UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act

of 1934

(Amendment

No. )

Filed

by the Registrant [X]

Filed

by a Party other than the Registrant [ ]

Check

the appropriate box:

☐ Preliminary Proxy

Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

☑ Definitive Proxy

Statement

☐ Definitive Additional

Materials

☐

Soliciting Material Under Rule 14a-12

DropCar,

Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the

Registrant)

Payment

of Filing Fee (Check the appropriate box):

☑

No fee required.

☐

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11.

1)

Title of each class

of securities to which transaction applies:

2)

Aggregate number of

securities to which transaction applies:

3)

Per unit price or

other underlying value of transaction computed pursuant to Exchange

Act Rule 0-11 (set forth the amount on which the filing fee is

calculated and state how it was determined):

4)

Proposed maximum

aggregate value of transaction:

☐

Fee paid previously with preliminary materials.

☐

Check box if any

part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its

filing:

1) Amount

previously paid:

2) Form,

Schedule or Registration Statement No:

3) Filing

party:

4) Date

Filed:

October

9, 2018

To Our

Stockholders:

You are

cordially invited to attend the 2018 annual meeting of stockholders

of DropCar, Inc. to be held at 10:00 A.M. EST on Thursday, November

15, 2018, at the offices of Mintz, Levin, Cohn, Ferris, Glovsky

& Popeo, P.C., 666 Third Avenue, New York, New York

10017.

Details

regarding the meeting, the business to be conducted at the meeting,

and information about DropCar, Inc. that you should consider when

you vote your shares are described in this proxy

statement.

At the

annual meeting, eight persons will be elected to our Board of

Directors. In addition, we will ask stockholders to approve the

following proposals:

1.

To approve a

proposed amendment to the WPCS International Incorporated Amended

and Restated 2014 Equity Incentive Plan to increase the number of shares

available for the grant of awards by 1,712,500 shares;

2.

To authorize, for purposes of complying with

Nasdaq Listing Rule 5635(d), the issuance of shares of our common

stock underlying Series H-4 Convertible Preferred Stock and

warrants issued by us pursuant to the terms of that certain

Securities Purchase Agreement, dated March 8, 2018, by and among

DropCar, Inc. and the investors named therein, in an amount equal

to or in excess of 20% of our common stock outstanding before the

issuance of such Series H-4 Convertible Preferred Stock and

warrants (including upon the operation of anti-dilution

provisions contained in such Series

H-4 Convertible Preferred Stock and warrants);

3.

To

approve an amendment to the DropCar, Inc. Amended and Restated

Certificate of Incorporation, as amended, to effect a reverse stock

split of our issued and outstanding shares of common stock, at a

ratio of between 2-for-1 and 25-for-1, if the Board of Directors

believes that a reverse stock split is in the best interests of the

Company and its stockholders;

4.

To ratify the

appointment of EisnerAmper LLP as the Company’s independent

registered public accounting firm for the fiscal year

ending December 31,

2018;

5

To approve by an

advisory vote the compensation of our named executive officers, as

disclosed in this proxy statement; and

6.

To

approve an adjournment of our annual meeting of stockholders, if

necessary, to solicit additional proxies if there are not

sufficient votes in favor of any of the foregoing

proposals.

The

Board of Directors recommends a vote “FOR” each of the

director nominees and “FOR” the approval of each of the

above proposals. Such other business will be transacted as may

properly come before the annual meeting.

We hope

you will be able to attend the annual meeting. Whether you plan to

attend the annual meeting or not, it is important that you cast

your vote either in person or by proxy. You may vote over the

Internet as well as by telephone or by mail. When you have finished

reading the proxy statement, you are urged to vote in accordance

with the instructions set forth in this proxy statement.

We encourage you to vote by proxy so

that your shares will be represented and voted at the meeting,

whether or not you can attend.

Thank

you for your continued support of DropCar, Inc. We look forward to

seeing you at the annual meeting.

|

|

Sincerely,

Spencer

Richardson

Chief

Executive Officer

|

October

9, 2018

NOTICE

OF 2018 ANNUAL MEETING OF STOCKHOLDERS

TIME:

10:00 A.M. EST

DATE:

Thursday, November 15, 2018

PLACE:

Mintz, Levin, Cohn, Ferris, Glovsky & Popeo, P.C., located at

666 Third Avenue, New York, New York, 10017

PURPOSES:

1.

To

elect eight directors

to hold office until the 2019 annual meeting of stockholders or

until their successors are duly elected and qualified;

2.

To approve a

proposed amendment to the WPCS International Incorporated Amended

and Restated 2014 Equity Incentive Plan to increase the number of shares

available for the grant of awards by 1,712,500 shares;

3.

To authorize, for purposes of complying with

Nasdaq Listing Rule 5635(d), the issuance of shares of our common

stock underlying Series H-4 Convertible Preferred Stock and

warrants issued by us pursuant to the terms of that certain

Securities Purchase Agreement, dated March 8, 2018, by and among

DropCar, Inc. and the investors named therein, in an amount equal

to or in excess of 20% of our common stock outstanding before the

issuance of such Series H-4 Convertible Preferred Stock and

warrants (including upon the operation of anti-dilution

provisions contained in such Series

H-4 Convertible Preferred Stock and warrants);

4.

To

approve an amendment to the DropCar, Inc. Amended and Restated

Certificate of Incorporation, as amended, to effect a reverse stock

split of our issued and outstanding shares of common stock, at a

ratio of between 2-for-1 and 25-for-1, if the Board of Directors

believes that a reverse stock split is in the best interests of the

Company and its stockholders;

5.

To ratify the

appointment of EisnerAmper LLP as the Company’s independent

registered public accounting firm for the fiscal year

ending December 31,

2018;

6.

To approve by an

advisory vote the compensation of our named executive officers, as

disclosed in this proxy statement;

7.

To

approve an adjournment of our annual meeting of stockholders, if

necessary, to solicit additional proxies if there are not

sufficient votes in favor of any of the foregoing proposals;

and

8.

To transact such

other business that is properly presented at the annual meeting and

any adjournments or postponements thereof.

WHO MAY

VOTE:

You may

vote if you were the record owner of DropCar, Inc. common stock at

the close of business on September 26, 2018. A list of stockholders of record will

be available at the annual meeting and, during the 10 days prior to

the annual meeting, at our principal executive offices located at

1412 Broadway, Suite 2105, New York,

New York 10018.

All

stockholders are cordially invited to attend the annual meeting.

Whether you plan to attend the

annual meeting or not, we urge you to vote and submit your proxy by

the Internet, telephone or mail in order to ensure the presence of

a quorum. You may change or

revoke your proxy at any time before it is voted at the

meeting.

