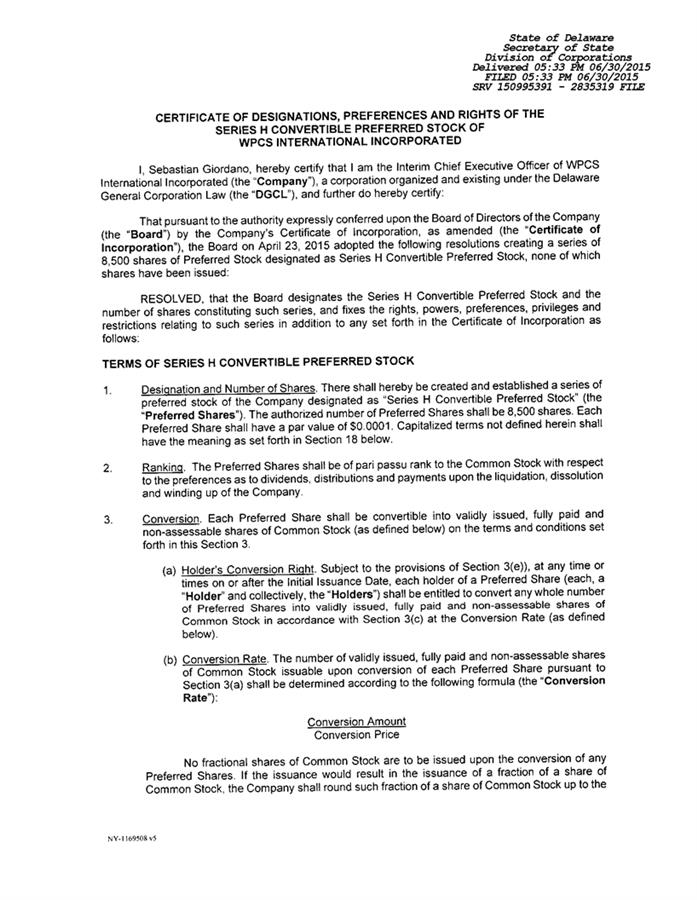

CERTIFICATE OF DESIGNATIONS, PREFERENCES AND

RIGHTS OF THE

SERIES H-5 CONVERTIBLE PREFERRED STOCK OF

DROPCAR, INC.

I, Joshua

Silverman, hereby certify that I am the Chairman of the Board of

Directors of DropCar, Inc. (the “Company”), a corporation organized

and existing under the Delaware General Corporation Law (the

“DGCL”), and

further do hereby certify:

That pursuant to

the authority expressly conferred upon the Board of Directors of

the Company (the “Board”) by the Company’s

Certificate of Incorporation, as amended (the “Certificate of Incorporation”),

the Board on December 6, 2019 adopted the following resolutions

creating a series of 50,000 shares of Preferred Stock designated as

Series H-5 Convertible Preferred Stock, none of which shares have

been issued:

RESOLVED, that the

Board designates the Series H-5 Convertible Preferred Stock and the

number of shares constituting such series, and fixes the rights,

powers, preferences, privileges and restrictions relating to such

series in addition to any set forth in the Certificate of

Incorporation as follows:

TERMS OF SERIES H-5 CONVERTIBLE PREFERRED

STOCK

|

1.

|

Designation and Number of

Shares. There shall hereby be created and established a

series of preferred stock of the Company designated as

“Series H-5 Convertible Preferred Stock” (the

“Preferred

Shares”). The authorized number of Preferred Shares

shall be 50,000 shares. Each Preferred Share shall have a par value

of $0.0001. Capitalized terms not defined herein shall have the

meaning as set forth in Section 18 below.

|

|

2.

|

Ranking. Except with respect to

any current series of preferred stock of senior rank to the

Preferred Shares in respect of the preferences as to dividends,

distributions and payments upon the liquidation, dissolution and

winding up of the Company (collectively, the “Senior Preferred Stock”) and any

current or future series of preferred stock of pari passu rank to

the Preferred Shares in respect of the preferences as to dividends,

distributions and payments upon the liquidation, dissolution and

winding up of the Company, which, as of the date hereof, consists

of Series H Convertible Preferred Stock, Series H-3 Convertible

Preferred Stock and Series H-4 Convertible Preferred Stock

(collectively, the “Parity

Stock”), all shares of capital stock of the Company

shall be junior in rank to all Preferred Shares with respect to the

preferences as to dividends, distributions and payments upon the

liquidation, dissolution and winding up of the Company

(collectively, the “Junior Stock”). The rights of all

such shares of capital stock of the Company shall be subject to the

rights, powers, preferences and privileges of the Preferred Shares.

