Exhibit 99.1

AYRO

MD&A AND BUSINESS

AYRO

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

You should read the following discussion and analysis of

AYRO’s financial condition and operating results together

with AYRO’s financial statements and related notes included

elsewhere in the exhibits to this Current Report on Form 8-K (the

"Form 8-K"). This discussion and analysis and other parts of this

section contain forward-looking statements based upon current

beliefs, plans and expectations that involve risks, uncertainties

and assumptions. See “ Forward-Looking

Statements” under Item 8.01 of this Form 8-K.

AYRO’s actual results may differ materially from those

anticipated in these forward-looking statements as a result of

various factors, including those set forth under “Risk

Factors” or in other parts of this

Form

8-K .

Overview

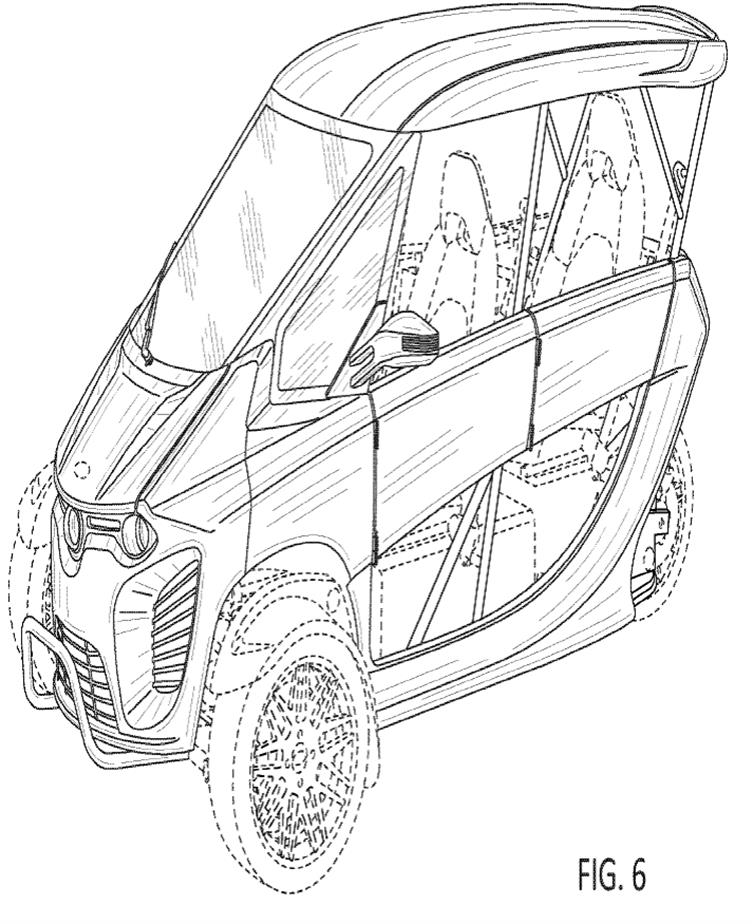

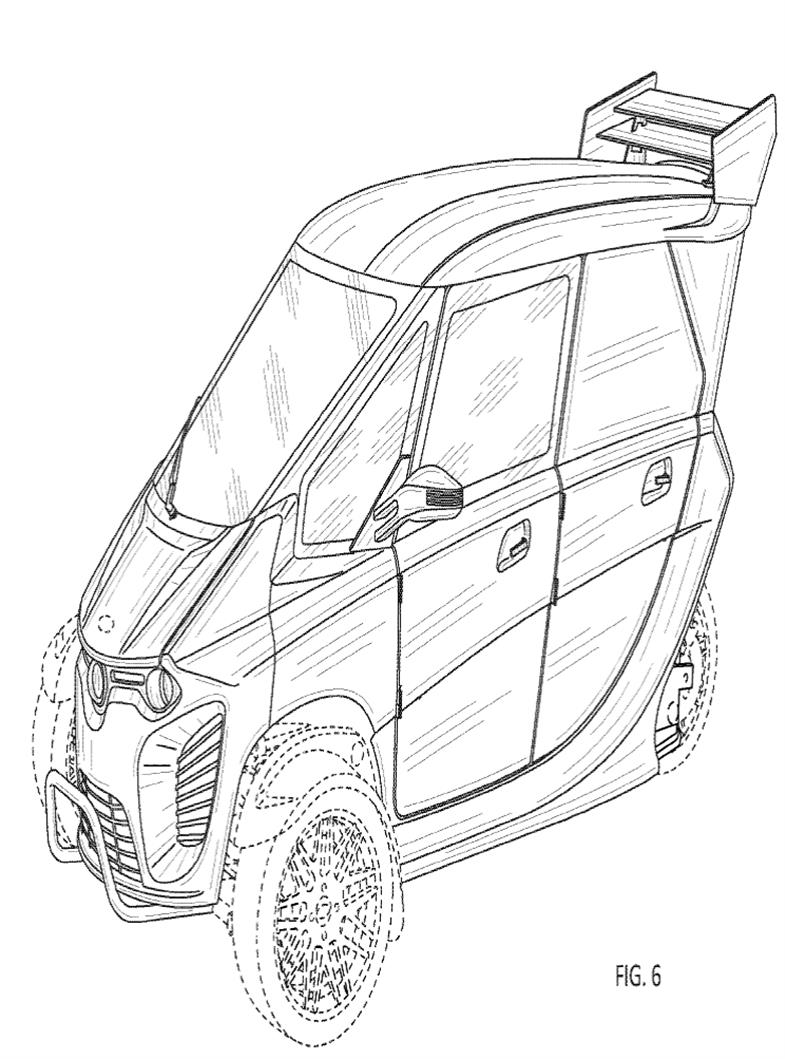

AYRO

designs, manufactures and markets three- and four-wheeled

purpose-built electric vehicles primarily to commercial customers.

These vehicles allow the end user an environmentally friendly

alternative to internal combustion engines for light duty uses,

including logistics, maintenance and cargo services, at a lower

total cost of ownership. AYRO’s four-wheeled vehicles are

classified as low-speed vehicles (LSVs) based on federal and state

regulations and are ideal for both college and corporate campuses.

AYRO’s three-wheeled vehicle is classified as a motorcycle

for federal purposes and an autocycle in states that have passed

certain autocycle laws, allowing the user to operate the vehicle

with a standard automobile driver’s license. AYRO’s

three-wheeled vehicle is not an LSV and is ideal for urban

transport. The majority of AYRO’s sales are comprised of

sales of its four-wheeled vehicle to Club Car through a strategic

arrangement entered in early 2019. AYRO plans to continue growing

its business through its experienced management team by leveraging

its supply chain, allowing it to scale production without a large

capital investment.

AYRO

has also developed a strategic partnership with Autonomic, a

division of Ford. Pursuant to AYRO’s agreement with

Autonomic, AYRO received a license to use Autonomic’s

transportation mobility cloud and has agreed to jointly develop the

monetization of cloud-based vehicle applications.

Manufacturing

Agreement with Cenntro

In

April 2017, AYRO entered into a Manufacturing Licensing Agreement

with Cenntro Automotive Group, Ltd., or Cenntro, one of

AYRO’s equityholders, that provides for its four-wheel

sub-assemblies to be licensed and sold to AYRO for final

manufacturing and sale in the United States.

Master

Procurement Agreement with Club Car

In

March 2019, AYRO entered into a five-year Master Procurement

Agreement, or the MPA, with Club Car, a division of Ingersoll Rand

Inc., for the sale of AYRO’s four-wheeled vehicle. The MPA

grants Club Car the exclusive right to sell AYRO’s

four-wheeled vehicle in North America, provided that Club Car

orders at least 500 vehicles per year. Under the terms of the MPA,

AYRO receives orders from Club Car dealers for vehicles of specific

configurations, and AYRO invoices Club Car once the vehicle has

shipped. The MPA has an initial term of five (5) years commencing

January 1, 2019 and may be renewed by Club Car for successive

one-year periods upon 60 days’ prior written notice. Pursuant

to the MPA, AYRO granted Club Car a right of first refusal for

sales of 51% or more of AYRO’s assets or equity interests,

which right of first refusal is exercisable for a period of 45 days

following AYRO’s delivery of an acquisition notice to Club

Car. AYRO also agreed to collaborate with Club Car on new products

similar to its four-wheeled vehicle and improvements to existing

products and granted Club Car a right of first refusal to purchase

similar commercial utility vehicles AYRO develops during the term

of the MPA. AYRO is currently engaged in discussions with Club Car

to develop additional products to be sold by Club Car in Europe and

Asia but there can be no assurance that these discussions will be

successful.