|

|

BY ORDER OF THE

BOARD OF DIRECTORS

Paul

Commons

Chief

Financial Officer

|

TABLE OF CONTENTS

|

|

PAGE

|

|

Important Information About the Annual Meeting and

Voting

|

3

|

|

Security Ownership of Certain Beneficial Owners and

Management

|

9

|

|

Management and Corporate Governance

|

11

|

|

Executive Committee Report

|

14

|

|

Executive Officer and Director Compensation

|

18

|

|

Equity Compensation Plan Information

|

21

|

|

Report of Audit Committee

|

21

|

|

Section 16(a) Beneficial Ownership Reporting

Compliance

|

22

|

|

Certain Relationships and Related Person Transactions

|

22

|

|

Election of Directors

|

23

|

|

Approval of Amendment to the Company’s 2014 Equity Incentive

Plan

|

24

|

|

Approval of Issuance of Shares of Common Stock in Financing

Transaction

|

26

|

|

Approval of Reverse Stock Split

|

32

|

|

Independent Registered Public Accounting Firm

|

39

|

|

Advisory Vote on Executive Compensation as Disclosed in this Proxy

Statement

|

41

|

|

Code of Conduct and Ethics

|

43

|

|

Other Matters

|

43

|

|

Stockholder Proposals and Nominations For Director

|

43

|

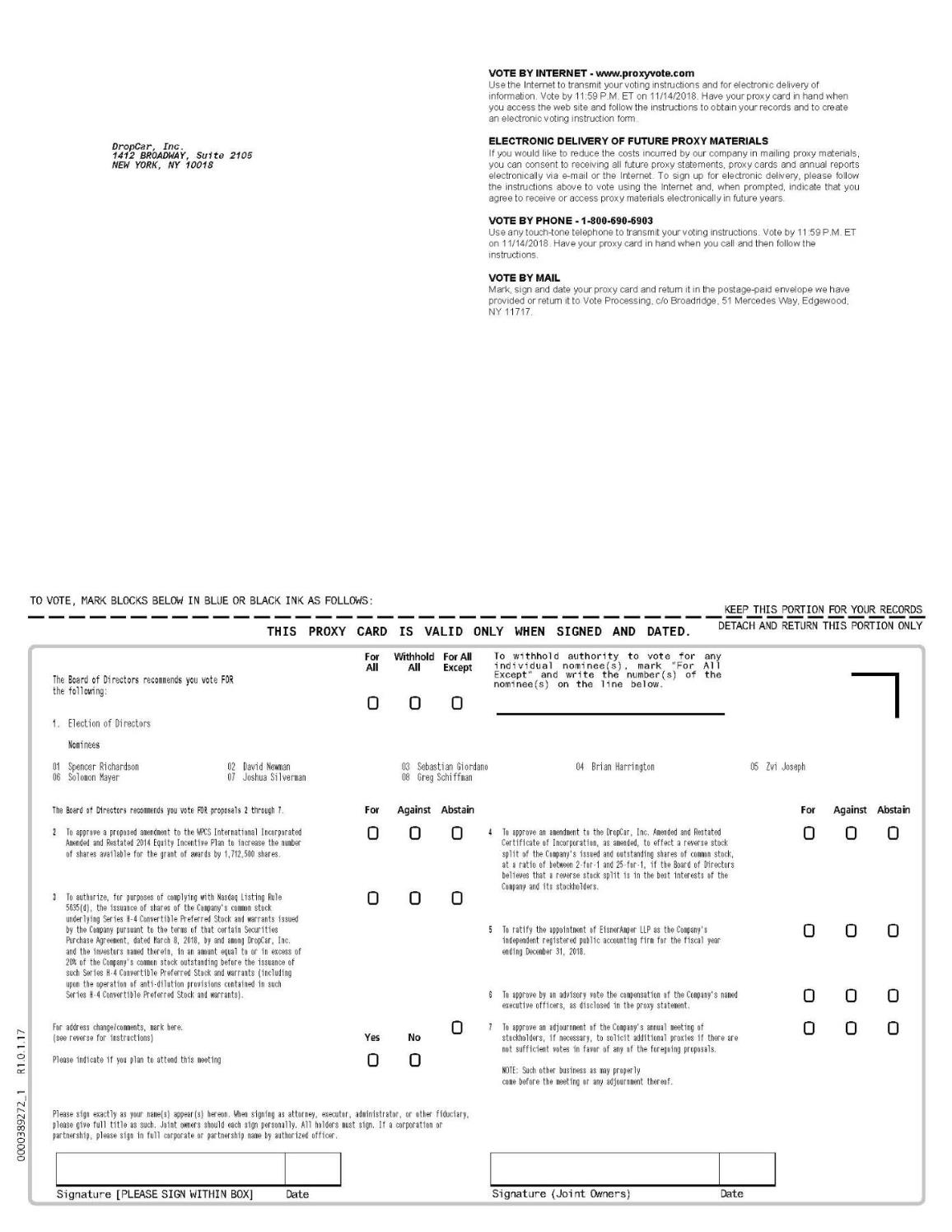

Appendix

Appendix A –

Form of Certificate of Amendment to Amended and Restated

Certificate of Incorporation to Effect Reverse Stock

Split

Appendix B

–

Proxy Card

DropCar, Inc.

1412 Broadway, Suite 2105

New York, New York 10018

PROXY STATEMENT FOR THE DROPCAR, INC.

2018 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 15,

2018

This

proxy statement, along with the accompanying notice of 2018 annual

meeting of stockholders, contains information about the 2018 annual

meeting of stockholders of DropCar, Inc., including any

adjournments or postponements of the annual meeting. We are holding

the annual meeting at 10:00 A.M. EST on Thursday, November 15,

2018, at the offices of Mintz, Levin, Cohn, Ferris, Glovsky &

Popeo, P.C., 666 Third Avenue, New York, New York

10017.

In this

proxy statement, we refer to DropCar, Inc. as

“DropCar,” “the Company,” “we”

and “us.”

This

proxy statement relates to the solicitation of proxies by our Board

of Directors for use at the annual meeting.

On or

about October 10, 2018, we began sending this proxy statement, the

attached Notice of Annual Meeting of Stockholders and the enclosed

proxy card to all stockholders entitled to vote at the annual

meeting.

Although not part

of this proxy statement, we are also sending along with this proxy

statement a copy of our Current

Report on Form 8-K/A, which includes financial statements

for the fiscal year ended December 31,

2017.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE

SHAREHOLDER MEETING TO BE HELD ON NOVEMBER 15, 2018

This

proxy statement and a copy of

our Current Report on Form 8-K/A, which includes financial

statements for the fiscal year ended

December 31, 2017, are available for viewing, printing and

downloading at www.proxyvote.com. To view

these materials please have your 16-digit control number(s)

available that appears on your proxy card. On this website,

you can also elect to receive future distributions of our proxy

statements and annual reports to stockholders by electronic

delivery.

Additionally, you can find a copy of our

Current Report on Form 8-K/A, which includes our financial

statements for the fiscal year ended December 31, 2017 on the

website of the Securities and Exchange Commission, or the SEC,

at www.sec.gov,

or in the “Investors”

section of our website at www.dropcar.com.

You may also obtain a printed copy

of our Current Report on Form 8-K/A, including our financial

statements, free of charge, from us by sending a written request

to: DropCar, Inc., Investor Relations, 1412 Broadway, Suite 2105,

New York, New York 10018. Exhibits will be provided upon written

request and payment of an appropriate processing

fee.

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND

VOTING

Why is the Company Soliciting My Proxy?

The Board of Directors of DropCar, Inc. is

soliciting your proxy to vote at the 2018 annual meeting of

stockholders to be held at the offices of Mintz, Levin, Cohn,

Ferris, Glovsky & Popeo, P.C., 666 Third Avenue, New York, New

York 10017, at 10:00 A.M. EST on Thursday, November 15,

2018, and any adjournments of the

meeting, which we refer to as the annual meeting. The proxy

statement along with the accompanying Notice of Annual Meeting of

Stockholders summarizes the purposes of the meeting and the

information you need to know to vote at the Annual

Meeting.

We have made available to you on the Internet or

have sent you this proxy statement, the Notice of Annual Meeting of

Stockholders, the proxy card and a copy of our Current

Report on Form 8-K/A, which includes financial statements

for the fiscal year ended December 31,

2017, because you owned shares of DropCar, Inc. common stock on the

record date. The Company intends to commence distribution of the

proxy materials to stockholders on or about October

10, 2018.

Who May Vote?

Only

stockholders who owned our common stock at the close of business on

September 26, 2018, are entitled to vote at the annual meeting. On

this record date, there were 8,884,411 shares of our common stock

outstanding and entitled to vote. Our common stock is our only

class of voting stock.

You do

not need to attend the annual meeting to vote your shares. Shares

represented by valid proxies, received in time for the annual

meeting and not revoked prior to the annual meeting, will be voted

at the annual meeting. For instructions on how to change or revoke

your proxy, see “May I Change or Revoke My Proxy?”

below.

How Many Votes Do I Have?