In the event of the merger or consolidation of the Company with or

into another corporation, the Preferred Shares shall maintain their

relative rights, powers, designations, privileges and preferences

provided for herein and no such merger or consolidation shall

result inconsistent therewith. For the avoidance of doubt, in no

circumstance will a Preferred Share have any rights subordinate or

otherwise inferior to the rights of shares of Parity Stock or

Common Stock (as defined below).

|

|

3.

|

Conversion. Each Preferred

Share shall be convertible into validly issued, fully paid and

non-assessable shares of Common Stock on the terms and conditions

set forth in this Section 3.

|

|

|

(a)

|

Holder’s Conversion

Right. Subject to the provisions of Section 3(e)), at any

time or times on or after the Initial Issuance Date, each holder of

a Preferred Share (each, a “Holder” and collectively, the

“Holders”) shall

be entitled to convert any whole number of Preferred Shares into

validly issued, fully paid and non-assessable shares of Common

Stock in accordance with Section 3(c) at the Conversion Rate (as

defined below).

|

|

|

(b)

|

Conversion Rate. The number of

validly issued, fully paid and non-assessable shares of Common

Stock issuable upon conversion of each Preferred Share pursuant to

Section 3(a) shall be determined according to the following formula

(the “Conversion

Rate”):

|

Conversion Amount

Conversion Price

No fractional

shares of Common Stock are to be issued upon the conversion of any

Preferred Shares. If the issuance would result in the issuance of a

fraction of a share of Common Stock, the Company shall round such

fraction of a share of Common Stock up to the nearest whole

share.

|

|

(c)

|

Mechanics of Conversion. The

conversion of each Preferred Share shall be conducted in the

following manner:

|

|

|

(i)

|

Holder’s Conversion. To

convert a Preferred Share into validly issued, fully paid and

non-assessable shares of Common Stock on any date (a

“Conversion

Date”), a Holder shall deliver (whether via electronic

mail, facsimile or otherwise), for receipt on or prior to 11:59

p.m., New York time, on such date, a copy of an executed notice of

conversion of the share(s) of Preferred Shares subject to such

conversion in the form attached hereto as Exhibit I (the

“Conversion

Notice”) to the Company. If required by Section

3(c)(vi), within five (5) Trading Days following a conversion of

any such Preferred Shares as aforesaid, such Holder shall surrender

to a nationally recognized overnight delivery service for delivery

to the Company the original certificates representing the share(s)

of Preferred Shares (the “Preferred Share Certificates”) so

converted as aforesaid.

|

|

|

(ii)

|

Company’s Response. On or

before the first (1st) Trading Day

following the date of receipt of a Conversion Notice, the Company

shall transmit by electronic mail or facsimile an acknowledgment of

confirmation, in the form attached hereto as Exhibit II, of receipt

of such Conversion Notice to such Holder and the Company’s

transfer agent (the “Transfer

Agent”), which confirmation shall constitute an

instruction to the Transfer Agent to process such Conversion Notice

in accordance with the terms herein. On or before the second

(2nd)

Trading Day following the date of receipt by the Company of such

Conversion Notice, the Company shall (1) provided that (x) the

Transfer Agent is participating in the Depository Trust Company

(“DTC”) Fast

Automated Securities Transfer Program and (y) Common Stock shares

to be so issued are otherwise eligible for resale pursuant to Rule

144 promulgated under the Securities Act of 1933, as amended,

credit such aggregate number of shares of Common Stock to which

such Holder shall be entitled to such Holder’s or its

designee’s balance account with DTC through its

Deposit/Withdrawal at Custodian system, or (2) if either of the

immediately preceding clauses (x) or (y) are not satisfied, issue

and deliver (via reputable overnight courier) to the address as

specified in such Conversion Notice, a certificate, registered in

the name of such Holder or its designee, for the number of shares

of Common Stock to which such Holder shall be entitled. If the

number of Preferred Shares represented by the Preferred Share

Certificate(s) submitted for conversion pursuant to Section

3(c)(vi) is greater than the number of Preferred Shares being

converted, then the Company shall if requested by such Holder, as

soon as practicable and in no event later than three (3) Trading

Days after receipt of the Preferred Share Certificate(s) and at its

own expense, issue and deliver to such Holder (or its designee) a

new Preferred Share Certificate representing the number of

Preferred Shares not converted.