Recent

Developments

During

the calendar year 2019, AYRO continued to develop its products,

establishing channel relationships and filling out the management

team. To support AYRO’s growth, AYRO raised operating funds

with the following debt and equity initiatives:

●

In the first

quarter of 2019, AYRO sold convertible promissory notes to seven

individual lenders for an aggregate of $800,000. The notes have a

maturity date of 60 days, subject to AYRO’s right to extend

the notes for one period of 60 days in AYRO’s discretion. The

notes accrued interest at the rate of 12% per annum for the first

60 days and at 15% for the 60-day extension. The lenders had the

option to convert the notes and accrued interest into Series Seed 2

Preferred Stock at $1.75 per share before the 60-day extension

period expired. In May 2019, four lenders converted $350,000 of

principal and $9,062 of accrued interest into 205,178 of

AYRO’s Series Seed 2 Preferred Stock. In September 2019, one

lender converted $100,000 of convertible notes to a twelve-month

term loan. Additionally, two lenders redeemed an aggregate of

$60,000 in principal from their outstanding note. In December 2019,

the remaining $290,000 in principal and associated accrued interest

was converted to preferred stock as identified below. Warrants to

purchase up to 97,500 of AYRO’s common stock at a price of

$2.00 per share were issued in connection with the notes. A

discount on debt related to the common stock issuance of $69,174

was recorded and is being amortized over the life of the

notes.

●

In the third

quarter of 2019, AYRO received cash in exchange for term loans from

six individual lenders, totaling $350,000. The notes have a term of

12 months and bear interest at the rate of 12% per annum, which is

payable quarterly. AYRO issued 1.056 shares of its common stock to

the lenders for each dollar borrowed, for an aggregate of 369,600

shares of common stock. A discount on debt related to the common

stock issuance of $185,675 was recorded and is being amortized over

the life of the notes.

●

During the first

half of 2019, AYRO issued 1,092,215 shares of Series Seed 2

Preferred Stock for $1.75 per share, for aggregate cash proceeds of

$1,911,375. During the second quarter of 2019, AYRO sold 238,500

shares of Series Seed 3 Preferred Stock for $2.00 per share for

aggregate cash proceeds of $477,000. During the third quarter of

2019, AYRO issued 65,000 shares of Series Seed 3 Preferred Stock

for $2.00 per share for aggregate cash proceeds of

$130,000.

●

In October 2019,

AYRO received $500,000 under a 120-day bridge term loan bearing

interest at the rate of 14% per annum, payable quarterly, from Mark

Adams, a founding board member. As an inducement for the bridge

loan, AYRO granted Mr. Adams 528,000 shares of common stock. On

December 13, 2019, Mr. Adams agreed to extend the maturity date for

this loan until April 30, 2021 in exchange for AYRO’s

issuance of 500,000 shares of common stock.

●

In October 2019,

Sustainability Initiatives, LLC (“SI”), a company owned

by Christian Okonsky and Mark Adams, AYRO’s founders and

board members, agreed to terminate the revenue royalty-based

contract with AYRO in exchange for 850,000 shares of common

stock.

●

In November 2019,

AYRO received cash in exchange for a term loan from an individual

lender of $75,000. The note has a term of 12 months and bears

interest at the rate of 12% per annum, payable quarterly. AYRO

issued 1.056 shares of its common stock to the lenders for each

dollar borrowed, for an aggregate of 79,200 shares of common

stock.

●

In December 2019,

AYRO, SI, Christian Okonsky and Mark Adams agreed to cancel options

to purchase an aggregate of 1,750,000 shares of common stock in

exchange for AYRO’s issuance of 1,593,550 shares of common

stock.

●

In December 2019,

AYRO issued Sustainability Consultants, LLC (“SCLLC”),

an entity that is controlled by Mark Adams, Will Steakley and John

Constantine, who are principal stockholders of AYRO, 247,500 shares

of common stock for services rendered under AYRO’s consulting

agreement with SCLLC.

●

In December 2019,

Cenntro agreed to convert $1,100,000 of the accounts payable due to

Cenntro into 1,100,000 shares of AYRO’s Series Seed 3

Preferred Stock.

●

In December 2019, a

local marketing firm agreed to convert 90% of the amount AYRO owed

that company to a term loan with a principal amount of $137,729.03

and bearing interest at the rate of 15% per annum, payable

quarterly, with a maturity date of May 31, 2021. AYRO also issued

the marketing firm 66,000 shares of common stock in conjunction

with this term loan.

●

In December 2019,

notes payable to eight individual lenders in the total amount of

$715,000 plus accrued interest were converted into 777,301 shares

of AYRO’s Series Seed 3 Preferred Stock.

Merger

Agreement with DropCar and Related Transactions

On

December 19, 2019, AYRO entered into an Agreement and Plan of

Merger and Reorganization (the “Merger Agreement”) with

DropCar, Inc. (“DropCar”), pursuant to which, among

other matters, and subject to the satisfaction or waiver of the

conditions set forth in the Merger Agreement, a wholly owned

subsidiary of DropCar will merge with and into AYRO, with AYRO

continuing as a wholly owned subsidiary of DropCar and the

surviving corporation of the merger (the “Merger”). The

Merger is intended to qualify for federal income tax purposes as a

tax-free reorganization under the provisions of Section 368(a) of

the Internal Revenue Code of 1986, as amended. Subject to the terms

and conditions of the Merger Agreement, at the closing of the

Merger, (a) each outstanding share of AYRO common stock and

preferred stock will be converted into the right to receive shares

of DropCar common stock at the Exchange Ratio described below; and

(b) each of AYRO’s outstanding stock options and warrants

that have not previously been exercised prior to the closing of the

Merger will be assumed by DropCar.

Under the

exchange ratio formula in the Merger Agreement (the “Exchange

Ratio”), upon the closing of the Merger, on a pro forma basis

and based upon the number of shares of DropCar common stock to be

issued in the Merger, current DropCar stockholders (along with

DropCar’s financial advisor) will own approximately 20% of

the combined company and current AYRO investors will own

approximately 80% of the combined company (including the additional

financing transaction referenced below). For purposes of

calculating the Exchange Ratio, the number of outstanding shares of

DropCar common stock immediately prior to the Merger does not take

into account the dilutive effect of shares of DropCar common stock

underlying options, warrants or certain classes of preferred stock

outstanding as of the date of the Merger Agreement.

Simultaneous with

the signing of the Merger Agreement, accredited investors,

including certain investors in DropCar, purchased $1.0 million of

AYRO’s convertible bridge notes bearing interest at the rate

of 5% per annum (the “Bridge Notes”). The Bridge Notes

automatically convert into shares of AYRO common stock immediately

prior to the consummation of the Merger representing an aggregate

of 7.45% of the outstanding common stock of the combined company

after giving effect to the Merger. In addition, immediately prior

to the execution and delivery of the Merger Agreement, AYRO entered

into agreements with accredited investors, including certain

stockholders of DropCar, pursuant to which such investors agreed to

purchase, prior to the consummation of the Merger, shares of AYRO

common stock (or common stock equivalents) representing an

aggregate of 16.55% of the outstanding common stock of the combined

company after giving effect to the Merger and warrants to purchase

an equivalent number of shares of AYRO common stock for an

aggregate purchase price of $2.0 million (the “AYRO Private

Placement”). As additional consideration to the lead investor

in the AYRO Private Placement, AYRO also entered into a stock

subscription agreement with the lead investor, pursuant to which,

immediately prior to the Merger, AYRO will issue up to an aggregate

of 1,750,000 shares of AYRO common stock for the nominal per share

purchase price of $0.001 per share, or, if applicable, pre-funded

warrants to purchase AYRO common stock, in lieu of AYRO common

stock (the “Nominal Stock Subscription”). The

consummation of the transactions contemplated by the Nominal Stock

Subscription is conditioned upon the satisfaction or waiver of the

conditions set forth in the Merger Agreement.

