply Chain for Charming Shoppes, and from May 1999 to February 2006, as Manager of Finance – Supply Chain for Charming Shoppes. Previously, Mr. Benton spent approximately 20 years for Consolidated Rail Corporation. He holds a B.S. degree in accounting from St. Joseph’s University in Philadelphia, Pennsylvania. Mr. Benton’s financial experience was instrumental in his selection as a member of our board of directors.

Norm Dumbroff, Director

Mr. Dumbroff became a director of WPCS in November 2002. Since April 1990, he has been the Chief Executive Officer of Wav Incorporated, a distributor of wireless products in North America. Prior to Wav Incorporated, Mr. Dumbroff was an engineer for Hughes Aircraft. He holds a B.S. degree in Computer Science from Albright College. Mr. Dumbroff’s experience with wireless communications, his engineering background and his senior executive experience was instrumental in his selection as a member of our board of directors.

Edward Gildea, Director

Mr. Gildea became a director of WPCS in February 2013. Since February 2014, Mr. Gildea has been a partner in the law firm Fisher Broyles LLP. From 2006 to 2013, Mr. Gildea was President, Chief Executive Officer and Chairman of the Board of Directors of Converted Organics Inc., a publicly held green technology company that manufactured and sold an organic fertilizer, made from recycled food waste. Mr. Gildea is a director for the following publicly held companies: Worlds, Inc. (intellectual property) and Worlds Online Inc. (online games). Mr. Gildea received a B.A. from The College of the Holy Cross and a J.D. from Suffolk University Law School. Mr. Gildea’s executive business experience was instrumental in his selection as a member of our board of directors.

Joshua Silverman, Director

Mr. Silverman currently serves as the Managing Member of Parkfield Funding LLC. Mr. Silverman has served as a director of the Company since August 15, 2016. Mr. Silverman was the co-founder, and a Principal and Managing Partner of Iroquois Capital Management, LLC, an investment advisory firm. Mr. Silverman served as Co-Chief Investment Officer of Iroquois since its inception in 2003 until July 2016. While at Iroquois, he designed and executed complex transactions, structuring and negotiating investments in both public and private companies and has often been called upon by the companies solve inefficiencies as they relate to corporate structure, cash flow, and management. From 2000 to 2003, Mr. Silverman served as Co-Chief Investment Officer of Vertical Ventures, LLC, a merchant bank. Prior to forming Iroquois, Mr. Silverman was a Director of Joele Frank, a boutique consulting firm specializing in mergers and acquisitions. Previously, Mr. Silverman served as Assistant Press Secretary to The President of the United States. Mr. Silverman has served as a Director of National Holdings Corporation (NASDAQ:NHLD), a financial services firm, since July 2014 and MGT Capital Investments, Inc. (NYSEMKT:MGT), a company which acquires, develops, and monetizes assets in the online, mobile, and casino gaming space, from December 2014 to May 2016. Mr. Silverman received his B.A. from Lehigh University in 1992. Mr. Silverman’s extensive knowledge of the capital markets and experience serving in senior executive positions and on the board of directors of public companies well qualifies him for service on our board of directors.

Information About The Board Of Directors

The Board of Directors oversees our business and affairs and monitors the performance of management. In accordance with corporate governance principles, the Board does not involve itself in day-to-day operations. The directors keep themselves informed through discussions with the Chief Executive Officer, other key executives and by reading the reports and other materials that we send them and by participating in Board and committee meetings. Our directors hold office until their successors have been elected and duly qualified unless the director resigns or by reasons of death or other cause is unable to serve in the capacity of director.

How often did the Board and the Board committees meet during fiscal 2016?

During fiscal year 2016, the Board of Directors held 7 meetings and the Audit Committee held 4 meetings. The Board, Audit Committee, Executive Committee and Nominating Committee also approved certain actions by unanimous written consent.

What committees has the Board established?