|

|

|

(iii)

|

Record Holder. The Person or

Persons entitled to receive the shares of Common Stock issuable

upon a conversion of Preferred Shares shall be treated for all

purposes as the record holder or holders of such shares of Common

Stock on the Conversion Date.

|

|

|

(iv)

|

Company’s Failure to Timely

Convert. If the Company shall fail, for any reason or for no

reason, to issue to a Holder within three (3) Trading Days after

the Company’s receipt of a Conversion Notice (whether via

electronic mail, facsimile or otherwise) (the “Share Delivery Deadline”), a

certificate for the number of shares of Common Stock to which such

Holder is entitled and register such shares of Common Stock on the

Company’s share register or to credit such Holder’s or

its designee’s balance account with DTC for such number of

shares of Common Stock to which such Holder is entitled upon such

Holder’s conversion of any Preferred Shares (as the case may

be) (a “Conversion

Failure”), then, in addition to all other remedies

available to such Holder, such Holder, upon written notice to the

Company, may void its Conversion Notice with respect to, and retain

or have returned (as the case may be) any Preferred Shares that

have not been converted pursuant to such Holder’s Conversion

Notice, provided that the voiding of a Conversion Notice shall not

affect the Company’s obligations to make any payments which

have accrued prior to the date of such notice pursuant to the terms

of this Certificate of Designations or otherwise. In addition to

the foregoing, if within three (3) Trading Days after the

Company’s receipt of a Conversion Notice (whether via

electronic mail, facsimile or otherwise), the Company shall fail to

issue and deliver a certificate to such Holder and register such

shares of Common Stock on the Company’s share register or

credit such Holder’s or its designee’s balance account

with DTC for the number of shares of Common Stock to which such

Holder is entitled upon such Holder’s conversion hereunder

(as the case may be), and if on or after such third (3rd) Trading Day such

Holder (or any other Person in respect, or on behalf, of such

Holder) purchases (in an open market transaction or otherwise)

shares of Common Stock to deliver in satisfaction of a sale by such

Holder of all or any portion of the number of shares of Common

Stock, or a sale of a number of shares of Common Stock equal to all

or any portion of the number of shares of Common Stock, issuable

upon such conversion that such Holder so anticipated receiving from

the Company, then, in addition to all other remedies available to

such Holder, the Company shall, within three (3) Business Days

after such Holder’s request, which request shall include

reasonable documentation of all broker fees, costs and expenses and

in such Holder’s discretion, either (i) pay cash to such

Holder in an amount equal to such Holder’s total purchase

price (including brokerage commissions and other reasonable out of

pocket expenses related to the Buy-In, if any) for the shares of

Common Stock so purchased (including, without limitation, by any

other Person in respect, or on behalf, of such Holder) (the

“Buy-In Price”),

at which point the Company’s obligation to so issue and

deliver such certificate or credit such Holder’s balance

account with DTC for the number of shares of Common Stock to which

such Holder is entitled upon such Holder’s conversion

hereunder (as the case may be) (and to issue such shares of Common

Stock) shall terminate, or (ii) promptly honor its obligation to so

issue and deliver to such Holder a certificate or certificates

representing such shares of Common Stock or credit such

Holder’s balance account with DTC for the number of shares of

Common Stock to which such Holder is entitled upon such

Holder’s conversion hereunder (as the case may be) and pay

cash to such Holder in an amount equal to the excess (if any) of

the Buy-In Price over the product of (A) such number of shares of

Common Stock multiplied by (B) the sale price of the Common Stock

at which the sell order giving rise to such purchase obligation was

executed.

|

|

|

(v)

|

Pro Rata Conversion; Disputes.