On

December 19, 2019, AYRO entered into a letter agreement with ALS

Investment, LLC (“ALS”), which provides that if the

merger is consummated by June 19, 2020, upon consummation of the

merger, AYRO shall issue ALS shares of common stock of the combined

company, which shall be equal to 4.5% of the outstanding shares of

common stock of the combined company giving effect to the merger.

In addition to introducing AYRO and DropCar, ALS will provide, as

an independent contractor, consulting services to AYRO relating to

financial, capital market and investor relations for twelve months

following the closing of the merger.

Factors

Affecting Results of Operations

Master Procurement Agreement.

In March 2019, AYRO entered into the MPA with Club Car. In

partnership with Club Car and its interaction with its substantial

dealer network, AYRO has redirected its business development

resources towards supporting Club Car’s enterprise and fleet

sales function as Club Car proceeds in its new product introduction

initiatives.

Devirra Transaction. In the

first half of 2018, AYRO engaged in a one-time sale of automotive

parts from AYRO’s China-based supplier to one of its

customers in New Jersey (the “Devirra Transaction”).

Pursuant to the Devirra Transaction, AYRO purchased the products

which were then drop-shipped directly from the supplier to the end

customer. Total revenue for the Devirra Transaction was $4,065,000.

The cost of goods sold related to the Devirra Transaction was

$4,003,068. The total gross margin for the one-time Devirra

Transaction for the six months ended June 30, 2018 was 1.45%. This

one-time transaction should be taken into account when making

comparisons between 2018 and 2019.

Components

of Results of Operations

Revenue

AYRO

derives revenue from the sale of its three- and four-wheeled

electric vehicles, rental revenue from vehicle revenue sharing

agreements with AYRO’s tourist destination fleet operators,

or DFOs, and, to a lesser extent, shipping, parts and service fees.

Provided that all other revenue recognition criteria have been met,

AYRO typically recognizes revenue upon shipment, as title and risk

of loss are transferred to customers and channel partners at that

time. Products are typically shipped to dealers or directly to end

customers, or in some cases to AYRO’s international

distributors. These international distributors assist with import

regulations, currency conversions and local language. AYRO’s

vehicle product sales revenues vary from period to period based on,

among other things, the customer orders received and AYRO’s

ability to produce and deliver the ordered products. Customers

often specify requested delivery dates that coincide with their

need for AYRO’s vehicles.

Because

these customers may use AYRO’s products in connection with a

variety of projects of different sizes and durations, a

customer’s orders for one reporting period generally do not

indicate a trend for future orders by that customer. Additionally,

order patterns do not necessarily correlate amongst customers. AYRO

has observed limited seasonality trends in the sales of its

vehicles, depending on model.

Cost of Revenue

Cost of

revenue primarily consists of costs of materials and personnel

costs associated with manufacturing operations, and an accrual for

post-sale warranty claims. Personnel costs consist of wages and

associated taxes and benefits. Cost of revenue also includes

freight and changes to AYRO’s warranty reserves. Allocated

overhead costs consist of certain facilities and utility costs.

AYRO expects cost of revenue to increase in absolute dollars, as

product revenue increases.

Operating Expenses

AYRO’s

operating expenses consist of general and administrative, sales and

marketing and research and development expenses. Salaries and

personnel-related costs, benefits, and stock-based compensation

expense, are the most significant components of each category of

operating expenses. Operating expenses also include allocated

overhead costs for facilities and utility costs.

General and Administrative Expense

General

and administrative expense consists primarily of employee

compensation and related expenses for administrative functions

including finance, legal, human resources and fees for third-party

professional services, and allocated overhead. AYRO expects its

general and administrative expense to increase in absolute dollars

as it continues to invest in growing the business.

Sales and Marketing Expense

Sales

and marketing expense consists primarily of employee compensation

and related expenses, sales commissions, marketing programs, travel

and entertainment expenses and allocated overhead. Marketing

programs consist of advertising, tradeshows, events, corporate

communications and brand-building activities. AYRO expects sales

and marketing expenses to increase in absolute dollars as AYRO

expands its sales force, expands its product lines, increases

marketing resources, and further develops sales

channels.

Research and Development Expense

Research and

development expense consists primarily of employee compensation and

related expenses, prototype expenses, depreciation associated with

assets acquired for research and development, amortization of

product development costs, product strategic advisory fees,

third-party engineering and contractor support costs, and allocated

overhead. AYRO expects its research and development expenses to

increase in absolute dollars as it continues to invest in new and

existing products.

Other Income (Expense), Net

Other

income (expense) consists of income received or expenses incurred

for activities outside of AYRO’s core business. Other expense

consists primarily of interest expense.

Provision for Income Taxes

Provision for

income taxes consists of estimated income taxes due to the United

States government and to the state tax authorities in jurisdictions

in which AYRO conducts business.

Results of Operations

Comparison of the Nine-Month Periods Ended September 30, 2019 and

2018

Results

of operations for the nine-month period ended September 30, 2018

includes operating results for a single transaction for

AYRO’s supply chain. For this single, non-repeatable

transaction, AYRO recognized $4,065,000 of revenue in the first

half of 2018 at a gross margin of approximately 1.45%. The

following tables set forth AYRO’s results of operations for

the nine-month periods ended September 30, 2019 and 2018,

respectively.

|

|

For the nine months ended

|

|

|

|

|

|

|

|

|

Revenue

|

$745,530

|

$5,239,429

|

|

Cost

of Goods Sold

|

577,539

|

4,965,204

|

|

Gross

Profit

|

167,991

|

274,225

|

|

Operating

Expenses:

|

|

|

|

Research

and Development

|

780,605

|

565,372

|

|

Sales

and Marketing

|

932,902

|

684,239

|

|

General

and Administrative

|

3,437,176

|

1,809,754

|

|

Total

Operating Expenses

|

5,150,683

|

3,059,365

|

|

Loss

from Operations

|

(4,982,692)

|

(2,785,140)

|

|

Other

Income and Expense:

|

|

|

|

Other

Income

|

1,198

|

18

|

|

Interest

Expense

|

(233,084)

|

(38,448)

|

|

Net Loss

|

$(5,214,578)

|

$(2,823,570)

|

|

|

|

|

|

Weighted-average

common shares outstanding

|

$10,263,192

|

$10,241,866

|

|

|

|

|

|

Net

Loss per common share

|

$(0.51)

|

$(0.28)

|

Non-GAAP Financial Measure

AYRO

presents Adjusted EBITDA because AYRO considers it to be an

important supplemental measure of AYRO’s operating

performance and AYRO believes it may be used by certain investors

as a measure of AYRO’s operating performance. Adjusted EBITDA

is defined as income (loss) from operations before interest income

and expense, income taxes, depreciation, amortization of intangible

assets, impairment of long-lived assets, acquisition and financing

costs, stock-based compensation expense and certain non-recurring

expenses.

Adjusted EBITDA is

not a measurement of financial performance under generally accepted

accounting principles in the United States, or GAAP. Because of

varying available valuation methodologies, subjective assumptions

and the variety of equity instruments that can impact AYRO’s

non-cash operating expenses, AYRO believes that providing a

non-GAAP financial measure that excludes non-cash and non-recurring

expenses allows for meaningful comparisons between AYRO’s

core business operating results and those of other companies, as

well as providing AYRO with an important tool for financial and

operational decision making and for evaluating AYRO’s own

core business operating results over different periods of

time.

AYRO’s

Adjusted EBITDA measure may not provide information that is

directly comparable to that provided by other companies in

AYRO’s industry, as other companies in AYRO’s industry

may calculate non-GAAP financial results differently, particularly

related to non-recurring, unusual items. AYRO’s Adjusted

EBITDA is not a measurement of financial performance under GAAP and

should not be considered as an alternative to operating income or

as an indication of operating performance or any other measure of

performance derived in accordance with GAAP. AYRO does not consider

Adjusted EBITDA to be a substitute for, or superior to, the

information provided by GAAP financial results.