Each

share of our common

stock that you own entitles you to one vote.

How Do I Vote?

Whether

you plan to attend the annual meeting or not, we urge you to vote

by proxy. All shares represented by valid proxies that we receive

through this solicitation, and that are not revoked, will be voted

in accordance with your instructions on the proxy card or as

instructed via Internet or telephone. You may specify whether your

shares should be voted for or withheld for each nominee for

director and whether your shares should be voted for, against or

abstain with respect to each of the other proposals. If you

properly submit a proxy without giving specific voting

instructions, your shares will be voted in accordance with the

Board of Directors’ recommendations as noted below. Voting by

proxy will not affect your right to attend the annual meeting. If

your shares are registered directly in your name through our stock

transfer agent, Issuer Direct Corporation, or you have stock

certificates registered in your name, you may vote:

●

By Internet or by

telephone. Follow the

instructions included in the Notice or, if you received printed

materials, in the proxy card to vote by Internet or

telephone.

●

By mail. If you received a proxy card by mail, you can vote

by mail by completing, signing, dating and returning the proxy card

as instructed on the card. If you sign the proxy card but do not

specify how you want your shares voted, they will be voted in

accordance with the Board of Directors’ recommendations as

noted below.

●

In person at the

meeting. If you attend the

meeting, you may deliver a completed proxy card in person or you

may vote by completing a ballot, which will be available at the

meeting.

Telephone and Internet voting facilities for stockholders of record

will be available 24 hours a day and will close at 11:59 p.m.

Eastern Time on November 14, 2018.

If

your shares are held in “street name” (held in the name

of a bank, broker or other holder of record), you will receive

instructions from the holder of record. You must follow the

instructions of the holder of record in order for your shares to be

voted. Telephone and Internet voting also will be offered to

stockholders owning shares through certain banks and brokers. If

your shares are not registered in your own name and you plan to

vote your shares in person at the annual meeting, you should

contact your broker or agent to obtain a legal proxy or

broker’s proxy card and bring it to the annual meeting in

order to vote.

How Does the Board of Directors Recommend That I Vote on the

Proposals?

The

Board of Directors recommends that you vote as

follows:

● “FOR” the election of the nominees

for director;

● “FOR” the amendment to

the WPCS International

Incorporated Amended and Restated 2014 Equity Incentive

Plan;

● “FOR” the authorization, for purposes of complying with

Nasdaq Listing Rule 5635(d), the issuance of shares of our common

stock underlying Series H-4 Convertible Preferred Stock and

warrants issued by us pursuant to the terms of that certain

Securities Purchase Agreement, dated March 8, 2018, by and among

DropCar, Inc. and the investors named therein, in an amount equal

to or in excess of 20% of our common stock outstanding before the

issuance of such Series H-4 Convertible Preferred Stock and

warrants (including upon the operation of anti-dilution

provisions contained in such Series

H-4 Convertible Preferred Stock and warrants);

● “FOR” the amendment to our Amended and Restated

Certificate of Incorporation to effect a reverse stock split of our

common stock, par value $0.0001 per share, at a ratio of between

2-for-1 and 25-for-1, if the Board of Directors believes that a

reverse stock split is in the best interests of the Company and its

stockholders;

● “FOR” the ratification of the

selection of EisnerAmper LLP as our independent registered public

accounting firm for our fiscal year ending December 31,

2018;

● “FOR” the advisory vote on the

compensation of our named executive officers, as disclosed in this

proxy statement; and

● “FOR” the adjournment of our annual meeting of

stockholders, if necessary, to solicit additional proxies if there

are not sufficient votes in favor of any of the foregoing

proposals.

If any

other matter is presented at the annual meeting, your proxy

provides that your shares will be voted by the proxy holder listed

in the proxy in accordance with his best judgment. At the time this

proxy statement was first made available, we knew of no matters

that needed to be acted on at the annual meeting, other than those

discussed in this proxy statement.

May I Change or Revoke My Proxy?

If you

give us your proxy, you may change or revoke it at any time before

the annual meeting. You may change or revoke your proxy in any one

of the following ways:

● if you received a

proxy card, by signing a new proxy card with a date later than your

previously delivered proxy and submitting it as instructed

above;

● by re-voting by

Internet or by telephone as instructed above;

● by notifying

DropCar’s Secretary/Clerk in writing before the annual

meeting that you have revoked your proxy; or

● by

attending the annual meeting in person and voting in person.

Attending the annual meeting in person will not in and of itself

revoke a previously submitted proxy. You must specifically request

at the annual meeting that it be revoked.

Your

most current vote, whether by telephone, Internet or proxy card is

the one that will be counted.

What if I Receive More Than One Notice or Proxy Card?

You may

receive more than one Notice or proxy card if you hold shares of

our common stock in more than one account, which may be in

registered form or held in street name. Please vote in the manner

described above under “How Do I Vote?” for each account

to ensure that all of your shares are voted.

Will My Shares be Voted if I Do Not Vote?

If your

shares are registered in your name or if you have stock

certificates, they will not be counted if you do not vote as

described above under “How Do I Vote?” If your shares

are held in street name and you do not provide voting instructions

to the bank, broker or other nominee that holds your shares as

described above, the bank, broker or other nominee that holds your

shares has the authority to vote your unvoted shares only on

certain of the proposals set forth in this proxy statement without

receiving instructions from you. Therefore, we encourage you to

provide voting instructions to your bank, broker or other nominee.

This ensures your shares will be voted at the annual meeting and in

the manner you desire. A “broker non-vote” will occur

if your broker cannot vote your shares on a particular matter

because it has not received instructions from you and does not have

discretionary voting authority on that matter or because your

broker chooses not to vote on a matter for which it does have

discretionary voting authority.

What Vote is Required to Approve Each Proposal and How are Votes

Counted?

|

Proposal 1: Elect Directors

|

The

nominees for director who receive the most votes (also known as a

“plurality” of the votes cast) will be elected. You may

vote either FOR all of the nominees, WITHHOLD your vote from all of

the nominees or WITHHOLD your vote from any one or more of the

nominees. Votes that are withheld will not be included in the vote

tally for the election of the directors. Brokerage firms do not

have authority to vote customers’ unvoted shares held by the

firms in street name for the election of the directors. As a

result, any shares not voted by a customer will be treated as a

broker non-vote. Such broker non-votes will have no effect on the

results of this vote.

|

|

Proposal 2: Approve Amendment to the WPCS International

Incorporated Amended and Restated 2014 Equity Incentive

Plan

|

The

affirmative vote of a majority of the Company’s outstanding

capital stock entitled to vote thereon is required to approve the

amendment to the WPCS International Incorporated Amended and

Restated 2014 Equity Incentive Plan to increase the aggregate

number of shares available to be granted under the Company’s

WPCS International Incorporated Amended and Restated 2014 Equity

Incentive Plan. Abstentions will be treated as votes against this

proposal. Brokerage firms do not have authority to vote

customers’ unvoted shares held by the firms in street name on

this proposal. As a result, any shares not voted by a customer will

have the same effect as a vote against this proposal.

|

|

Proposal 3: Approve the Issuance of Shares of our Common Stock in

the Financing Transaction

|

The affirmative vote of the holders of a

majority of the total votes cast in person or by proxy at the

annual meeting is required to approve, in accordance with Nasdaq

Listing Rule 5635(d), the issuance, under the terms of that certain

Securities Purchase Agreement dated March 8, 2018, by and among

DropCar, Inc. and the investors thereto, and related documents, of

shares of our common stock underlying Series H-4 Convertible

Preferred Stock and warrants issued by us (including upon the

operation of “ratchet” anti-dilution provisions

contained in such shares of Series H-4 Convertible Preferred Stock

and warrants). Abstentions will be treated as votes against this

proposal. Brokerage firms do not have authority to vote

customers’ unvoted shares held by the firms in street name on

this proposal. As a result, any shares not voted by a customer will

be treated as a broker non-vote. Such broker non-votes will have no

effect on the results of this vote.

|

|

Proposal 4: Reverse Stock Split

|

The affirmative vote of the holders of a

majority of the total votes cast in person or by proxy at the

annual meeting is required to approve the amendment to our Amended and Restated

Certificate of Incorporation, as amended, to effect a reverse stock

split of our common stock, if the Board of Directors believes that

a reverse stock split is in the best interests of the Company and

its stockholders. Brokerage firms have authority to vote customers'

unvoted shares held by the firms in street name on this proposal.