In the event the Company receives a Conversion Notice from more

than one Holder for the same Conversion Date and the Company can

convert some, but not all, of such Preferred Shares submitted for

conversion, the Company shall convert from each Holder electing to

have Preferred Shares converted on such date a pro rata amount of

such Holder’s Preferred Shares submitted for conversion on

such date based on the number of Preferred Shares submitted for

conversion on such date by such Holder relative to the aggregate

number of Preferred Shares submitted for conversion on such date.

In the event of a dispute as to the number of shares of Common

Stock issuable to a Holder in connection with a conversion of

Preferred Shares, the Company shall issue to such Holder the number

of shares of Common Stock not in dispute and resolve such dispute

in accordance with the Purchase Agreement.

|

|

|

(vi)

|

Book-Entry. Notwithstanding

anything to the contrary set forth in this Section 3, upon

conversion of any Preferred Shares in accordance with the terms

hereof, no Holder thereof shall be required to physically surrender

the certificate representing the Preferred Shares to the Company

following conversion thereof unless (A) the full or remaining

number of Preferred Shares represented by the certificate are being

converted (in which event such certificate(s) shall be delivered to

the Company as contemplated by this Section 3(c)(vi) or (B) such

Holder has provided the Company with prior written notice (which

notice may be included in a Conversion Notice) requesting

reissuance of Preferred Shares upon physical surrender of any

Preferred Shares. Each Holder and the Company shall maintain

records showing the number of Preferred Shares so converted by such

Holder and the dates of such conversions or shall use such other

method, reasonably satisfactory to such Holder and the Company, so

as not to require physical surrender of the certificate

representing the Preferred Shares upon each such conversion. In the

event of any dispute or discrepancy, such records of such Holder

establishing the number of Preferred Shares to which the record

holder is entitled shall be controlling and determinative in the

absence of manifest error. A Holder and any transferee or assignee,

by acceptance of a certificate, acknowledge and agree that, by

reason of the provisions of this paragraph, following conversion of

any Preferred Shares, the number of Preferred Shares represented by

such certificate may be less than the number of Preferred Shares

stated on the face thereof. Each certificate for Preferred Shares

shall bear the following legend:

|

ANY TRANSFEREE OR

ASSIGNEE OF THIS CERTIFICATE SHOULD CAREFULLY REVIEW THE TERMS OF

THE CORPORATION’S CERTIFICATE OF DESIGNATIONS RELATING TO THE

SHARES OF SERIES H-5 PREFERRED STOCK REPRESENTED BY THIS

CERTIFICATE, INCLUDING SECTION 3(c)(vi) THEREOF. THE NUMBER OF

SHARES OF SERIES H-5 PREFERRED STOCK REPRESENTED BY THIS

CERTIFICATE MAY BE LESS THAN THE NUMBER OF SHARES OF SERIES H-5

PREFERRED STOCK STATED ON THE FACE HEREOF PURSUANT TO SECTION

3(c)(vi) OF THE CERTIFICATE OF DESIGNATIONS RELATING TO THE SHARES

OF SERIES H-5 PREFERRED STOCK REPRESENTED BY THIS

CERTIFICATE.

|

|

(d)

|

Taxes. The Company shall pay

any and all documentary, stamp, transfer (but only in respect of

the registered holder thereof), issuance and other similar taxes

that may be payable with respect to the issuance and delivery of

shares of Common Stock upon the conversion of Preferred

Shares.

|

|

|

(e)

|

Limitation on Beneficial

Ownership.

|

|

|

(i)