Below

is a reconciliation of Adjusted EBITDA to net loss for the nine

months ended September 30, 2019 and 2018.

|

|

For the nine months ended

|

|

|

|

|

|

|

|

|

Net

Loss

|

$(5.214.578)

|

$(2,823,570)

|

|

Depreciation

and Amortization

|

388,686

|

148,390

|

|

Stock-based

compensation expense

|

1,360,623

|

306,320

|

|

Interest

expense

|

233,084

|

38,448

|

|

Settlement

expenses (1)

|

0

|

151,488

|

|

Acquisition

and financing costs

|

0

|

0

|

|

Provision

(benefit) for income taxes

|

3,147

|

0

|

|

Adjusted EBITDA

|

$(3,229,038)

|

$(2,178,924)

|

______________________

(1)

Settlement expenses represent one-time amounts paid in connection

with the departure of AYRO’s former chief executive

officer.

Net revenue

For the

nine-month period ended September 30, 2019, total revenue decreased

$4,493,899, as compared to the same period in 2018. The decrease in

revenue was primarily driven by a one-time sale of automotive parts

from AYRO’s China-based supplier to one of its customers in

New Jersey during 2018, or the Devirra Transaction. The products

purchased by the customer were drop-shipped directly from

AYRO’s supplier to the end customer. Total revenue for the

Devirra Transaction was $4,065,000. AYRO’s revenues in the

first nine months of 2019 were also impacted by the MPA that it

entered with Club Car on March 13, 2019. The MPA provides Club Car

with exclusive distribution rights in North America of AYRO’s

four-wheeled AYRO 411 vehicle. During AYRO’s negotiations

with Club Car throughout the fourth quarter of 2018 and up to March

13, 2019, AYRO gave Club Car and its dealers an unrestricted dealer

channel, which precluded AYRO from signing new AYRO 411 dealers in

the fourth quarter of 2018 and the first quarter of 2019. As a

result, AYRO experienced a decline in AYRO 411 sales during the

first nine months of 2019. Sales during the nine months ended

September 30, 2019 included sales of the AYRO 311 vehicle, which

was deployed in February 2019.

Cost of goods sold and gross margin

Cost of

goods sold decreased by $4,387,665 for the nine months ended

September 30, 2019, as compared to the same period in 2018. The

decrease in cost of goods sold related to the Devirra Transaction

was $4,003,068.

Gross

margin percentage was 23% for the nine months ended September 30,

2019, as compared to 5% for the nine months ended September 30,

2018. The increase in gross margin percentage was primarily driven

by the Devirra Transaction during 2018, which had a gross margin

percentage of 1.5%. Gross margin percentage for product revenue not

including the Devirra Transaction increased from 18% during the

nine-month period ended September 30, 2018 to 23% during the

nine-month period ended September 30, 2019, an increase of 5%. The

increase in gross margin excluding the Devirra Transaction was

predominately attributable to increases in product pricing as well

as efficiency gains in the manufacturing process.

Below

is a reconciliation of gross margin percentage excluding the

Devirra Transaction to gross margin percentage for the nine months

ended September 30, 2018:

|

|

Nine months ended

September 30, 2018

|

|

Revenue

|

$5,239,429

|

|

Less: Devirra

Transaction Revenue

|

4,065,000

|

|

Adjusted

Revenue

|

$1,174,429

|

|

|

|

|

Cost of Goods

Sold

|

$4,965,204

|

|

Less: Costs of Good

Sold related to Devirra Transaction

|

4,003,068

|

|

Adjusted Cost of

Goods Sold

|

$962,136

|

|

|

|

|

Gross Margin

Percentage

|

5%

|

|

Gross Margin

Percentage excluding the Devirra Transaction

|

18%

|

General and administrative expenses

General

and administrative expense increased $1,627,422, or 89.9%, for the

nine months ended September 30, 2019, as compared to same period in

2018. General and administrative expense increased primarily due to

increased headcount resulting in higher employee compensation

related costs and administrative costs, including hiring a chief

financial officer on March 13, 2018 and a manufacturing director on

May 21, 2018. Additionally, AYRO relocated to larger office

facilities in April 2018 and expanded its facilities in July 2019,

both of which resulted in higher rent and utilities expense during

the nine months ended September 30, 2019 versus the same period in

2018. AYRO also expanded its product liability and other insurance

policies in August 2018.

Sales and marketing expense

Sales

and marketing expense increased by $248,663, or 36.3%, for the nine

months ended September 30, 2019, as compared to the same period in

2018. These expenses are mainly comprised of salary and related

costs and consulting services fees. The majority of the increase in

sales and marketing expense was to support and develop industry

standard product management, product marketing and go-to-market

marketing communication strategies, primarily surrounding the new

AYRO 311 vehicle.

Research and development expense

Research and

development expense increased by $215,233, or 38.1%, for the nine

months ended September 30, 2019, as compared to same period in

2018. These expenses were mainly compromised of salary and related

costs, professional services, royalty-based services provided under

the Chief Visionary Officer, or CVO, agreement and prototypes

attributable to continued development of new and enhanced product

offerings. The CVO revenue-based royalty fee decreased by $115,494

during the nine months ended September 30, 2019, as compared to

same period in 2018, which was offset by a year-over-year increase

in headcount-related expenses of $106,374 and $256,037 of

consulting expenses supporting new product

development.

Interest expense

Interest expense

increased $194,636 for the nine months ended September 30, 2019, as

compared to same period in 2018, as a result of issuances of

convertible debt to seven individual angel investors in January and

February 2019, plus finance charges accrued for certain accounts

payable. Interest expense in 2019 also includes noncash

amortization of warrant discounts issued in conjunction with debt

offerings.

Comparison of the Years Ended December 31, 2018 and

2017

The

following tables set forth AYRO’s results of operations for

the years ended December 31, 2018 and 2017, respectively, in both

dollars and a percentage of revenue.

|

|

For the year ended

December 31,

|

|

|

|

|

|

Revenue

|

$5,302,964

|

$39,415

|

|

Cost

of Goods Sold

|

5,008,700

|

38,448

|

|

Gross

Profit

|

294,264

|

967

|

|

Operating

Expenses:

|

|

|

|

Research

and Development

|

768,382

|

171,376

|

|

Sales

and Marketing

|

999,724

|

163,944

|

|

General

and Administrative

|

2,578,078

|

742,002

|

|

Total

Operating Expenses

|

4,346,184

|

1,077,322

|

|

Loss

from Operations

|

(4,051,920)

|

(1,076,355)

|

|

Other

Income and Expense:

|

|

|

|

Other

Income

|

47

|

7,600

|

|

Interest

Expense

|

(144,618)

|

(12,331)

|

|

Net Loss

|

$(4,196,491)

|

$(1,081,086)

|

|

|

|

|

|

Weighted-average

fully diluted shares

|

10,242,650

|

8,888,746

|

|

|

|

|

|

Net

Loss per fully diluted share

|

$(0.41)

|

$(0.12)

|

Non-GAAP Financial Measure

AYRO

presents Adjusted EBITDA because AYRO considers it to be an

important supplemental measure of the company’s operating

performance, and AYRO believes it may be used by certain investors

as a measure of AYRO’s operating performance. Adjusted EBITDA

is defined as income (loss) from operations before interest income

and expense, income taxes, depreciation, amortization of intangible

assets, impairment of long-lived assets, acquisition and financing

costs, stock-based compensation expense and certain non-recurring

expenses.

Below

is a reconciliation of Adjusted EBITDA to net loss for the year

ended December 31, 2018 and 2017.

|

|

For the year ended

December 31,

|

|

|

|

|

|

Net

Loss

|

$(4,196,491)

|

$(1,081,086)

|

|

Depreciation

and Amortization

|

288,549

|

35,184

|

|

Stock-based

compensation expense

|

586,371

|

86,010

|

|

Interest

expense

|

144,618

|

12,331

|

|

Settlement

expenses(1)

|

162,488

|

49,168

|

|

Acquisition

and financing costs

|

0

|

0

|

|

Provision

(benefit) for income taxes

|

742

|

50

|

|

Adjusted EBITDA

|

$(3,013,723)

|

$(898,343)

|

_________________

(1)

Settlement expenses represent one-time amounts paid in connection

with the departure of a former executive officer of the

Company.

Net Revenue

Total

revenue increased overall by $5,263,549 during the year ended

December 31, 2018 as compared to the year ended December 31, 2017.