Abstention and broker non-votes, if any, will be treated as votes

against this proposal.

|

|

Proposal 5: Ratify Selection of Independent Registered Public

Accounting Firm

|

The

affirmative vote of the holders of a majority of the shares of our

common stock present and entitled to vote on the matter either in

person or by proxy at the annual meeting is required to ratify the

appointment of EisnerAmper LLP as our independent registered public

accounting firm for the fiscal year ending December 31, 2018.

Abstentions will be treated as votes against this proposal.

Brokerage firms have authority to vote customers’ unvoted

shares held by the firms in street name on this proposal. If a

broker does not exercise this authority, such broker non-votes will

have no effect on the results of this vote. We are not required to

obtain the approval of our stockholders to select our independent

registered public accounting firm. However, if our stockholders do

not ratify the selection of EisnerAmper LLP as our independent

registered public accounting firm for 2018, our Audit Committee of

our Board of Directors will reconsider its selection.

|

|

Proposal 6: Approve an Advisory Vote on the Compensation of our

Named Executive Officers

|

The

affirmative vote of a majority of the votes cast in person or by

proxy at the annual meeting is required to approve, on an advisory

basis, the compensation of our named executive officers, as

described in this proxy statement. Abstentions will be treated as

votes against this proposal. Brokerage firms do not have authority

to vote customers’ unvoted shares held by the firms in street

name on this proposal. As a result, any shares not voted by a

customer will be treated as a broker non-vote. Such broker

non-votes will have no effect on the results of this vote. Although

the advisory vote is non-binding, the Executive Committee and the

Board of Directors will review the voting results and take them

into consideration when making future decisions regarding executive

compensation.

|

|

Proposal 7: Approve an Adjournment of

the Annual Meeting, if Necessary, to Solicit Additional Proxies if

there are not Sufficient Votes in Favor of Any of the Foregoing

Proposals

|

Approval of the adjournment of the annual meeting,

if necessary, to solicit additional proxies if there are not

sufficient votes in favor of the above proposals requires the

affirmative vote of the holders of a majority of the shares of

common stock present and entitled to vote either in person or by

proxy at the annual meeting. Abstentions will be treated as

votes against this proposal. Brokerage firms do not have authority

to vote customers’ unvoted shares held by the firms in street

name on this proposal. As a result, any shares not voted by a

customer will be treated as a broker non-vote. Such broker

non-votes will have no effect on the results of this

vote.

|

Is Voting Confidential?

We will

keep all the proxies, ballots and voting tabulations private. We

only let our Inspector of Election, a representative from Mintz,

Levin, Cohn, Ferris, Glovsky & Popeo, P.C., examine these

documents. Management will not know how you voted on a specific

proposal unless it is necessary to meet legal requirements. We

will, however, forward to management any written comments you make

on the proxy card or otherwise provide.

Where Can I Find the Voting Results of the Annual

Meeting?

The

preliminary voting results will be announced at the annual meeting,

and we will publish preliminary, or final results if available, in

a Current Report on Form 8-K within four business days of the

annual meeting. If final results are

unavailable at the time we file the Form 8-K, then we will file an

amended report on Form 8-K to disclose the final voting results

within four business days after the final voting results are

known. In

addition, we are required to file on a Current Report on Form 8-K

no later than the earlier of one hundred fifty calendar days after

the annual meeting or sixty calendar days prior to the deadline for

submission of stockholder proposals set forth on page 43

of this proxy

statement under the heading “Stockholder Proposals and

Nominations for Director” our decision on how frequently we

will include a stockholder vote on the compensation of our named

executive officers in our proxy materials.

What Are the Costs of Soliciting these Proxies?

We will

pay all of the costs of soliciting these proxies. Our directors and

employees may solicit proxies in person or by telephone, fax or

email. We will pay these employees and directors no additional

compensation for these services. We will ask banks, brokers and

other institutions, nominees and fiduciaries to forward these proxy

materials to their principals and to obtain authority to execute

proxies. We will then reimburse them for their

expenses.

We

have engaged Kingsdale Advisors (“Kingsdale”) to act as

our proxy solicitor in connection with the proposals to be acted

upon at our annual meeting. Pursuant to our agreement with

Kingsdale, Kingsdale will, among other things, provide advice

regarding proxy solicitation issues and solicit proxies from our

stockholders on our behalf in connection with the annual meeting.

For these services, we will pay a fee of approximately $2,000 plus

expenses. We have also agreed to pay to Kingsdale a performance fee

of $10,000 in the event all proposals achieve requisite stockholder

approval.

What Constitutes a Quorum for the Annual Meeting?

The

presence, in person or by proxy, of the holders of thirty-three and

one-third percent (33.33%) of our outstanding shares entitled to

vote at the annual meeting is necessary to constitute a quorum at

the annual meeting. Votes of stockholders of record who are present

at the annual meeting in person or by proxy, abstentions, and

broker non-votes are counted for purposes of determining whether a

quorum exists.

Attending the Annual Meeting

The

annual meeting will be held at 10:00 A.M. EST on Thursday, November

15, 2018, at the offices of Mintz, Levin, Cohn, Ferris, Glovsky

& Popeo, P.C., 666 Third Avenue, New York, New York 10017. When

you arrive at the meeting, signs will direct you to the appropriate

meeting rooms. You need not attend the annual meeting in order to

vote.

Householding of Annual Disclosure Documents

Some

brokers or other nominee record holders may be sending you a single

Notice or, if applicable, a single set of our proxy materials if

multiple DropCar, Inc. stockholders live in your household. This

practice, which has been approved by the SEC, is called

“householding.” Once you receive notice from your

broker or other nominee record holder that it will be

“householding” the Notice or if, applicable, our proxy

materials, the practice will continue until you are otherwise

notified or until you notify them that you no longer want to

participate in the practice. Stockholders who participate in householding will

continue to have access to and utilize separate proxy voting

instructions.

We will

promptly deliver a separate copy of our Notice or if applicable,

our proxy materials to you if you write or call our corporate

secretary at: DropCar, Inc., Investor Relations, 1412 Broadway,

Suite 2105, New York, New York 10018. If you want to receive your

own Notice or, if applicable, set of our proxy materials in the

future or, if you share an address with another DropCar, Inc.

stockholder and together both of you would like to receive only a

single Notice or, if applicable, set of proxy materials, you should

contact your broker or other nominee record holder directly or you

may contact us at the above address and phone number.

Electronic Delivery of Company Stockholder

Communications

Most

stockholders can elect to view or receive copies of future proxy

materials over the Internet instead of receiving paper copies in

the mail.

You can

choose this option and save the Company the cost of producing and

mailing these documents by:

●

following the

instructions provided on your proxy card;

●

following the

instructions provided when you vote over the Internet;

or

●

going to

www.proxyvote.com and

following the instructions provided.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT

The

following table sets forth certain information with respect to the

beneficial ownership of our common stock as of September 15, 2018

for (a) the executive officers named in the Summary Compensation

Table on page 18 of

this proxy statement, (b) each of our directors and director

nominees, (c) all of our current directors and executive officers

as a group and (d) each stockholder known by us to own beneficially

more than 5% of our common stock. Beneficial ownership is

determined in accordance with the rules of the SEC and includes

voting or investment power with respect to the securities. We deem

shares of common stock that may be acquired by an individual or

group within 60 days of September 15, 2018 pursuant to the exercise

of options or warrants or the vesting of restricted stock

units to be outstanding

for the purpose of computing the percentage ownership of such

individual or group, but those shares are not deemed to be

outstanding for the purpose of computing the percentage ownership

of any other person shown in the table. Except as indicated in

footnotes to this table, we believe that the stockholders named in

this table have sole voting and investment power with respect to

all shares of common stock shown to be beneficially owned by them

based on information provided to us by these stockholders.