The Board of Directors has standing Audit, Executive, and Nominating Committees. Information concerning the membership and function of each committee is as follows:

Board Committee Membership

| Name | Audit Committee | Executive Committee | Nominating Committee | |||

| Norm Dumbroff | * | * | ** | |||

| Charles Benton | ** | * | * | |||

| Edward Gildea | * | ** | * |

* Member of Committee

** Chairman of Committee

Audit Committee

Our Audit Committee consists of Charles Benton, Norm Dumbroff, and Edward Gildea, with Mr. Benton appointed as Chairman of the Committee. Our Board has determined that all of the members are “independent” as that term is defined under applicable SEC rules and under the current listing standards of The NASDAQ Stock Market. The Board has determined that Mr. Benton qualifies as an “audit committee financial expert” as defined under applicable SEC rules, and that all members of the Audit Committee meet the additional criteria for independence of audit committee members set forth in Rule 10A-3(b)(1) under the Exchange Act.

The Audit Committee is responsible for overseeing the Company’s corporate accounting, financial reporting practices, audits of financial statements, and the quality and integrity of the Company’s financial statements and reports. In addition, the Audit Committee oversees the qualifications, independence and performance of the Company’s independent auditors. In furtherance of these responsibilities, the Audit Committee’s duties include the following: evaluating the performance and assessing the qualifications of the independent auditors; determining and approving the engagement of the independent auditors to perform audit, reviewing and attesting to services and performing any proposed permissible non-audit services; evaluating employment by the Company of individuals formerly employed by the independent auditors and engaged on the Company’s account and any conflicts or disagreements between the independent auditors and management regarding financial reporting, accounting practices or policies; discussing with management and the independent auditors the results of the annual audit; reviewing the financial statements proposed to be included in the Company’s annual or transition report on Form 10-K; discussing with management and the independent auditors the results of the auditors’ review of the Company’s quarterly financial statements; conferring with management and the independent auditors regarding the scope, adequacy and effectiveness of internal auditing and financial reporting controls and procedures; and establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting control and auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters. The Audit Committee is governed by a written charter approved by the board of directors, which complies with the applicable provisions of the Sarbanes-Oxley Act and related rules of the SEC and the NASDAQ Stock Market. A copy of the Audit Committee charter is available to view on the Company’s website.

Executive Committee

Our Executive Committee consists of Edward Gildea, Charles Benton, and Norm Dumbroff, with Mr. Gildea appointed as Chairman of the Committee. Our Board of Directors has determined that all of the members are “independent” under the current listing standards of The NASDAQ Stock Market. Our Board of Directors has adopted a written charter setting forth the authority and responsibilities of the Executive Committee.

Our Executive Committee has responsibility for assisting the Board of Directors in, among other things, evaluating and making recommendations regarding the compensation of our executive officers and directors, assuring that the executive officers are compensated effectively in a manner consistent with our stated compensation strategy, producing an annual report on executive compensation in accordance with the rules and regulations promulgated by the SEC, periodically evaluating the terms and administration of our incentive plans and benefit programs and monitoring of compliance with the legal prohibition on loans to our directors and executive officers. The executive committee is governed by a written charter approved by the Board. A copy of the Executive Committee Charter is available to view on the Company’s website.

Nominating Committee

Our Nominating Committee consists of Norm Dumbroff, Edward Gildea, and Charles Benton, with Mr. Dumbroff appointed as Chairman of the Committee. The Board of Directors has determined that all of the members are “independent” under the current listing standards of The NASDAQ Stock Market.

The Nominating Committee is responsible for assisting the Board in identifying individuals qualified to become members of the Board and executive officers of the Company; selecting, or recommending that the Board select, director nominees for election as directors by the stockholders of the Company; developing and recommending to the Board a set of effective governance policies and procedures applicable to the company; leading the Board in its annual review of the Board’s performance; recommending to the Board director nominees for each committee; making recommendations regarding committee purpose, structure and operations; and overseeing and approving a managing continuity planning process. During the fiscal year ended April 30, 2016, there were no changes to the procedures by which holders of our common stock may recommend nominees to the Board. The nominating committee is governed by a written charter approved by the Board. A copy of the Nominating Committee charter is available to view on the Company’s website.

Nomination of Directors

As provided in its charter and our company’s corporate governance principles, the Nominating Committee is responsible for identifying individuals qualified to become directors. The Nominating Committee seeks to identify director candidates based on input provided by a number of sources, including (1) the Nominating Committee members, (2) our other directors, (3) our stockholders, (4) our Chief Executive Officer or Chairman, and (5) third parties such as professional search firms. In evaluating potential candidates for director, the Nominating Committee considers the entirety of each candidate’s credentials.