The increase in revenue was primarily driven by the fact that 2018

was AYRO’s first full year of operations and during the

period prior to January 2018, there was no salesforce.

Additionally, the one-time Devirra Transaction occurred in the

first half of 2018, which contributed $4,065,000 of the revenue

variance.

Cost of goods sold and gross margin

Cost of

goods sold increased by $4,970,252 for the year ended December 31,

2018, as compared to the year ended December 31, 2017. The increase

in revenue was primarily driven by the fact that 2018 was

AYRO’s first full year of operations and the prior to January

2018, there was no salesforce. Additionally, the one-time Devirra

Transaction occurred in the first half of 2018, which contributed

$4,003,068 of the cost of goods sold variance.

AYRO’s gross

margin percentage was 6% during the year ended December 31, 2018

and negligible for the year ended December 31, 2017.

General and administrative expense

General

and administrative expense increased $1,836,076, or 247%, for the

year ended December 31, 2018 (AYRO’s first full year of

operations), as compared to the year ended December 31, 2017. AYRO

began hiring its core employee base in November 2017. The increase

was primarily driven by employee compensation expenses and related

costs, office rent, travel and consulting services.

Marketing and selling expense

Marketing and

selling expense increased by $835,780, or 510% for the year ended

December 31, 2018 (AYRO’s first full year of operations), as

compared to the year ended December 31, 2017. AYRO began hiring its

core employee base in November 2017 through March 2018. The

increase was primarily driven by employee compensation expenses and

related costs, commissions, tradeshows and

advertising.

Research and development expense

Research and

development expense increased by approximately $597,005, or 348%,

for the year ended December 31, 2018 (AYRO’s first full year

of operations) as compared to the year ended December 31, 2017.

AYRO began hiring its core employee base in November 2017 through

March 2018. The increase was primarily driven by employee

compensation expenses and related costs, professional services,

royalty-based services provided under the CVO agreement and

prototypes attributable to continued development of new and

enhanced product offerings.

Interest expense

Interest expense

increased $132,287 for the year ended December 31, 2018 compared to

year ended December 31, 2017 as a result of finance charges accrued

for certain accounts payable in 2018.

Liquidity

and Capital Resources

As of

September 30, 2019, AYRO had approximately $60,000 in cash and cash

equivalents and working capital deficit of approximately

$(1,654,063). As of December 31, 2018, AYRO had approximately

$39,243 in cash and cash equivalents and working capital deficit of

approximately $(980,213). The deficit increase was primarily due to

an increase in accounts payable with Cenntro, AYRO’s primary

supply chain and largest single stockholder.

AYRO’s

sources of cash since AYRO’s inception in 2017 have been

predominantly from the sale of equity and debt.

In

December 2019, Cenntro agreed to convert $1,100,000 in accounts

payable to 1,100,000 of AYRO’s Series Seed 3 Preferred Stock.

Additionally, a service provider agreed to convert $137,729 in

accounts payable to a long-term promissory note.

In

October 2019, AYRO raised $500,000 in a 120-day short-term loan

from Mark Adams, one of AYRO’s founding board members. This

loan has a 14% interest rate per annum, payable quarterly and an

equity incentive of 528,000 shares of AYRO common stock. In

December 2019, this loan term was extended to April 30, 2021 in

exchange for the issuance of 500,000 shares of AYRO common

stock.

In

November 2019, AYRO received cash in exchange for term loans from

an individual lender of $75,000. The note has a term of for twelve

months and bears interest at the rate of 12% per annum, payable

quarterly. AYRO issued 79,200 shares of AYRO common stock to the

lender in connection with this loan.

In

December 2019, AYRO converted notes payable to eight individual

lenders in the total amount of $715,000 plus accrued interest into

777,301 shares of AYRO’s Series Seed 3 Preferred Stock, thus

reducing the amount of outstanding debt.

On

December 19, 2019, AYRO entered into the Merger Agreement with

DropCar, pursuant to which a subsidiary of DropCar will merge with

and into AYRO, with AYRO continuing as a wholly owned subsidiary of

DropCar. Simultaneously with the signing of the Merger Agreement,

certain accredited investors, including certain stockholders of

DropCar, purchased $1.0 million of AYRO’s convertible Bridge

Notes and agreed to purchase, prior to the Merger, shares of AYRO

common stock and warrants for $2.0 million in the AYRO Private

Placement and 1,750,000 shares of AYRO common stock for nominal

consideration in the Nominal Stock Subscription.

During

the nine months ended September 30, 2019, AYRO’s primary

sources of liquidity came from existing cash, cash generated from

operations, proceeds of $1,911,375 from the sales of 1,092,515

shares of AYRO’s Series Seed 2 Preferred Stock, $607,000 from

the sales of 303,500 shares of AYRO’s Series Seed 3 Preferred

Stock, issuance of $800,000 of promissory notes to seven individual

investors convertible into AYRO’s Series Seed 2 Preferred

Stock and the issuance of $350,000 of promissory notes to six

individual investors as term loans.

The

terms of the convertible promissory notes issued include interest

accrued at twelve percent (12%) per annum for the first sixty (60)

days and fifteen percent (15%) per annum thereafter. The holder can

convert the notes and accrued interest at $1.75 per share into

AYRO’s Series Seed 2 Preferred Stock.

The

terms of the promissory notes issued as term loans include interest

accrued at twelve percent (12%) per annum and the holders were

issued shares of common stock calculated by multiplying the

principal amount of the note by 1.056.

During

2018, AYRO’s primary sources of liquidity were from cash

generated from the sale of $3,298,007 of Series Seed 1 Preferred

Stock and Series Seed 2 Preferred Stock.

AYRO’s

business is capital intensive, and future capital requirements will

depend on many factors including AYRO’s growth rate, the

timing and extent of spending to support development efforts, the

expansion of AYRO’s sales and marketing teams, the timing of

new product introductions and the continuing market acceptance of

AYRO’s products and services.

Based

on AYRO’s current operating and funding plans and business

conditions, AYRO believes that existing cash, together with

DropCar’s cash on hand upon consummation of the merger and

the cash AYRO will receive pursuant to the AYRO Private Placement,

and cash generated from operations, will be sufficient to satisfy

AYRO’s anticipated cash requirements for the next twelve

months but that AYRO will be required to seek additional equity or

debt financing in the next 15 months. In the event that additional

financing is required from outside sources, AYRO may not be able to

raise monies on terms acceptable to it or at all. If AYRO is unable

to raise additional capital when desired, AYRO’s business,

operating results and financial condition would be adversely

affected.

AYRO’s

financial statements have been prepared on a going concern basis,

which contemplates the realization of assets and the satisfaction

of liabilities in the normal course of business. The financial

statements do not include any adjustments that might be necessary

should AYRO be unable to continue as a going concern.

Management’s plan includes raising capital through additional

funding sources, growing its dealer channel base to increase

product sales revenue, and expanding its product portfolio

offerings. If AYRO cannot achieve its operating plan, AYRO may find

it necessary to dispose of assets or undertake other actions, as

may be appropriate.

Cash Flow Analysis

For the Nine Month Periods Ended September 30, 2019 and

2018

The

following table summarizes AYRO’s cash flows for the

nine-month periods ended September 30, 2019 and 2018.

|

|

For the nine months ended

|

|

|

|

|

Cash Flows:

|

|

|

|

Net

cash used in operating activities

|

$(3,168,709)

|

$(1,789,842)

|

|

Net

cash used in investing activities

|

$(322,773)

|

$(586,977)

|

|

Net

cash provided by financing activities

|

$3,513,063

|

$2,870,750

|

Operating Activities

During

the nine months ended September 30, 2019, AYRO used $3,168,709 in

cash from operating activities, an increased use of $1,378,867 when

compared to the cash used in operating activities of $1,789,842

during the same period in 2018. The increase in cash used by

operating activities was primarily a result of an increase in net

loss as AYRO continued to invest in the infrastructure of the

company as AYRO plans for growth. Additionally, working capital

requirements decreased $343,108 attributable to accounts

receivable, inventory, prepaid expenses, accounts payable and

accrued expenses used over the same period in 2018.

AYRO’s

ability to generate cash from operations in future periods will

depend in large part on profitability, the rate and timing of

collections of AYRO’s accounts receivable, inventory turns

and AYRO’s ability to manage other areas of working

capital.