Percentage of ownership is based on 8,884,411 shares of common

stock outstanding on September 15, 2018. Except as otherwise indicated, the address of each

of the persons in this table is c/o DropCar, Inc., 1412 Broadway,

Suite 2105, New York, New York 10018.

|

Name and Address

of Beneficial Owner

|

Number of Shares

of Common Stock Beneficially Owned

|

Percent of

Shares of Common Stock Beneficially Owned

|

|

Five percent or more beneficial owners:

|

|

|

|

Alpha Capital

Anstalt(1)

|

887,552

|

9.9%

|

|

Iroquois Master

Fund Ltd.(2)

|

887,552

|

9.9%

|

|

Directors and named executive officers:

|

|

|

|

Spencer

Richardson(3)

|

732,210

|

8.2%

|

|

David

Newman(4)

|

722,210

|

8.1%

|

|

Paul

Commons(5)

|

—

|

*

|

|

Sebastian

Giordano(6)

|

290,374

|

*

|

|

Brian

Harrington

|

—

|

*

|

|

Zvi

Joseph

|

—

|

*

|

|

Solomon

Mayer

|

—

|

*

|

|

Joshua

Silverman(7)

|

47,609

|

0.5%

|

|

Greg

Schiffman

|

—

|

*

|

|

David

Allen(8)

|

123,750

|

1.4%

|

|

Robert Roller(9)

|

89,984

|

1.0%

|

|

All current

directors and officers as a group (10 individuals)(10):

|

2,006,137

|

21.0%

|

*

Represents beneficial ownership of less than 1% of the outstanding

shares of our common stock.

1)

Based

on a Schedule 13G filed on May 24, 2018. The principal business

address of the beneficial owner is Lettstrasse 32, FL-9490 Vaduz,

Furstentums, Liechtenstein. Konrad Ackerman is the Director of

Alpha Capital Anstalt. The shares included in the table

report the number of shares that would be issuable upon exercise of

the warrants after giving effect to the 9.99% blocker included in

such warrants.

2)

Based on a Schedule 13G/A filed on February 14,

2018. The principal business address of the beneficial owner is 205

East 42nd Street, 20th Floor, New York, New York 10017. Iroquois

Master Fund (“IMF”) is a private investment fund.

Iroquois Capital Management LLC (“Iroquois Capital”) is

an investment adviser that provides investment advisory services to

IMF. Iroquois Capital Investment Group LLC (“ICIG”) is

a private investment fund. Richard Abbe is the President of

Iroquois Capital and managing member of ICIG. Kimberly Page is the

manager of American Capital and the Chief Operating Officer,

Compliance Officer of Iroquois Capital. Beneficial ownership

includes 315,586 shares of common stock and warrants to obtain

1,175,140 shares of common stock which are exercisable within 60

days of September 15, 2018. IMF, Iroquois Capital, Richard Abbe and

Kimberly Page share voting and dispositive power over all shares

and warrants. Richard Abbe additionally holds sole voting and

dispositive power over an additional 27,394 shares and warrants to

purchase 132,183 shares, which in each case are held indirectly by

Mr. Abbe through American Capital, an investment entity that was

dissolved as of December 31, 2017 and which distributed securities

held by it to its members. ICIG shares voting and dispositive power

over 27,394 shares and warrants to purchase 105,120 shares.

The shares included in the table

report the number of shares that would be issuable upon exercise of

the warrants after giving effect to the 9.99% blocker included in

such warrants.

3)

Consists of 732,210

shares of common stock held by Mr. Richardson. Does not include

restricted stock units which are not exercisable within 60 days of

September 15, 2018.

4)

Consists of 722,210

shares of common stock held by Mr. Newman. Does not include

restricted stock units which are not exercisable within 60 days of

September 15, 2018.

5)

Consists of options

to purchase 148,750 shares of common stock which are exercisable

within 60 days of September 15, 2018.

6)

Consists of options

to purchase 290,374 shares of common stock which are exercisable

within 60 days of September 15, 2018.

7)

Consists of 35,109

shares of common stock held by JNS Holdings Group LLC and warrants

to obtain 6,766 shares of common stock which are exercisable within

60 days of September 15, 2018. Mr. Silverman is the Principal of

JNS Holdings Group LLC and may be deemed to have voting and

investment power with respect to the shares owned by JNS Holdings

Group LLC.

8)

Consists of options

to purchase 148,750 shares of common stock which are exercisable

within 60 days of September 15, 2018.

9)

Consists of options

to purchase 89,984 shares of common stock, which are exercisable

within 60 days of September 15, 2018.

10)

Includes all

directors and officers named in the above table except David Allen,

the Company’s previous Chief Financial Officer, who is not a

current director or executive officer.

MANAGEMENT AND CORPORATE GOVERNANCE

The Board of Directors

On

September 26, 2018, our Board of Directors accepted the

recommendation of the Nominating Committee and voted to nominate

Spencer Richardson, David Newman, Sebastian Giordano, Brian

Harrington, Zvi Joseph, Solomon Mayer, Joshua Silverman and Greg

Schiffman for election at the annual meeting for a term of one year

to serve until the 2019 annual meeting of stockholders, and until

their respective successors have been elected and

qualified.

Set

forth below are the names of the persons nominated as directors,

their ages, their offices in the Company, if any, their principal

occupations or employment for at least the past five years, the

length of their tenure as directors and the names of other public

companies in which such persons hold or have held directorships

during the past five years. Additionally, information about the

specific experience, qualifications, attributes or skills that led

to our Board of Directors’ conclusion at the time of filing

of this proxy statement that each person listed below should serve

as a director is set forth below.

|

Name

|

|

|

Age

|

|

|

Position(s)

|

|

|

Employee Directors

|

|

|

|

|

|

|

|

|

Spencer Richardson

|

|

|

33

|

|

|

Chief Executive Officer; Director

|

|

|

David Newman

|

|

|

58

|

|

|

Chief Business Development Officer; Director

|

|

|

Non-Employee Directors

|

|

|

|

|

Joshua Silverman

|

|

|

48

|

|

|

Director; Chairman of the Board of Directors

|

|

|

Sebastian

Giordano

|

|

|

61

|

|

|

Director

|

|

|

Brian Harrington

|

|

|

51

|

|

|

Director

|

|

|

Zvi Joseph

|

|

|

52

|

|

|

Director

|

|

|

Solomon Mayer

|

|

|

65

|

|

|

Director

|

|

|

Greg Schiffman

|

|

|

60

|

|

|

Director

|

|

Our

Board of Directors has reviewed the materiality of any relationship

that each of our directors has with DropCar, Inc. either directly or indirectly.

Based upon this review, our Board of

Directors has determined that the following members of the

Board of Directors are

“independent directors” as defined by The Nasdaq Stock

Market: Brian Harrington, Zvi Joseph,

Solomon Mayer, Joshua Silverman and Greg

Schiffman.

On January 30, 2018, the Company completed its business combination

with DropCar, Inc. (“Private DropCar”) in accordance

with the terms of the Agreement and Plan of Merger and

Reorganization, dated as of September 6, 2017, as subsequently

amended, by and among the Company, DC Acquisition Corporation

(“Merger Sub”), and Private DropCar (as amended, the

“Merger Agreement”), pursuant to which Merger Sub

merged with and into Private DropCar, with Private DropCar

surviving as a wholly owned subsidiary of the Company (the

“Merger”). The information below includes information

regarding each director’s service on the boards of directors

of WPCS, Private DropCar and the Company.