Qualifications for consideration as a director nominee may vary according to the particular areas of expertise being sought as a complement to the existing composition of the Board of Directors. However, at a minimum, candidates for director must possess:

| · | high personal and professional ethics and integrity; |

| · | the ability to exercise sound judgment; |

| · | the ability to make independent analytical inquiries; |

| · | a willingness and ability to devote adequate time and resources to diligently perform Board and committee duties; and |

| · | the appropriate and relevant business experience and acumen. |

In addition to these minimum qualifications, the Nominating Committee also takes into account when considering whether to nominate a potential director candidate the following factors:

| · | whether the person possesses specific industry expertise and familiarity with general issues affecting our business; |

| · | whether the person’s nomination and election would enable the Board to have a member that qualifies as an “audit committee financial expert” as such term is defined by the SEC in Item 401 of Regulation S-K; |

| · | whether the person would qualify as an “independent” director under the listing standards of the Nasdaq Stock Market; |

| · | the importance of continuity of the existing composition of the Board of Directors to provide long term stability and experienced oversight; and |

| · | the importance of diversified Board membership, in terms of both the individuals involved and their various experiences and areas of expertise. |

The Nominating Committee will consider director candidates recommended by stockholders provided such recommendations are submitted in accordance with the procedures set forth below. In order to provide for an orderly and informed review and selection process for director candidates, the Board of Directors has determined that stockholders who wish to recommend director candidates for consideration by the Nominating Committee must comply with the following:

| · | The recommendation must be made in writing to the Corporate Secretary at WPCS International Incorporated; |

| · | The recommendation must include the candidate's name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between the candidate and the Company within the last three years and evidence of the recommending person's ownership of the Company’s common stock; |

| · | The recommendation shall also contain a statement from the recommending shareholder in support of the candidate; professional references, particularly within the context of those relevant to board membership, including issues of character, judgment, diversity, age, independence, expertise, corporate experience, length of service, other commitments and the like; and personal references; and |

| · | A statement from the shareholder nominee indicating that such nominee wants to serve on the Board and could be considered "independent" under the Rules and Regulations of the Nasdaq Stock Market and the SEC, as in effect at that time. |

All candidates submitted by stockholders will be evaluated by the Nominating Committee according to the criteria discussed above and in the same manner as all other director candidates.

How are directors compensated?

Each Director is entitled to annual compensation of $24,000 per year for his service on the Board. The chairperson of the Audit Committee is entitled to an additional $6,000 per year for his service. Directors are also entitled to receive discretionary cash bonuses and stock options under our stock option plans as determined by the Board of Directors. We reimburse our directors for expenses incurred in connection with attending Board meetings.

Code of Ethics

We have adopted a Code of Ethics that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file reports of securities ownership and changes in such ownership with the SEC. Officers, directors and greater than ten percent stockholders also are required by SEC rules to furnish the Company with copies of all Section 16(a) forms they file.

Based solely upon a review of the copies of such forms furnished to the Company, and on written representations from the reporting persons, the Company believes that all Section 16(a) filing requirements applicable to the Company’s directors and officers were timely met during the fiscal year ended April 30, 2016.

Executive Committee Interlocks and Insider Participation

Mr. Benton, Mr. Dumbroff, and Mr. Gildea were the members of the Executive Committee during the year ended April 30, 2016. None of the members of the Executive Committee is or has been an employee or officer of the Company, nor did any member of the Executive Committee have any relationships requiring disclosure by the Company under Item 404 of Regulation S-K.

None of the Company’s executive officers served as a director or as a member of the compensation committee (or other committee performing equivalent functions) of another entity, one of whose executive officers served as a director of the Company or as a member of the Company’s Executive Committee.

Annual Meeting Attendance

The Company has no policy with respect to director attendance at annual meetings, but encourages all directors to attend. 4 directors attended last year’s annual meeting.

Director Independence

Mr. Benton, Mr. Dumbroff, Mr. Gildea, and Mr. Silverman are independent directors of the Company, and as such, they satisfy the definition of independence in accordance with SEC rules and NASDAQ listing standards.