Investing Activities

During

the nine months ended September 30, 2019, AYRO used cash of

$322,773 in investing activities as compared to $586,977 used

during the same period in 2018, a reduction of $264,204. The net

decrease was primarily due to $364,000 of tooling purchased for the

AYRO 311 vehicle in June 2018, combined with an increase in capital

expenditures of equipment purchased in the normal course of

business.

Financing Activities

During

the nine months ended September 30, 2019, AYRO generated a net

$3,512,063 from financing activities, as compared to the cash

generated of $2,870,750 during the same period in 2018. During the

nine months ended September 30, 2019, cash was generated through

the sale of 1,092,215 shares of AYRO’s Series Seed 2

Preferred Stock for total proceeds of $1,911,375 and 303,500 shares

of AYRO’s Series Seed 3 Preferred Stock for total proceeds of

$607,000. Additionally, $800,000 in proceeds were received from the

sale of promissory notes convertible into AYRO’s Series Seed

2 Preferred Stock and 300,000 in proceeds were received from the

sale of promissory notes recorded as short term loans during the

nine months ended September 30, 2019. In the second quarter of

2019, $350,000 of principal and $9,062 of accrued interest from the

convertible notes were exchanged into 205,178 shares of

AYRO’s Series Seed 2 Preferred Stock. During the nine months

ended September 30, 2018, cash was generated through the sale

2,300,000 shares of AYRO’s Series Seed 1 Preferred Stock for

total proceeds of $2,300,000 and 469,219 shares of AYRO’s

Series Seed 2 Preferred Stock for total proceeds of $771,133. In

March 2018, AYRO repurchased 250,000 shares of its Series Seed 1

Preferred Stock from certain early investors for

$250,000.

For the Years Ended December 31, 2018 and 2017

The

following table summarizes AYRO’s cash flows for the years

ended December 31, 2018 and 2017:

|

|

For the years ended December 31,

|

|

Cash Flows:

|

|

|

|

Net

cash used in operating activities

|

$(2,364,957)

|

$(863,203)

|

|

Net

cash used in investing activities

|

$(760,922)

|

$(336,577)

|

|

Net

cash provided by financing activities

|

$3,082,578

|

$1,282,324

|

Operating Activities

During

the year ended December 31, 2018, AYRO used $2,364,957 in cash from

operating activities, an increase of $1,501,754 when compared to

the $863,203 in cash used in operating activities during the year

ended December 31, 2017. The increase in cash used by operating

activities was primarily a result of growing the infrastructure of

the business. The 2018 fiscal year was AYRO’s first full year

of operations which required an increase in investment in

additional personnel, additional office and warehouse space and

other costs associated with developing a high-quality manufacturing

business. Additionally, cash used in operations for 2018 was

supported by increases in working capital of $956,614, composed of:

reductions in inventories, prepaid expenses combined with increases

in accrued expenses and related party payables (sources of cash) of

$2,259,376; offset by an increase in accounts receivable and

deposits combined with reductions in accounts payable and deferred

revenue (uses of cash) of $1,302,762. The increase in working

capital requirements was predominately offset by an increase in net

loss of $3,115,405 during the year ended December 31, 2018, as

compared to December 31, 2017, and a net increase in non-cash

operating expenses of $753,726, as compared to the prior year.

Non-cash expenditures include allowances for bad debt, depreciation

and amortization and stock-based compensation expense.

AYRO’s

ability to generate cash from operations in future periods will

depend in large part on AYRO’s profitability, the rate and

timing of collections of its accounts receivable, its inventory

turns and its ability to manage other areas of working

capital.

Investing Activities

During

the year ended December 31, 2018, AYRO used cash of $760,922 in

investing activities as compared to $336,577 used during the

comparative period in 2017, an increase in cash used of $424,345.

The net increase is primarily due to cash used in the purchase of

capital equipment including tooling for the AYRO 311 vehicle. Other

than capital expense needed to develop new products, AYRO does not

anticipate any significant purchases of equipment beyond that which

is anticipated for use in the normal course of AYRO’s core

business activity.

Financing Activities

During

the year ended December 31, 2018, AYRO raised $3,298,007 through

non-institutional sales of Series Seed 1 and Series Seed 2

Preferred Stock, as compared to $1,222,500 in the year ended

December 31, 2017. Additionally, in 2018, AYRO redeemed $250,000 of

preferred stock and $375 of common stock to certain early

investors.

In

2018, AYRO financed a delivery truck for $34,946 under a standard

purchase finance agreement.

Contractual

Obligations and Commitments

AYRO

has made certain indemnities, under which it may be required to

make payments to an indemnified party, in relation to certain

transactions. AYRO indemnifies its directors and officers, to the

maximum extent permitted under the laws of the State of Delaware.

In connection with AYRO’s facility leases, AYRO has

indemnified its lessors for certain claims arising from the use of

the facilities. The duration of the indemnities varies and, in many

cases, is indefinite. These indemnities do not provide for any

limitation of the maximum potential future payments AYRO could be

obligated to make. Historically, AYRO has not been obligated to

make any payments for these obligations and no liabilities have

been recorded for these indemnities.

Off-Balance

Sheet Arrangements

Other

than lease commitments incurred in the normal course of business

and certain indemnification provisions, AYRO does not have any

off-balance sheet financing arrangements or liabilities, guarantee

contracts, retained or contingent interests in transferred assets,

or any obligation arising out of a material variable interest in an

unconsolidated entity. AYRO does not have any subsidiaries to

include or otherwise consolidate into the financial statements.

Additionally, AYRO does not have interests in, nor relationships

with, any special purpose entities.

Related

Party Transactions

Royalty Agreement

On

March 1, 2017, AYRO entered into the Outsourced CVO Services

Agreement with SI that is controlled by Mr. Okonsky and Mr. Adams,

each a founder of AYRO and a current AYRO board member, in its

effort to accelerate the start-up of AYRO’s operations. In

return for acceleration assistance and SI providing services of the

Chief Visionary Officer role, pursuant to the agreement, AYRO paid

a monthly retainer of $6,000 per month. On a quarterly basis, AYRO

also remitted to SI a royalty of a percentage (see table below) of

its revenues less the retainer amounts for the measurement quarter

paid. In connection with this agreement, AYRO granted 350,000

options to purchase shares of AYRO common stock at an exercise

price of $0.667 per share under the AYRO Equity Plan, which was

subsequently cancelled in December 2019.

|

|

|

|

$0 - $25,000,000

|

3.0%

|

|

$25,000,000 -

$50,000,000

|

2.0%

|

|

$50,000,000 -

$100,000,000

|

1.0%

|

|

|

0.5%

|

SI was

also granted a right to nominate up to two members of AYRO’s

board of directors.

In

addition, on April 1, 2017, AYRO and SI entered into a

fee-for-service agreement, pursuant to which SI agreed to provide

accounting and financial, graphics and marketing services to AYRO,

based on the market-standard hourly rates as set forth in the

agreement.

Effective as of

January 1, 2019, AYRO agreed to an amendment to the Outsourced CVO

Services Agreement to reduce the royalty percentage to a flat 0.5%

for all revenue levels. In connection to this amendment, AYRO

granted each of Mr. Okonsky and Mr. Adams an additional 700,000

options to purchase $0.95 per share, pursuant to the AYRO Equity

Plan, which options were fully vested as of September 30, 2019 and

subsequently cancelled in December 2019.

Effective as of

October 14, 2019, AYRO and SI terminated the Outsourced CVO

Services Agreement, and as consideration for SI to terminate the

agreement, AYRO issued 850,000 shares of AYRO common stock to SI

(or its designees).

In

December 2019, the Company, SI, Christian Okonsky and Mark Adams

agreed to cancel (i) the options to purchase 350,000 shares of AYRO

common stock previously granted to SI in March 2017, and (ii) the

options to purchase an aggregate of 1,400,000 shares of AYRO common

stock previously granted to Mr. Okonsky and Mr. Adams in connection

with the amendment to the Outsourced CVO Services Agreement to

reduce the royalty percentages, in exchange for 1,593,550 shares of

AYRO common stock.