|

Notwithstanding anything

to the contrary contained in this Certificate of Designations, the

Preferred Shares held by a Holder shall not be convertible by such

Holder, and the Company shall not effect any conversion of any

Preferred Shares held by such Holder, to the extent (but only to

the extent) that such Holder or any of its affiliates would

beneficially own in excess of 9.99% (the “Maximum Percentage”) of the Common

Stock. To the extent the above limitation applies, the

determination of whether the Preferred Shares held by such Holder

shall be convertible (vis-à-vis other convertible, exercisable

or exchangeable securities owned by such Holder or any of its

affiliates) and of which such securities shall be convertible,

exercisable or exchangeable (as among all such securities owned by

such Holder and its affiliates) shall, subject to such Maximum

Percentage limitation, be determined on the basis of the first

submission to the Company for conversion, exercise or exchange (as

the case may be). No prior inability of a Holder to convert

Preferred Shares, or of the Company to issue shares of Common Stock

to such Holder, pursuant to this Section 3(e) shall have any effect

on the applicability of the provisions of this Section 3(e) with

respect to any subsequent determination of convertibility or

issuance (as the case may be). For purposes of this Section 3(e),

beneficial ownership and all determinations and calculations

(including, without limitation, with respect to calculations of

percentage ownership) shall be determined in accordance with

Section 13(d) of the 1934 Act and the rules and regulations

promulgated thereunder. The provisions of this Section 3(e) shall

be implemented in a manner otherwise than in strict conformity with

the terms of this Section 3(e) to correct this Section 3(e) (or any

portion hereof) which may be defective or inconsistent with the

intended Maximum Percentage beneficial ownership limitation herein

contained or to make changes or supplements necessary or desirable

to properly give effect to such Maximum Percentage limitation. The

limitations contained in this Section 3(e) shall apply to a

successor holder of Preferred Shares. The Company may not waive

this Section 3(e) without the consent of holders of a majority of

its Common Stock. For any reason at any time, upon the written or

oral request of a Holder, the Company shall within one (1) Business

Day confirm orally and in writing to such Holder the number of

shares of Common Stock then outstanding, including by virtue of any

prior conversion or exercise of convertible or exercisable

securities into Common Stock, including, without limitation,

pursuant to this Certificate of Designations or securities issued

pursuant to the other Transaction Documents. By written notice to

the Company, any Holder may increase or decrease the Maximum

Percentage to any other percentage not in excess of 9.99% specified

in such notice; provided that (i) any such increase will not be

effective until the 61st day after such notice is delivered to the

Company, and (ii) any such increase or decrease will apply only to

such Holder sending such notice and not to any other

Holder.

|

|

4.

|

Adjustment of Conversion

Price

|

|

|

(a)

|

Subdivision or Combination of Common

Stock. Without limiting any provision of Section 9, if the

Company at any time on or after the Initial Issuance Date

subdivides (by any stock split, stock dividend, recapitalization or

otherwise) one or more classes of its outstanding shares of Common

Stock into a greater number of shares, the Conversion Price in

effect immediately prior to such subdivision will be

proportionately reduced. Without limiting any provision of Section

9, if the Company at any time on or after the Initial Issuance Date

combines (by combination, reverse stock split or otherwise) one or

more classes of its outstanding shares of Common Stock into a

smaller number of shares, the Conversion Price in effect

immediately prior to such combination will be proportionately

increased. Any adjustment pursuant to this Section 4 shall become

effective immediately after the effective date of such subdivision

or combination. If any event requiring an adjustment under this

Section 4 occurs during the period that a Conversion Price is

calculated hereunder, then the calculation of such Conversion Price

shall be adjusted appropriately to reflect such event.

|

|

|

(b)

|

Certain Anti-Dilution

Adjustments. If the Company shall, at any time while any of

the Preferred Shares are outstanding, issue any shares of its

Common Stock, other than Exempt Issuances (as defined in the

Purchase Agreement), without consideration or for a consideration

per share less than the applicable Conversion Price, then with

respect to any such issuance, the applicable Conversion Price as in

effect immediately prior to each such issuance shall forthwith be

lowered to a price equal to the issuance, conversion, exchange or

exercise price, as applicable, of any such securities so issued.

Common Stock issued or issuable by the Company for no consideration

or for consideration that cannot be determined at the time of issue

will be deemed issuable or to have been issued for the Reduced

Conversion Floor Price. For purposes of the issuance and

adjustments described in this paragraph, in the event of the

issuance of any Common Stock Equivalent, the Company shall be

deemed to have issued Common Stock at the lowest price issuable

pursuant to such Common Stock Equivalent and shall result in a

reduction of the Conversion Price pursuant to this Section 4(b)

upon each of: (i) the issuance of such Common Stock Equivalent; and

(ii) upon any subsequent issuances of shares of Common Stock upon

exercise of such Common Stock Equivalent if such issuance is at a

price lower than the Conversion Price in effect upon such issuance.