Involvement in Certain Legal Proceedings

Our directors have not been involved in any of the following events during the past ten years:

| 1. | any bankruptcy petition filed by or against such person or any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; | |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); | |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting his involvement in any type of business, securities or banking activities or to be associated with any person practicing in banking or securities activities; | |

| 4. | being found by a court of competent jurisdiction in a civil action, the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a Federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; | |

| 5. | being subject of, or a party to, any Federal or state judicial or administrative order, judgment decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of any Federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or | |

| 6. | being subject of or party to any sanction or order, not subsequently reversed, suspended, or vacated, of any self-regulatory organization, any registered entity or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Arrangements or Understandings

IMF, a stockholder of the Company, notified the Company, by letter dated July 29, 2016, of its nomination of Joshua Silverman for election to the Board of the Company at the Annual Meeting, to which Mr. Silverman consented. Subsequently, the Company agreed to add Mr. Silverman to the Board and include him in its slate of nominees for election as directors of the Company at the Annual Meeting, subject to the agreement of Mr. Silverman, IMF, and certain persons and entities affiliated with IMF (collectively, the “Iroquois Group”) to various conditions, to be set forth in a separate Nomination, Standstill and Voting Agreement. To facilitate Mr. Silverman’s inclusion on the Board, on August 5, 2016 the Board resolved to increase its size from 4 directors to 5 directors.

Under the terms of the Nomination, Standstill and Voting Agreement, the Company agreed to appoint Mr. Silverman as a member of the Board to fill the newly created vacancy and agreed to include him in its slate of nominees for election as directors of the Company at the Annual Meeting. The Iroquois Group agreed to refrain from certain activities at the Annual Meeting and for so long as Mr. Silverman is serving as a director and further agreed to vote for the Company slate of directors and according to the Company’s recommendation for other items of business at the Annual Meeting, subject to certain exceptions.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF ITS NOMINEES.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed the firm of Marcum LLP as the independent registered public accounting firm of the Company for the year ending April 30, 2017, subject to ratification of the appointment by the Company's stockholders. A representative of Marcum LLP is not expected to attend the Annual Meeting.

Audit Fees

The aggregate fees billed by our independent auditors, for professional services rendered for the audit of our annual financial statements for the years ended April 30, 2016 and 2015, and for the reviews of the financial statements included in our Quarterly Reports on Form 10-Q during the fiscal years were $194,000 and $457,000, respectively.

Audit Related Fees

We incurred no fees to our independent auditors for non-audit related fees during the fiscal years ended April 30, 2016 and 2015.

Tax Fees

We did not incur fees to our independent auditors for tax compliance services during the fiscal years ended April 30, 2016 and 2015.

All Other Fees

We did not incur fees for products and services provided by the principal accountants other than those set forth above.

Consistent with SEC policies and guidelines regarding audit independence, the Audit Committee is responsible for the pre-approval of all audit and permissible non-audit services provided by our principal accountants on a case-by-case basis. Our Audit Committee has established a policy regarding approval of all audit and permissible non-audit services provided by our principal accountants. Our Audit Committee pre-approves these services by category and service. Our Audit Committee has pre-approved all of the services provided by our principal accountants

Recommendation

THE BOARD RECOMMENDS A VOTE FOR THE ELECTION OF MARCUM LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDED APRIL 30, 2017.

AUDIT COMMITTEE REPORT

Review of the Company's audited financial statements for the fiscal year ended April 30, 2016

The Audit Committee met and held discussions with management and the independent auditors. Management represented to the Audit Committee that the Company's consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States, and the Audit Committee reviewed and discussed the consolidated financial statements with management and the independent auditors. The Audit Committee also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 114 (Codification of Statements on Auditing Standards, AU 380), as amended.

In addition, the Audit Committee discussed with the independent auditors the auditors' independence from the Company and its management, and the independent auditors provided to the Audit Committee the written disclosures and letter required by the Independence Standards Board Standard No. 1 (Independence Discussions With Audit Committees).

The Audit Committee discussed with the Company's independent auditors the overall scope and plans for their respective audits. The Audit Committee met with the independent auditors, with and without management present, to discuss the results of their examinations and the overall quality of the Company's internal controls and financial reporting.

Based on the reviews and discussions referred to above, the Audit Committee approved the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended April 30, 2016, for filing with the SEC.