Employee Directors

Spencer Richardson

Mr.

Richardson has served as our Chief Executive Officer and a member

of the Board of Directors since the closing of the Merger, and

prior to that time, served as a member of the board of directors of

Private DropCar since September 2014. Mr. Richardson served as

Co-Founder and Chief Executive Officer of Private DropCar since its

inception in September 2014 through the closing of the Merger. Mr.

Richardson also served as the Chairman of our Board of Directors

from January 2018 to May 2018. Prior to his service with DropCar,

from March 2009 through February 2016, Mr. Richardson served as

Co-Founder and Chief Executive Officer of FanBridge, Inc., a

platform that enables clients, such as musicians, comedians,

influencers, and anyone with a fan base, to manage fan acquisition,

retention, and engagement. In 2012, Forbes Magazine selected Mr.

Richardson as a “30 Under 30” innovator. Mr. Richardson

currently serves on the boards of directors of numerous private

companies. Mr. Richardson holds a B.S. in Finance and Marketing

from New York University Stern School of Business.

David Newman

Mr.

Newman has served as our Chief Business Development Officer and a

member of the Board of Directors since the closing of the Merger,

and prior to that time, served as a member of the board of

directors of Private DropCar since its inception in September 2014.

Mr. Newman served as Co-Founder, Secretary and Treasurer of Private

DropCar since its inception and as Chief Business Development

Officer since April 2017. Mr. Newman has served as President of

David B. Newman Consultants, Inc., a New York-based consulting

corporation, as President of Rockland Westchester Legal Services,

PC, a New York-based legal services company, and as a Senior

Managing Director of Brock Securities LLC, a broker-dealer that

provides investment banking and advisory services, in each instance

since August 2013. He previously served as a director of United

Realty Trust Inc., a public real estate investment trust, from

August 2012 through September 2015. Mr. Newman holds a B.B.A. in

Business Management from Hofstra University and a J.D. from Fordham

Law School.

Non-Employee Directors

Sebastian Giordano

Mr.

Giordano currently serves as a consultant to the Company and has

served as a member of the Board of Directors since the closing of

the Merger, and prior to that time, served as a director of WPCS

since February 2013. Mr. Giordano served as the Interim Chief

Executive Officer of WPCS from August 2013 until April 25, 2016,

when the interim label was removed from his title. He served as the

Chief Executive Officer of WPCS since such time through the closing

of the Merger. Since 2002, Mr. Giordano has been Chief Executive

Officer of Ascentaur, LLC, a business consulting firm providing

comprehensive strategic, financial and business development

services to start-up, turnaround and emerging growth companies.

From 1998 to 2002, Mr. Giordano was Chief Executive Officer of

Drive One, Inc., a safety training and education business. From

1992 to 1998, Mr. Giordano was Chief Financial Officer of Sterling

Vision, Inc., a retail optical chain. Mr. Giordano received B.B.A.

and M.B.A. degrees from Iona College.

Mr. Giordano’s qualifications to sit on

the Board of Directors include

his broad management experience, including having served as Chief

Executive Officer of WPCS.

Brian Harrington

Mr. Harrington has served as a member of

the Board of Directors since

the closing of the Merger. Mr. Harrington has served as the Chief

Product Officer for CBRE, Inc. since December 2017. He previously

served as Entrepreneur in Residence and Adjunct Faculty Member of

Boston College from January 2016 through May 2017. From August 2012

through September 2015, he served as Executive Vice President and

Chief Marketing Officer at ZipCar, Inc. From January 2012 through

December 2013, Mr. Harrington served as Principal at Little Harbor

Group, a boutique consulting firm specializing in consulting for

business services. Mr. Harrington holds a B.S. in Finance/Marketing

from Boston College and an MBA from the University of Notre

Dame.

Mr. Harrington’s qualifications to sit on

the Board of Directors include

his financial background, business and marketing experience and

education.

Greg Schiffman

Mr. Schiffman has served as a member of the

Board of Directors since the closing

of the Merger. Mr. Schiffman served as the Chief Financial Officer

of Vineti, Inc. from October 2017 through April 2018. He previously

served as the Chief Financial Officer of each of Iovance

Biotherapeutics (formerly Lion Biotechnologies), from October 2016

through June 2017, Stem Cells, Inc., from January 2014 through

September 2016, and Dendreon Corporation, from December 2006

through December 2013. He currently serves on the boards of

directors of several private companies. Mr. Schiffman holds a B.S.

in Accounting from DePaul University and an MM (MBA) from

Northwestern University Kellogg Graduate School of

Management.

Mr. Schiffman’s qualifications to sit on

the Board of Directors include

his financial background, business experience and

education.

Zvi Joseph

Mr. Joseph has served as a member of the

Board of Directors since the closing

of the Merger. He has served as Deputy General Counsel of Amdocs

Limited, a publicly traded corporation that provides software and

services to communications and media companies, since October 2005.

He received his A.A.S. in Business Administration from Rockland

Community College, his B.A. in Literature from New York University

and his J.D. from Fordham University School of Law. He also holds a

Certificate in Business Excellence from Columbia University School

of Business.

Mr. Joseph’s qualifications to sit on

the Board of Directors include

his legal experience and education.

Solomon Mayer

Mr. Mayer has served as a member of the

Board of Directors since the closing

of the Merger and, prior to that time, served as a member of the

Board of Directors of Private DropCar. He has served as President

and Chief Executive Officer of Mooney Aviation Company, a private

company that manufactures four-place, single-engine and

piston-powered aircraft, since 1999. Prior to that time, he held

the position of Chief Executive Officer of, and consultant to,

Overseas Trading, a department store wholesaler. Mr. Mayer

serves as a director of Laniado Hospital, a voluntary,

not-for-profit hospital in Kiryat Sanz, Netanya, Israel, as well as

a director of several private companies. He previously served as a

consultant to and director of each of Innovative Food Holdings, a

provider of sourcing, preparation and delivery of specialty/fresh

food for both professional chefs and consumers, and BlastGard

International Inc., which manufactures and markets proprietary

blast mitigation materials, in each case, from 2002 until

2016.

Mr. Mayer’s qualifications to sit on

the Board of Directors include

his and extensive management experience as an executive and

director of a variety of companies.

Joshua Silverman

Mr. Silverman has served as a member of the

Board of Directors since the closing

of the Merger, and prior to that time, served as a director of WPCS

since August 2016. Mr. Silverman currently serves as the Managing

Member of Parkfield Funding LLC. Mr. Silverman was the co-founder,

and a Principal and Managing Partner of Iroquois Capital

Management, LLC, an investment advisory firm. Since its inception

in 2003 until July 2016, Mr. Silverman served as Co-Chief

Investment Officer of Iroquois. While at Iroquois, he designed and

executed complex transactions, structuring and negotiating

investments in both public and private companies and has often been

called upon by the companies solve inefficiencies as they relate to

corporate structure, cash flow, and management. From 2000 to 2003,

Mr. Silverman served as Co-Chief Investment Officer of Vertical

Ventures, LLC, a merchant bank. Prior to forming Iroquois, Mr.

Silverman was a Director of Joele Frank, a boutique consulting firm

specializing in mergers and acquisitions. Previously, Mr. Silverman

served as Assistant Press Secretary to The President of the United

States. Mr. Silverman currently serves as a director of WPCS,

Protagenic Therapeutics, Neurotrope, Inc., and TapImmune Inc., all

of which are public companies. He previously served as a Director

of National Holdings Corporation from July 2014 through August

2016, MGT Capital Investments, Inc. from December 2014 to May 2016,

and Alanco Technologies Inc. from March 2016 through August 2016.

Mr. Silverman received his B.A. from Lehigh University in

1992.

Mr. Silverman’s qualifications to sit on

the Board of Directors include

his experience as an investment banker, management consultant and

as a director of numerous public companies.