Notwithstanding the foregoing, no reduction of the Conversion Price

shall be less than twenty percent (20%) of the original Conversion

Price on the Closing Date (subject to appropriate adjustments for

stock splits, stock dividends, recapitalizations, reorganizations,

reclassifications, combinations, reverse stock splits or other

similar transactions after the Issuance Date) (the

“Reduced Conversion Floor

Price”). Notwithstanding anything herein to the

contrary, this Section 4(b) shall not apply until receipt of the

Shareholder Approval.

|

|

|

(a)

|

Reservation. The Company shall

initially reserve out of its authorized and unissued Common Stock a

number of shares of Common Stock equal to 100% of the Conversion

Rate with respect to the Conversion Amount of each Preferred Share

as of the Initial Issuance Date (assuming for purposes hereof, that

all the Preferred Shares issuable pursuant to the Purchase

Agreement have been issued, such Preferred Shares are convertible

at the Conversion Price and without taking into account any

limitations on the conversion of such Preferred Shares set forth in

herein). So long as any of the Preferred Shares are outstanding,

the Company shall take all action necessary to reserve and keep

available out of its authorized and unissued shares of Common

Stock, solely for the purpose of effecting the conversion of the

Preferred Shares, as of any given date, 100% of the number of

shares of Common Stock as shall from time to time be necessary to

effect the conversion of all of the Preferred Shares issued or

issuable pursuant to the Purchase Agreement, assuming for purposes

hereof, that all the Preferred Shares issuable pursuant to the

Purchase Agreement have been issued and without taking into account

any limitations on the issuance of securities set forth herein),

provided that at no time shall the number of shares of Common Stock

so available be less than the number of shares required to be

reserved by the previous sentence (without regard to any

limitations on conversions contained in this Certificate of

Designations) (the “Required

Amount”). The initial number of shares of Common Stock

reserved for conversions of the Preferred Shares and each increase

in the number of shares so reserved shall be allocated pro rata

among the Holders based on the number of Preferred Shares held by

each Holder on the Initial Issuance Date or increase in the number

of reserved shares (as the case may be) (the “Authorized Share Allocation”). In

the event a Holder shall sell or otherwise transfer any of such

Holder’s Preferred Shares, each transferee shall be allocated

a pro rata portion of such Holder’s Authorized Share

Allocation. Any shares of Common Stock reserved and allocated to

any Person which ceases to hold any Preferred Shares shall be

allocated to the remaining Holders of Preferred Shares, pro rata

based on the number of Preferred Shares then held by such

Holders.

|

|

|

(b)

|

Insufficient Authorized Shares.

If, notwithstanding Section 5(a) and not in limitation thereof, at

any time while any of the Preferred Shares remain outstanding the

Company does not have a sufficient number of authorized and

unissued shares of Common Stock to satisfy its obligation to have

available for issuance upon conversion of the Preferred Shares at

least a number of shares of Common Stock equal to the Required

Amount (an “Authorized Share

Failure”), then the Company shall promptly take all

reasonable action (within its control) to increase the

Company’s authorized shares of Common Stock to an amount

sufficient to allow the Company to reserve and have available the

Required Amount for all of the Preferred Shares then outstanding.

Without limiting the generality of the foregoing sentence, as soon

as practicable after the date of the occurrence of an Authorized

Share Failure, but in no event later than ninety (90) days after

the occurrence of such Authorized Share Failure, the Company shall

hold a meeting of its stockholders for the approval of an increase

in the number of authorized shares of Common Stock. In connection

with such meeting, the Company shall provide each stockholder with

a proxy statement and shall use its best efforts to solicit its

stockholders’ approval of such increase in authorized shares

of Common Stock. Nothing contained in this Section 5 shall limit

any obligations of the Company under any provision of the Purchase

Agreement.

|

|

|

6.