Submitted by the Audit Committee

Charles Benton, Chairman

Norm Dumbroff

Edward Gildea

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows certain information as of August 16, 2016 with respect to the beneficial ownership of the Company’s common stock by: (i) each person the Company believes beneficially holds more than 5% of the outstanding shares of the Company’s common stock based solely on the Company’s review of SEC filings; (ii) each director; (iii) each named executive officer; and (iv) all directors and executive officers as a group. Unless otherwise noted below, the address of each beneficial owner listed in the table is c/o WPCS International, Incorporated, 521 Railroad Avenue, Suisun City, California, 94585.

We have determined beneficial ownership in accordance with the rules of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons and entities named in the table below have sole voting and investment power with respect to all shares of common stock that they beneficially own, subject to applicable community property laws.

Applicable percentage ownership is based on 2,848,659 shares of common stock outstanding at August 5, 2016. In computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, we deemed outstanding shares of common stock underlying convertible preferred stock and subject to options or warrants held by that person that are currently convertible or exercisable, as the case may be, or convertible or exercisable within sixty days of August 16, 2016. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person.

| Name And Address Of Beneficial Owner | Number of Shares Owned |

Percentage of Class |

||||||

| Sebastian Giordano | 861,494 | (1) | 23.2 | % | ||||

| David Allen | 420,000 | (1) | 12.8 | % | ||||

| Charles Benton | 234,935 | (1) | 7.6 | % | ||||

| Norm Dumbroff | 232,598 | (1) | 7.5 | % | ||||

| Edward Gildea | 234,675 | (1) | 7.6 | % | ||||

| Robert Roller | 184,935 | (1) | 6.1 | % | ||||

| Joshua Silverman | 0 | 0 | % | |||||

| All Officers and Directors as a Group | 2,168,637 | (1) | 43.2 | % | ||||

| Iroquois Capital Management LLC (2) | 286,513 | (3) | 9.99 | % | ||||

| (1) | Includes the following number of shares of common stock which may be acquired by certain officers and directors through the exercise of stock options which were exercisable as of August 16, 2016, or which will or may become exercisable within 60 days of that date: Sebastian Giordano, 861,494 shares; Charles Benton, 234,935 shares; Norm Dumbroff, 232,598 shares; Edward Gildea, 234,675 shares; David Allen, 420,000; Robert Roller, 184,935 shares; and all officers and directors as a group, 2,168,637 shares. The address for each of our officers and directors is 521 Railroad Avenue, Suisun City, California 94585. |

| (2) | The principal business address of the beneficial owner is 205 East 42nd Street, 20th Floor, New York, New York 10017. Iroquois Master Fund (“IMF”) is a private investment fund. Iroquois Capital Management LLC (“Iroquois Capital”) is an investment adviser that provides investment advisory services to IMF. Iroquois Capital Investment Group LLC (“ICIG”) is a private investment fund. American Capital Management, LLC (“American Capital”) is an investment vehicle for investment purposes. Richard Abbe is the President of Iroquois Capital and managing member of ICIG. Kimberly Page is the manager of American Capital and the Chief Operating Officer, Compliance Officer of Iroquois Capital. |

| (3) |

Based on a Schedule 13D/A filed August 2, 2016, each of IMF, Iroquois Capital, ICIG, Joshua Silverman, Richard Abbe, and Kimberly Page, are considered to be members of a “group” with all of the other persons and entities just listed, for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (each, a “member,” and, collectively, the “Iroquois Group”). The Iroquois Group beneficially owns an aggregate of 286,513 shares, excluding certain securities held by the Iroquois Group subject to a beneficial ownership limitation which prevents conversion in excess of 9.99% of the total outstanding shares of common stock, discussed further below.

Based on a Schedule 13D/A filed August 2, 2016, Joshua Silverman was included as a member of the Iroquois Group due to his service as a nominee for IMF to the Board of Directors at the Annual Meeting and does not have any beneficial ownership notwithstanding the fact that Mr. Silverman, along with all other reporting persons on such Schedule 13D/A, are described as members of the Iroquois Group. Mr. Silverman has since been appointed as a director of the Company effective as of August 15, 2016 pursuant to a Nomination, Standstill and Voting Agreement between the Company and Mr. Silverman, IMF, and certain persons and entities affiliated with IMF. Mr. Silverman has also informed the Company that he is no longer a member of the Iroquois Group and may no longer be deemed to beneficially own any shares as a result of his prior membership in the Iroquois Group.