Committees of the Board of Directors and Meetings

Meeting Attendance.

During the fiscal year ended December 31, 2017, which concluded

prior to the closing of the Merger on January 30, 2018,

WPCS’s Board of Directors held eight meetings,

and the various committees of the WPCS Board of Directors met

a total of five times. All directors attended at least 75% of the

total number of meetings of the WPCS Board of Directors and

of committees of the WPCS Board of Directors on

which he served during fiscal 2017. WPCS did not hold an annual

meeting in 2017.

Audit Committee.

WPCS’s Audit Committee met four times during fiscal 2017.

This committee currently has three members, Greg Schiffman

(Chairman), Solomon Mayer and Zvi Joseph. Our Audit

Committee’s role and responsibilities are set forth in the

Audit Committee’s written charter and include the authority

to retain and terminate the services of our independent registered

public accounting firm. In addition, the Audit Committee reviews

annual financial statements, considers matters relating to

accounting policy and reviews the scope of annual audits.

All members

of the Audit Committee satisfy the current independence standards

promulgated by the Securities and Exchange Commission and by The

Nasdaq Stock Market, as such standards apply specifically to

members of audit committees. The Board of Directors has determined

that Mr. Schiffman is an “audit committee financial

expert” as the Securities and Exchange Commission has defined

that term in Item 407 of Regulation S-K. Please also see the report

of the Audit Committee set forth elsewhere in this proxy

statement.

A copy of the Audit Committee charter is available

to view on the Company’s website at www.dropcar.com.

Compensation

Committee.

WPCS’s Executive Committee did not meet during

fiscal 2017. This

committee, which has subsequently been renamed the Compensation

Committee, currently has two members, Solomon Mayer (Chairman) and

Zvi Joseph. Our Compensation Committee’s role and

responsibilities are set forth in the Compensation

Committee’s written charter and includes reviewing, approving

and making recommendations regarding our compensation policies,

practices and procedures to ensure that legal and fiduciary

responsibilities of the Board of Directors are carried out and that

such policies, practices and procedures contribute to our success.

Our Compensation Committee also administers our WPCS International

Incorporated Amended and Restated 2014 Equity Incentive Plan. The

Compensation Committee is responsible for the determination of the

compensation of our chief executive officer, and shall conduct its

decision making process with respect to that issue without the

chief executive officer present. All members of the Compensation

Committee qualify as independent under the definition promulgated

by The Nasdaq Stock

Market.

A copy of the Compensation Committee Charter is

available to view on the Company’s website at

www.dropcar.com.

Nominating

Committee. WPCS’s

Nominating and Corporate Governance Committee (“Nominating

Committee”) met one time during fiscal 2017 and has two

members, Zvi Joseph (Chairman) and Solomon Mayer. Our Board of

Directors has determined that all members of the Nominating

Committee qualify as independent under the definition promulgated

by The Nasdaq Stock Market.

The

Nominating Committee’s responsibilities are set forth in the

Nominating Committee’s written charter and

include:

●

evaluating and

making recommendations to the full Board of Directors as to the

composition, organization and governance of the Board and its

committees,

●

evaluating and

making recommendations as to director candidates,

●

evaluating current

Board of Directors members’ performance

●

overseeing the

process for CEO and other executive officer succession planning,

and

●

developing and

recommending governance guidelines for the Company.

Generally, our

Nominating Committee considers candidates recommended by

stockholders as well as from other sources such as other directors

or officers, third party search firms or other appropriate sources.

Once identified, the Nominating Committee will evaluate a

candidate’s qualifications in accordance with our Nominating

and Governance Committee Policy Regarding Qualifications of

Directors appended to our Nominating Committee’s written

charter. Threshold criteria include: personal integrity and sound

judgment, business and professional skills and experience,

independence, knowledge of our industry, possible conflicts of

interest, the extent to which the candidate would fill a present

need on the Board, and concern for the long-term interests of our

stockholders. Our Nominating Committee has not adopted a formal

diversity policy in connection with the consideration of director

nominations or the selection of nominees. However, the Nominating

Committee will consider issues of diversity among its members in

identifying and considering nominees for director, and strive where

appropriate to achieve a diverse balance of backgrounds,

perspectives, experience, age, gender, ethnicity and country of

citizenship on the board and its committees.

If a

stockholder wishes to propose a candidate for consideration as a

nominee for election to the Board of Directors, it must follow the

procedures described in our Amended and Restated Bylaws, as

amended, and in “Stockholder Proposals and Nominations For

Director” at the end of this proxy statement. In general, persons recommended by

stockholders will be considered in accordance with our Policy on

Shareholder Recommendation of Candidates for Election as Directors

appended to our Nominating Committee’s written charter. Any

such recommendation should be made in writing to the Nominating

Committee, care of our Corporate Secretary at our principal office

and should be accompanied by the following information concerning

each recommending stockholder and the beneficial owner, if any, on whose behalf the nomination

is made:

●

all information

relating to such person that would be required to be disclosed in a

proxy statement;

●

certain

biographical and share ownership information about the stockholder

and any other proponent, including a description of any derivative

transactions in the Company’s securities;

●

a description of

certain arrangements and understandings between the proposing

stockholder and any beneficial owner and any other person in

connection with such stockholder nomination; and

●

a statement whether

or not either such stockholder or beneficial owner intends to

deliver a proxy statement and form of proxy to holders of voting

shares sufficient to carry the proposal.

The

recommendation must also be accompanied by the following

information concerning the proposed nominee:

●

certain

biographical information concerning the proposed

nominee;

●

all

information concerning the proposed nominee required to be

disclosed in solicitations of proxies for election of

directors;

●

certain information

about any other security holder of the Company who supports the

proposed nominee;

●

a description of

all relationships between the proposed nominee and the recommending

stockholder or any beneficial owner, including any agreements or

understandings regarding the nomination; and

●

additional

disclosures relating to stockholder nominees for directors,

including completed questionnaires and disclosures required by our

Bylaws.

A copy of the Nominating Committee charter is

available to view on the Company’s website at

www.dropcar.com.

Board Leadership Structure and Role in Risk Oversight

Our

Board of Directors has five independent members, including Brian

Harrington, Zvi Joseph, Solomon Mayer, Joshua Silverman and Greg

Schiffman, and three non-independent members, Spencer Richardson,

our Chief Executive Officer, David Newman, our Chief Business

Development Officer, and Sebastian Giordano, our former Chief

Executive Officer. We believe that the number of independent,

experienced directors that make up our Board of Directors benefits

our Company and our stockholders.

Our

current Board of Directors leadership structure separates the

positions of CEO and Chairman of the Board of Directors, although

we do not have a corporate policy requiring that structure. Until

May 2018, Spencer Richardson served as both our CEO and Chairman of

the Board of Directors. In May 2018, Mr. Silverman was appointed

Chairman of the Board of Directors. The Board of Directors believes

that this separation is appropriate for the organization at this

time because it allows for a division of responsibilities and a

sharing of ideas between individuals having different perspectives.

Our current CEO, who is also a member of our Board of Directors, is

primarily responsible for our operations and strategic direction,

while our Chairman is primarily focused on matters pertaining to

corporate governance and management oversight. While the Board of

Directors believes that this is the most appropriate structure at

this time, the Board of Directors retains the authority to change

the Board of Directors structure, including the possibility of

combining the CEO and Chairman of the Board of Directors positions,

if it deems such a change to be appropriate in the

future.

Our

management is principally responsible for defining the various

risks facing the Company, formulating risk management policies and

procedures, and managing our risk exposures on a day-to-day basis.

The Board of Directors’ principal responsibility in this area

is to ensure that sufficient resources, with appropriate technical

and managerial skills, are provided throughout the Company to

identify, assess and facilitate processes and practices to address

material risk and to monitor our risk management processes by

informing itself concerning our material risks and evaluating

whether management has reasonable controls in place to address the

material risks. The involvement of the Board of Directors in

reviewing our business strategy is an integral aspect of the Board

of Directors’ assessment of management’s tolerance for

risk and also its determination of what constitutes an appropriate

level of risk for the Company.