|

Voting Rights. Holders of

Preferred Shares shall have no voting rights, except as required by

law (including without limitation, the DGCL) and as expressly

provided in this Certificate of Designations. Subject to Section

3(e), to the extent that under the DGCL holders of the Preferred

Shares are required to vote on a matter with holders of shares of

Common Stock, voting together as one class, each Preferred Share

shall entitle the holder thereof to cast that number of votes per

share as is equal to the number of shares of Common Stock into

which it is then convertible (subject to the ownership limitations

specified in Section 3(e) hereof) using the record date for

determining the stockholders of the Company eligible to vote on

such matters as the date as of which the Conversion Price is

calculated. Holders of the Preferred Shares shall be entitled to

written notice of all stockholder meetings or written consents (and

copies of proxy materials and other information sent to

stockholders) with respect to which they would be entitled by vote,

which notice would be provided pursuant to the Company’s

bylaws and the DGCL.

|

|

|

8.

|

Liquidation, Dissolution,

Winding-Up. In the event of a Liquidation Event, the Holders

shall be entitled to receive in cash out of the assets of the

Company, whether from capital or from earnings available for

distribution to its stockholders (the “Liquidation Funds”), before any

amount shall be paid to the holders of any of shares of Junior

Stock, an amount per Preferred Share equal to the amount per share

such Holder would receive if such Holder converted such Preferred

Shares into Common Stock immediately prior to the date of such

payment, provided that if the Liquidation Funds are insufficient to

pay the full amount due to the Holders and holders of shares of

Parity Stock, then each Holder and each holder of Parity Stock

shall receive a percentage of the Liquidation Funds equal to the

full amount of Liquidation Funds payable to such Holder and such

holder of Parity Stock as a liquidation preference, in accordance

with their respective certificate of designations (or equivalent),

as a percentage of the full amount of Liquidation Funds payable to

all holders of Preferred Shares and all holders of shares of Parity

Stock. To the extent necessary, the Company shall cause such

actions to be taken by each of its Subsidiaries so as to enable, to

the maximum extent permitted by law, the proceeds of a Liquidation

Event to be distributed to the Holders in accordance with this

Section 8. All the preferential amounts to be paid to the Holders

under this Section 8 shall be paid or set apart for payment before

the payment or setting apart for payment of any amount for, or the

distribution of any Liquidation Funds of the Company to the holders

of shares of Junior Stock in connection with a Liquidation Event as

to which this Section 8 applies.

|

|

|

9.

|

Participation. In addition to

any adjustments pursuant to Section 4, the Holders shall, as

holders of Preferred Shares, be entitled to receive such dividends

paid and distributions made to the holders of shares of Common

Stock to the same extent as if such Holders had converted each

Preferred Share held by each of them into shares of Common Stock

(without regard to any limitations on conversion herein or

elsewhere) and had held such shares of Common Stock on the record

date for such dividends and distributions. Payments under the

preceding sentence shall be made concurrently with the dividend or

distribution to the holders of shares of Common Stock (provided,

however, to the extent that a Holder’s right to participate

in any such dividend or distribution would result in such Holder

exceeding the Maximum Percentage, then such Holder shall not be

entitled to participate in such dividend or distribution to such

extent (or the beneficial ownership of any such shares of Common

Stock as a result of such dividend or distribution to such extent)

and such dividend or distribution to such extent shall be held in

abeyance for the benefit of such Holder until such time, if ever,

as its right thereto would not result in such Holder exceeding the

Maximum Percentage).

|

|

|

10.

|

Vote to Change the Terms of or Issue

Preferred Shares. In addition to any other rights provided

by law, except where the vote or written consent of the holders of

a greater number of shares is required by law or by another

provision of the Certificate of Incorporation, without first

obtaining the affirmative vote at a meeting duly called for such

purpose or the written consent without a meeting of the Required

Holders, voting together as a single class, the Company shall not:

(a) amend or repeal any provision of, or add any provision to, its

Certificate of Incorporation or bylaws, or file any certificate of

designations or certificate of amendment, if such action would

adversely alter or change in any respect the preferences, rights,

privileges or powers, or restrictions provided for the benefit, of

the Preferred Shares, regardless of whether any such action shall

be by means of amendment to the Certificate of Incorporation or by

merger, consolidation or otherwise; provided, however, the Company

shall be entitled, without the consent of the Required Holders

unless such consent is otherwise required by the DGCL, to amend the

Certificate of Incorporation to effectuate one or more reverse

stock splits of its issued and outstanding Common Stock for

purposes of maintaining compliance with the rules and regulations

of the Principal Market; or (b) without limiting any provision of

Section 13, whether or not prohibited by the terms of the Preferred

Shares, circumvent a right of the Preferred Shares.

|

|

|

11.

|

Lost or Stolen Certificates.