For the

years ended 2017, 2018, and 2019 prior to termination, AYRO paid SI

$60,000, $187,494 and $60,000, respectively, pursuant to the

Outsourced CVO Services Agreement, and $123,538, $36,694 and

$1,275, respectively, pursuant to the fee-for service agreement for

accounting and financial, graphics and marketing

services.

Consulting Agreement

On

January 15, 2019, AYRO entered into a fee-for-service-based

agreement with SCLLC, an entity that is controlled by Mr. Adams,

John Constantine and Will Steakley, who are principal stockholders

of AYRO, in an effort to support the strategic direction of AYRO.

The duties of SCLLC include (a) participating in strategic advisory

conference calls with management; (b) making introductions to

interested parties of strategic value; (c) advising AYRO on capital

structure; and (d) acting as ambassadors to promote the company

within the Central Texas community. In 2019, SCLLC received

five-year warrants to purchase an aggregate of 652,500 shares of

AYRO common stock at a $2.00 exercise price and 247,500 shares of

the AYRO common stock in connection with the services rendered.

Payments accrued for services rendered for the year ended December

31, 2019 were $249,938.

Loan from SI

In

January 2019, AYRO received $50,000 in a short-term loan from SI.

The short-term loan did not bear any interest. The amount was

repaid in March 2019.

Adams Note, Amendment and Lock-Up Agreement

On

October 14, 2019, Mr. Adams, a current member of the board of

directors of AYRO, was issued a secured promissory note in the

aggregate principal amount of $500,000, in exchange for funding

$100,000 to AYRO on or before October 15, 2019, and $400,000 on or

before October 24, 2019. The note is secured by a first lien

security interest in all of the assets of AYRO and accrues interest

at 14% per annum, until the promissory note is repaid. The note was

to mature on the earlier of March 12, 2020, or the date that is

three business days following the closing of a reverse merger

transaction involving AYRO.

On

December 13, 2019, AYRO and Mr. Adams entered into an amendment to

the promissory note, extending the maturity date of the note to

April 30, 2021. As consideration, AYRO issued 500,000 shares of

common stock to Mr. Adams. Such shares are subject to a six-month

lock-up period.

AYRO

has not paid any principal or interest accrued on the promissory

note. As of December 31, 2019, the aggregate principal amount of

$500,000 is outstanding and $13,386 of interest is accrued and

payable.

Cenntro Agreement

In

April 2017, AYRO entered into a Manufacturing Licensing Agreement

with Cenntro, that provides for its four-wheel sub-assemblies to be

licensed and sold to AYRO for final manufacturing and sale in the

United States.

In

2017, AYRO executed a Stock Purchase Agreement with Cenntro for

three million (3,000,000) shares of AYRO’s common stock. As

consideration, Cenntro contributed cash of $50,000, raw material

inventory items valued at $92,061 and supply chain tooling and

assembly line development and ramp-up valued at $307,939. As of

December 31, 2019, Cenntro owned approximately 13.73% of

AYRO’s outstanding common stock on a fully-diluted

basis.

In

2017, AYRO executed a supply chain contract with Cenntro.

Currently, AYRO purchases 100% of its four-wheel vehicle chassis,

cabs and wheels through this supply chain relationship with

Cenntro. Contract terms are industry-standard and reflect

arms-length market pricing and other relevant terms.

In

2018, AYRO purchased supply-chain tooling to be placed in

Cenntro’s facility with a promissory note to Cenntro for the

cost. The tooling note was repaid in March 2019. As of December 31,

2019 and 2018, the amounts outstanding to Cenntro for factory

tooling were $0 and $324,202, respectively.

In

December 2019, Cenntro agreed to convert $1,100,000 of its accounts

receivable due from AYRO into 1,100,000 shares of AYRO’s

Series Seed 3 Preferred Stock. As of December 31, 2019, and 2018,

the amounts outstanding to Cenntro for trade accounts payable were

$133,117 and $2,149,295, respectively.

Critical

Accounting Policies and Estimates

AYRO’s

accounting policies are fundamental to understanding its

management’s discussion and analysis. AYRO’s

significant accounting policies are presented in Note 1 to its

consolidated financial statements, which are included elsewhere in

the exhibits to this Form 8-K. AYRO has identified certain

significant accounting policies which involve a higher degree of

judgment and complexity in making certain estimates and assumptions

that affect amounts reported in its consolidated financial

statements, as summarized below.

Revenue Recognition

In May

2014, the Financial Accounting Standards Board (“FASB”)

issued Accounting Standard Update (“ASU”) No. 2014-09,

“Revenue from Contracts with Customers (Topic 606)”

(“ASU 2014-09”). ASU 2014-09 amends the guidance for

revenue recognition to replace numerous industry-specific

requirements and converges areas under this topic with those of the

International Financial Reporting Standards. AYRO adopted the ASU

No. 2014-09 for the year ended December 31, 2018.

Product

revenue from customer contracts is recognized on the sale of each

electric vehicle as vehicles are shipped to customers. Ownership

and risk of loss transfers to the customer based on FOB shipping

point and freight charges are the responsibility of the customer.

Payments are typically received at the point control transfers or

in accordance with payment terms customary to the

business.

Subscription

revenue from revenue sharing with Destination Fleet Operators

(“DFO”) is recorded in the month the vehicles in

AYRO’s fleet is rented. AYRO established its rental fleet in

late March 2019. For the rental fleet, AYRO retains title and

ownership to the vehicles and places them in DFO’s in resort

communities that typically rent golf cars for use in those

communities. Subscription revenue from revenue sharing activities

for the nine-months ended September 30, 2019 and 2018 were $9,941

and $0, respectively.

Amounts

billed to customers related to shipping and handling are classified

as shipping revenue, and AYRO has elected to recognize the cost for

freight and shipping when control over vehicles has transferred to

the customer as an operating expense. AYRO’s policy is to

exclude taxes collected from a customer from the transaction price

of automotive contracts. Shipping revenue for the nine-months ended

September 30, 2019 and 2018 were $67,168 and $38,049,

respectively.

Services and other

revenue consist of non-warranty after-sales vehicle services.

Service revenue for the nine-months ended September 30, 2019 and

2018 were $5,459 and $0, respectively.

Payments received

in advance of the delivery of vehicles or performance of services

are reported in the accompanying balance sheets as deferred

income.

Stock-Based Compensation

AYRO

accounts for stock-based compensation in accordance with the

guidance of FASB Accounting Standards Codification

(“ASC”) Topic 718, Compensation – Stock

Compensation. Under the fair value recognition provisions of

FASB ASC Topic 718, which requires all stock-based compensation

costs to be measured at the grant date based on the fair value of

the award and is recognized as compensation expense ratably over

the period the services are rendered, which is generally the option

vesting period. AYRO uses the Black-Scholes option pricing method

to determine the fair value of stock options and thus determining

compensation expense associated with the grant. AYRO measures

stock-based compensation expense for its non-employees and

consultants under FASB ASC 505-50, Accounting for Equity Instruments that are

Issued to Other than Employees for Acquiring or in Conjunction with

Selling Goods and Services. In accordance with ASC Topic

505-50, these stock options and warrants issued as compensation for

services provided to AYRO are accounted for based upon the fair

value of the services provided. The fair value of the equity

instrument is charged directly to compensation expense and

additional-paid-in capital over the period during which services

are rendered.

Net Earnings or Loss Per Share

AYRO’s

computation of earnings (loss) per share (“EPS”)

includes basic and diluted EPS. Basic EPS is measured as the income

(loss) available to common stockholders divided by the weighted

average number of common shares outstanding for the period. Diluted

EPS is similar to basic EPS but presents the dilutive effect on a

per share basis of potential common shares (e.g., common stock

warrants and common stock options) as if they had been converted at

the beginning of the periods presented, or issuance date, if later.

Potential common shares that have an anti-dilutive effect (i.e.,

those that increase income per share or decrease loss per share)

are excluded from the calculation of diluted EPS.

Loss

per common share is computed by dividing net loss by the weighted

average number of shares of common stock outstanding during the

respective periods. Basic and diluted loss per common share is the

same for all periods presented because all common stock warrants

and common stock options outstanding were

anti-dilutive.

At

September 30, 2019 and 2018, AYRO excluded the outstanding warrant

and option securities, which entitle the holders thereof to

ultimately acquire shares of common stock, from its calculation of

earnings per share, as their effect would have been

anti-dilutive.