While

the full Board of Directors has overall responsibility for risk

oversight, the Board of Directors has elected to delegate oversight

responsibility related to certain committees, which, in turn,

report on the matters discussed at the committee level to the full

Board of Directors. For instance, our Audit Committee focuses on

the material risks facing the Company, including operational,

market, credit, liquidity and legal risks. Additionally, our

Executive Committee could be charged with reviewing and discussing

with management whether our compensation arrangements are

consistent with effective controls and sound risk management. Our

management reports to the Board of Directors and Audit Committee on

a regular basis regarding risk management.

Stockholder Communications to the Board

Generally,

stockholders who have questions or concerns should contact our

Investor Relations department at (646) 916-4595. However, any

stockholders who wish to address questions regarding our business

directly with the Board of Directors, or any individual director,

should direct his or her questions in writing to the Chairman of

the Board of Directors at

1412 Broadway, Suite 2105, New York,

New York 10018. Communications will be distributed to the

Board of Directors, or to any

individual director or directors as appropriate, depending on the

facts and circumstances outlined in the communications. Items that

are unrelated to the duties and responsibilities of the

Board of Directors may be

excluded, such as:

●

junk mail and mass

mailings;

●

resumes and other

forms of job inquiries;

●

solicitations or

advertisements.

In

addition, any material that is unduly hostile, threatening, or

illegal in nature may be excluded, provided that any communication

that is filtered out will be made available to any outside director

upon request.

Executive Officers

The

following table sets forth certain information regarding our

executive officers who are not also directors. We have employment

agreements with Mr. Commons. All other executive officers are

at-will employees.

|

Name

|

|

|

Age

|

|

|

Position(s)

|

|

|

Executive Officers

|

|

|

|

|

Paul Commons

|

|

|

64

|

|

|

Chief Financial Officer

|

|

|

Leandro Larroulet

|

|

|

36

|

|

|

Chief Information Officer

|

|

Executive Officers

Paul Commons

Mr. Commons joined DropCar in January 2018 as its Chief Financial

Officer. Prior to joining DropCar, Mr. Commons served as the Chief

Financial Officer of Zipz Inc., a packaging tech company, from May

2015 through November 2017. Prior to that, from October 2007

through May 2015, Mr. Commons served in a variety of roles at WPC

Worldwide, which provided CFO consulting services to tech

companies. Mr. Commons holds a B.I.A. from Kettering University and

an MBA in Finance from the University of Denver.

Leandro Larroulet

Mr.

Larroulet joined DropCar in July 2017 as its Chief Information

Officer (CIO). Prior to joining DropCar, Mr. Larroulet served as

Chief Operating Officer (COO) for the Argentina based global

technology development and consulting firm FDV Solutions from

September 2016 to June 2017. Previously Mr. Larroulet held roles at

FDV including Senior Project Manager, Software Developer and

Network Operator, dating back to September 2007. Mr. Larroulet

graduated from FIUBA (Engineering University of Buenos Aires), and

also currently serves as both a member of their curricular

commission for Information Systems as well as an auxiliary teacher

for their Information Analysis program.

EXECUTIVE OFFICER AND DIRECTOR COMPENSATION

Summary Compensation Table

The

following table shows the total compensation paid or accrued during

the last two fiscal years ended December 31, 2017 and December 31,

2016 to (1) our former Chief Executive Officer, (2) our former

Chief Financial Officer, (3)

our next most highly compensated executive officer who earned more

than $100,000 during the fiscal year ended December 31, 2017.

Because SEC

rules require us to disclose this information as of the end of our

last fiscal year, and because the closing of the Merger occurred in

January 2018, this executive compensation section relates to

persons who were executive officers of WPCS International

Incorporated prior to its merger with Private DropCar. We note that

Mr. Giordano and Mr. Allen resigned from their positions as

executive officers on or prior to the closing of the

Merger.

|

Name and Principal

Position

|

|

|

|

|

|

Non-Equity Incentive Plan

Compensation

($)

|

Change in Pension Value and

Nonqualified Deferred Compensation Earnings

($)

|

All Other Compensation

($)

|

|

|

(a)

|

(b)

|

|

|

|

|

|

|

|

|

|

Sebastian Giordano,

previous Chief Executive Officer(3)

|

2017

|

180,000

|

0

|

0

|

104,000

|

0

|

0

|

0

|

284,000

|

|

|

2016

|

180,000

|

77,000

|

0

|

145,500

|

0

|

0

|

0

|

402,500

|

|

David Allen, previous

Chief Financial Officer(4)

|

2017

|

140,000

|

0

|

0

|

78,000

|

0

|

0

|

0

|

218,000

|

|

2016

|

140,000

|

20,000

|

0

|

72,750

|

0

|

0

|

0

|

232,750

|

|

Robert Roller, President of Suisun

Operations(5)

|

2017

|

170,000

|

100,000

|

0

|

78,000

|

0

|

0

|

0

|

348,000

|

|

|

2016

|

170,000

|

100,000

|

0

|

72,750

|

0

|

0

|

0

|

342,500

|

1)

These amounts represent the aggregate grant

date fair value for stock awards for calendar years 2017 and 2016,

respectively, computed in accordance with FASB ASC Topic 718.

A

discussion of the assumptions used in

determining grant date fair value may be found in Note 2 to our

Financial Statements, included in our Current Report on Form 8-K/A,

as filed with the Securities and Exchange Commission on April 2,

2018.

2)

These amounts represent the aggregate grant

date fair value for option awards for calendar years 2017 and 2016,

respectively, computed in accordance with FASB ASC Topic

718. A discussion

of the assumptions used in determining

grant date fair value may be found in Note 2 to our Financial

Statements, included in our Current Report on Form 8-K/A, as filed

with the Securities and Exchange Commission on April 2,

2018.

3)

Mr. Giordano

resigned as Chief Executive Officer on January 30,

2018.

4)

Mr. Allen resigned

as Chief Financial Officer on January 30, 2018.

5)

Mr. Roller is

currently employed as President of our Suisun

Operations.

Narrative Disclosure to Summary Compensation Table

Employment Agreements

The

compensation arrangement of Sebastian Giordano, our former Chief

Executive Officer, was set forth in a letter agreement, dated July

29, 2013, as amended on February 3, 2015. Pursuant to that

agreement, Mr. Giordano was entitled to a base salary of $180,000

per year (effective as of January 1, 2015).

On January 30, 2018,

Sebastian Giordano, our former Chief Executive Officer, and David

Allen, our former Chief Financial Officer, resigned as officers of

the Company. In connection with their respective resignations, each

of Mr. Giordano and Mr. Allen entered into a separation agreement,

effective as of January 30, 2018 (the “Giordano

Agreement” and the “Allen Agreement,”

respectively, and collectively, the “Separation

Agreements”), with the Company. Each of the Giordano

Agreement and Allen Agreement includes a customary release by Mr.

Giordano and Mr. Allen, respectively, of certain claims against the

Company that are held by Mr. Giordano and Mr. Allen,

respectively. Pursuant to the

Giordano Agreement, Mr. Giordano ceased serving as an employee of

the Company effective as of January 30, 2018 (the “Separation

Date”). Pursuant to the Giordano Agreement, Mr. Giordano

received a severance payment equal to $350,000. Pursuant to the

Allen Agreement, Mr. Allen ceased serving as an employee of

the Company effective as of the Separation Date. Pursuant to the

Allen Agreement, Mr. Allen received a severance payment equal

to $150,000.

On

July 11, 2018, we entered into a consulting agreement (the

“Consulting Agreement”) with Ascentaur, LLC

(“Ascentaur”). Sebastian Giordano is the Chief

Executive Officer of Ascentaur, LLC. Pursuant to the terms of the