IMF beneficially owns 277,839 shares, consisting of (i) 259,931 shares directly and beneficially, and (ii) 17,908 shares underlying Series H-1 Preferred Stock. By virtue of its relationship as the investment manager to IMF, Iroquois Capital beneficially owns 277,839 shares. ICIG directly and beneficially owns 0 shares. American Capital directly and beneficially owns 8,674 shares. By virtue of his relationships as the President of Iroquois Capital and managing member of ICIG, Richard Abbe beneficially owns 277,839 shares. By virtue of her relationship as manager of American Capital, Kimberly Page beneficially owns 8,674 shares. Joshua Silverman as the managing member of Parkfield Funding LLC does not beneficially own any shares.

Because each of IMF, Iroquois Capital, ICIG, Richard Abbe, and Kimberly Page are members of the Iroquois Group, each may be deemed to be the beneficial owner of the shares directly owned by the other members. Each of Iroquois Capital, ICIG, IMF, American Capital, Mr. Abbe, and Ms. Page disclaim beneficial ownership of the shares directly owned by the other members. Each member of the Iroquois Group disclaims beneficial ownership of such shares except to the extent of his, her, or its pecuniary interest therein. |

|

The Iroquois Group’s aggregate ownership figure of 286,513 shares excludes a total of 2,133,353 shares underlying certain Series H and H-1 Preferred Stock and issuable upon the exercise of certain warrants, because of a beneficial ownership limitation in the form of a conversion cap which precludes the Iroquois Group, collectively, from converting such Preferred Stock or exercising such warrants to the extent that the Iroquois Group would, after conversion or exercise, beneficially own in excess of 9.99% of the total outstanding shares of common stock.

The shares excluded include: (i) owned by IMF: 97,000 shares underlying Series H Preferred Stock, 685,792 shares underlying Series H-1 Preferred Stock, and 1,055,481 shares issuable upon the exercise of warrants; (ii) owned by ICIG: 54,100 shares underlying Series H-1 Preferred Stock and 81,190 shares issuable upon the exercise of warrants; (iii) owned by American Capital: 23,500 shares underlying Series H Preferred Stock, 54,100 shares underlying Series H-1 Preferred Stock, and 81,190 shares issuable upon the exercise of warrants. |

INFORMATION ABOUT THE EXECUTIVE OFFICERS

The executive officers are elected annually by our Board of Directors and hold office until their successors are elected and duly qualified. There are no family relationships between any of our directors or executive officers. The current executive officers of the Company are as follows:

| NAME | AGE | OFFICES HELD | ||

| Sebastian Giordano | 59 | Chief Executive Officer and Director | ||

| David Allen | 61 | Chief Financial Officer | ||

| Robert Roller | 64 | President, WPCS International - Suisun City, Inc. |

Biographical information about Mr. Giordano is provided in “Proposal No. 1 - Election of Directors”.

David Allen, Chief Financial Officer

Mr. Allen has been Chief Financial Officer of the Company since December 2014. Since June 2004, Mr. Allen has served as the Chief Financial Officer and a member of the board of Bailey’s Express, Inc., a private, family-owned business. From June 2006 to June 2013, Mr. Allen was the Chief Financial Officer and Vice President of Administration for Converted Organics, Inc. an environmentally friendly clean technology company. Previously, Mr. Allen served as Chief Financial Officer (1999 – 2003) and President and Chief Executive Officer (2003 – 2004) for Millbook Press, Inc., a Brookfield, Connecticut publisher of children’s books and as the chief financial officer and vice president of administration of JDM, Inc., a Wilton, Connecticut business development and consulting company to the direct marketing business. Mr. Allen has also previously worked for DeAgostini USA Inc., Contiki Travel and Arthur Andersen & Co. Mr. Allen served as an adjunct professor at Western Connecticut State University from 2005 to 2016. Mr. Allen holds a B.S. degree in Accounting and an M.S. degree in Taxation from Bentley University in Waltham, Massachusetts. Mr. Allen is a Certified Public Accountant.

Robert Roller, President, WPCS International - Suisun City, Inc.