Use of Accounting Estimates

The

preparation of financial statements in conformity with accounting

principles generally accepted in the United States of America

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during

the reporting period. Management makes these estimates using the

best information available at the time the estimates are made;

however, actual results could differ from those

estimates.

Fair Value Measurements

AYRO

follows FASB ASC 820-10, Fair

Value Measurements and Disclosures, which defines fair

value, establishes a framework for measuring fair value, and

expands disclosures about fair value measurements. The standard

provides a consistent definition of fair value which focuses on an

exit price that would be received upon sale of an asset or paid to

transfer a liability in an orderly transaction between market

participants at the measurement date.

The

standard also prioritizes, within the measurement of fair value,

the use of market-based information over entity specific

information and establishes a three-level hierarchy for fair value

measurements based on the nature of inputs used in the valuation of

an asset or liability as of the measurement date.

The

three-level hierarchy for fair value measurements is defined as

follows:

●

Level 1 –

inputs to the valuation methodology are quoted prices (unadjusted)

for identical assets or liabilities in active markets.

●

Level 2 –

inputs to the valuation methodology include quoted prices for

similar assets and liabilities in active markets, and inputs that

are observable for the asset or liability other than quoted prices,

either directly or indirectly including inputs in markets that are

not considered to be active.

●

Level 3 –

inputs to the valuation methodology are unobservable and

significant to the fair value measurement.

Categorization

within the valuation hierarchy is based upon the lowest level of

input that is significant to the fair value measurement. The

carrying amounts reported in the accompanying financial statements

for current assets and current liabilities approximate the fair

value because of the immediate or short-term maturities of the

financial instruments. As of September 30, 2019 and 2018, AYRO did

not have any level 2 or level 3 instruments.

Inventories

Inventories are

reported at the lesser of cost (using the first-in, first-out

method, “FIFO”) or net realizable value. Inventories

consist of purchased chassis, cabs, batteries, truck beds/boxes,

component parts as well as freight, tariffs, duties and other

transport-in costs. Inventories are categorized as raw materials,

work-in-process and finished goods as of September 30, 2019 and

December 31, 2018. Work-in-process and finished goods include labor

and overhead costs.

Intangible Assets

Intangible assets

consist of the cost in registering patents for AYRO’s unique

inventions. Such patent-related expenses are recorded at their

estimated fair value on the date of cost encumbrance and are being

amortized over an estimated life of 5 years. Intangible assets also

include investments made with the supply chain partner, who is also

an investor, for tooling and assembly line configuration.

Amortization expense for the nine months ended September 30, 2019

and 2018 was $87,968 and $65,876, respectively.

AYRO

follows FASB ASC 360, Accounting

for Impairment or Disposal of Long-Lived Assets (“ASC

360”). ASC 360 requires that if events or changes in

circumstances indicate that the cost of long-lived assets or asset

groups may be impaired, an evaluation of recoverability would be

performed by comparing the estimated future undiscounted cash flows

associated with the asset to the asset’s carrying value to

determine if a write-down to market value would be required.

Long-lived assets or asset groups that meet the criteria in ASC 360

as being held for sale are reflected at the lower of their carrying

amount or fair market value, less costs to sell. AYRO’s

management has determined that there is no impairment as of

September 30, 2019.

Income Taxes

AYRO

accounts for income tax using an asset and liability approach,

which allows for the recognition of deferred tax benefits in future

years. Under the asset and liability approach, deferred taxes are

provided for the net tax effects of temporary differences between

the carrying amounts of assets and liabilities for financial

reporting purposes and the amounts used for income tax purposes.

The accounting for deferred income tax calculation represents AYRO

management’s best estimate on the most likely future tax

consequences of events that have been recognized in AYRO’s

financial statements or tax returns and related future

anticipation. A valuation allowance is provided for deferred tax

assets if it is more likely than not these items will either expire

before AYRO is able to realize their benefits, or that future

realization is uncertain.

AYRO

evaluates uncertainty in income tax positions based on a

more-likely-than-not recognition standard. If that threshold is

met, the tax position is then measured at the largest amount that

is greater than 50% likely of being realized upon ultimate

settlement. If applicable, AYRO records interest and penalties as a

component of income tax expense.

As of

September 30, 2019 and December 31, 2018, there were no accruals

for uncertain tax positions.

Business Combinations

AYRO

utilizes the acquisition method of accounting for business

combinations and allocate the purchase price of an acquisition to

the various tangible and intangible assets acquired and liabilities

assumed based on their estimated fair values. AYRO primarily

establishes fair value using the income approach based upon a

discounted cash flow model. The income approach requires the use of

many assumptions and estimates including future revenues and

expenses, as well as discount factors and income tax rates. Other

estimates include:

● Estimated

step-ups or write-downs for fixed assets and

inventory;

● Estimated

fair values of intangible assets; and

● Estimated

income tax assets and liabilities assumed from the

target.

While

AYRO uses its best estimates and assumptions as part of the

purchase price allocation process to accurately value assets

acquired and liabilities assumed at the business acquisition date,

AYRO’s estimates and assumptions are inherently uncertain and

subject to refinement. As a result, during the purchase price

allocation period, which is generally one year from the business

acquisition date, AYRO records adjustments to the assets acquired

and liabilities assumed, with the corresponding offset to goodwill.

For changes in the valuation of intangible assets between

preliminary and final purchase price allocation, the related

amortization is adjusted in the period it occurs. Subsequent to the

purchase price allocation period, any adjustment to assets acquired

or liabilities assumed is included in operating results in the

period in which the adjustment is determined.

From

inception through September 30, 2019, AYRO has not contemplated nor

consummated any acquisitions. However, should AYRO issue shares of

its common stock in an acquisition, it will be required to estimate

the fair market value of the shares issued.

Recent

Accounting Pronouncements

In

February 2016, the FASB issued ASU Topic 2016-02, Leases, (“ASU

842”). The guidance

in this ASU supersedes the leasing guidance in ASU Topic 840,

Leases. Under the new

guidance, lessees are required to recognize lease assets and lease

liabilities on the balance sheet for all leases with terms longer

than 12 months. Leases will be classified as either finance or

operating, with classification affecting the pattern of expense

recognition in the income statement.

The new

standard is effective for fiscal years beginning after December 15,

2019. Early adoption is permitted. AYRO is currently evaluating the

impact of the pending adoption of the new standard on its financial

statements.

In May

2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers (Topic

606) (“ASU 2014-09”). ASU 2014-09 amends the

guidance for revenue recognition to replace numerous

industry-specific requirements and converges areas under this topic

with those of the International Financial Reporting Standards. ASU

2014-09 implements a five-step process for customer contract

revenue recognition that focuses on transfer of control, as opposed

to transfer of risk and rewards. The amendment also requires

enhanced disclosures regarding the nature, amount, timing and

uncertainty of revenues and cash flows from contracts and

customers. Other major provisions include the capitalization and

amortization of certain contract costs, ensuring the time value of

money is considered in the transaction price, and allowing

estimates of variable consideration to be recognized before

contingencies are resolved in certain circumstances. The amendments

in ASU 2014-09 are effective for reporting periods beginning after

December 15, 2017, and early adoption is prohibited. Entities can

transition to the standard either retrospectively or as a

cumulative-effect adjustment as of the date of the adoption. AYRO

adopted ASU 2014-09 for the year ended December 31, 2018. The

adoption of ASU 2014-09 did not have a material effect on

AYRO’s financial statements.

Concentration

of Credit Risk

Financial

instruments that potentially expose AYRO to concentrations of

credit risk consist principally of cash, cash equivalents and

accounts receivable. AYRO places its cash and cash equivalents with

financial institutions with high credit quality. As of September

30, 2019, AYRO had $60,823 of cash and cash equivalents on deposit

or invested with its financial and lending

institutions.

AYRO

provides credit to customers in the normal course of business. AYRO

performs ongoing credit evaluations of its customers’

financial condition and limit the amount of credit extended when

deemed necessary.

Foreign

Currency Risk

From

inception through September 30, 2019, all transactions for AYRO

have been settled in U.S. dollars. Should AYRO begin transacting

business in other currencies, AYRO is subject to exposure from

changes in the exchange rates of local currencies.

AYRO