Mr. Roller has served as the President of the Suisun City Operations, a subsidiary of the Company, since January of 2012. Prior to joining the Company’s Suisun City Operations, Mr. Roller served as President of MCS Fire and Security and Argyle Security from 2004 until 2012. Previously, Mr. Roller served as Director of West Coast Operations, Siemens Building Technology (2002 – 2004) and as Vice President of Pinkerton Security West Coast Operations (1999 – 2002). Before working in the private sector, Mr. Roller retired in May 1992 from the Marine Corps after 22 years of service, both as an enlisted and as an officer. Mr. Roller holds a B.S. degree in Aeronautics from Embry–Riddle Aeronautical University.

Involvement in Certain Legal Proceedings

Our executive officers have not been involved in any of the following events during the past ten years:

| 1. | any bankruptcy petition filed by or against such person or any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; | |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); | |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting his involvement in any type of business, securities or banking activities or to be associated with any person practicing in banking or securities activities; | |

| 4. | being found by a court of competent jurisdiction in a civil action, the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a Federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; | |

| 5. | being subject of, or a party to, any Federal or state judicial or administrative order, judgment decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of any Federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or | |

| 6. | being subject of or party to any sanction or order, not subsequently reversed, suspended, or vacated, of any self-regulatory organization, any registered entity or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

EXECUTIVE COMPENSATION

Executive Committee Report

The Executive Committee has reviewed and discussed the following Compensation Discussion and Analysis (CD&A) with management. Based on this review and these discussions, the Executive Committee recommended to the Board of Directors that the following Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K.

Submitted by the Executive Committee

Edward Gildea, Chairman

Norm Dumbroff

Charles Benton

COMPENSATION DISCUSSION AND ANALYSIS (CD&A)

The following discussion and analysis of compensation arrangements of our named executive officers for the fiscal year ended April 30, 2016 should be read together with the compensation tables and related disclosures set forth below.

Compensation Philosophy and Objectives

We believe our success depends on the continued contributions of our named executive officers. Our named executive officers are primarily responsible for our growth and operations strategy, and the management of the day-to-day operations of our subsidiaries. Therefore, it is important to our success that we retain the services of these individuals to ensure our future success and prevent them from competing with us should their employment with us terminate.

Our overall compensation philosophy is to provide an executive compensation package that enables us to attract, retain and motivate executive officers to achieve our short-term and long-term business goals. We strive to apply a uniform philosophy regarding compensation of all employees, including members of senior management. This philosophy is based upon the premise that our achievements result from the combined and coordinated efforts of all employees working toward common goals and objectives in a competitive, evolving market place. The goals of our compensation program are to align remuneration with business objectives and performance and to enable us to retain and competitively reward executive officers and employees who contribute to our long-term success. In making executive compensation and other employment compensation decisions, the Executive Committee considers achievement of certain criteria, some of which relate to our performance and others of which relate to the performance of the individual employee. Awards to executive officers are based on our achievement and individual performance criteria.

The Executive Committee will evaluate our compensation policies on an ongoing basis to determine whether they enable us to attract, retain and motivate key personnel. To meet these objectives, the Executive Committee may from time to time increase salaries, award additional stock options or provide other short and long-term incentive compensation to executive officers and other employees.

Compensation Program & Forms of Compensation

We provide our executive officers with a compensation package consisting of base salary and participation in benefit plans generally available to other employees. In setting total compensation, the Executive Committee considers individual and Company performance, as well as market information regarding compensation paid by other companies in our industry.

In order to achieve the above goals, our total compensation packages include base salary, annual bonus, as well as long-term compensation in the form of stock options.

Base Salary. Salaries for our executive officers are initially set based on negotiation with individual executive officers at the time of recruitment and with reference to salaries for comparable positions in the industry for individuals of similar education and background to the executive officers being recruited. We also consider the individual’s experience, and expected contributions to our company. Base salary is continuously evaluated by competitive pay and individual job performance. Base salaries for executives are reviewed annually or more frequently should there be significant changes in responsibilities. In each case, we take into account the results achieved by the executive, his or her future potential, scope of responsibilities and experience, and competitive salary practices.

Bonuses. A component of each executive officer’s potential annual compensation may take the form of a performance-based bonus. Contractually, our Executive Vice Presidents are entitled to receive an annual bonus range of 2-3% of the annual profit before interest and taxes of the designated subsidiaries assigned to him. Our CEO and CFO are entitled to an annual bonus, to be determined at the discretion of the Executive Committee, based on our financial performance and the achievement of the officer’s individual performance objectives.