Upon receipt by the Company of evidence reasonably satisfactory to

the Company of the loss, theft, destruction or mutilation of any

certificates representing Preferred Shares (as to which a written

certification and the indemnification contemplated below shall

suffice as such evidence), and, in the case of loss, theft or

destruction, of an indemnification undertaking by the applicable

Holder to the Company in customary and reasonable form and, in the

case of mutilation, upon surrender and cancellation of the

certificate(s), the Company shall execute and deliver new

certificate(s) of like tenor and date.

|

|

|

12.

|

Remedies, Characterizations, Other

Obligations, Breaches and Injunctive Relief. The

remedies provided in this Certificate of Designations shall be

cumulative and in addition to all other remedies available under

this Certificate of Designations and any of the other Transaction

Documents, at law or in equity (including a decree of specific

performance and/or other injunctive relief), and no remedy

contained herein shall be deemed a waiver of compliance with the

provisions giving rise to such remedy. Nothing herein shall limit

any Holder’s right to pursue actual and consequential damages

for any failure by the Company to comply with the terms of this

Certificate of Designations.. Amounts set forth or provided for

herein with respect to payments, conversion and the like (and the

computation thereof) shall be the amounts to be received by a

Holder and shall not, except as expressly provided herein, be

subject to any other obligation of the Company (or the performance

thereof). The Company acknowledges that a breach by it of its

obligations hereunder will cause irreparable harm to the Holders

and that the remedy at law for any such breach may be inadequate.

The Company therefore agrees that, in the event of any such breach

or threatened breach, each Holder shall be entitled, in addition to

all other available remedies, to an injunction restraining any such

breach or any such threatened breach, without the necessity of

showing economic loss and without any bond or other security being

required, to the extent permitted by applicable law. The Company

shall provide all information and documentation to a Holder that is

requested by such Holder to enable such Holder to confirm the

Company’s compliance with the terms and conditions of this

Certificate of Designations.

|

|

|

13.

|

Noncircumvention. The Company

hereby covenants and agrees that the Company will not, by amendment

of its Certificate of Incorporation, bylaws or through any

reorganization, transfer of assets, consolidation, merger, scheme

of arrangement, dissolution, issue or sale of securities, or any

other voluntary action, avoid or seek to avoid the observance or

performance of any of the terms of this Certificate of

Designations, and will at all times in good faith carry out all the

provisions of this Certificate of Designations and take all action

as may be required to protect the rights of the Holders. Without

limiting the generality of the foregoing or any other provision of

this Certificate of Designations, the Company (i) shall not

increase the par value of any shares of Common Stock receivable

upon the conversion of any Preferred Shares above the Conversion

Price then in effect without the consent or vote of the Required

Holders, (ii) shall take all such actions as may be necessary or

appropriate in order that the Company may validly and legally issue

fully paid and non-assessable shares of Common Stock upon the

conversion of Preferred Shares and (iii) shall, so long as any

Preferred Shares are outstanding, take all action necessary to

reserve and keep available out of its authorized and unissued

shares of Common Stock, solely for the purpose of effecting the

conversion of the Preferred Shares, the maximum number of shares of

Common Stock as shall from time to time be necessary to effect the

conversion of the Preferred Shares then outstanding (without regard

to any limitations on conversion contained herein).

|

|

|

14.

|

Failure or Indulgence Not

Waiver. No failure or delay on the part of a Holder in the

exercise of any power, right or privilege hereunder shall operate

as a waiver thereof, nor shall any single or partial exercise of

any such power, right or privilege preclude other or further

exercise thereof or of any other right, power or privilege. No

waiver shall be effective unless it is in writing and signed by an

authorized representative of the waiving party. This Certificate of

Designations shall be deemed to be jointly drafted by the Company

and all Holders and shall not be construed against any Person as

the drafter hereof.

|

|

|

15.

|

Notices. The Company shall

provide each Holder of Preferred Shares with prompt written notice

of all actions taken pursuant to the terms of this Certificate of

Designations, including in reasonable detail a description of such

action and the reason therefor. Whenever notice is required to be

given under this Certificate of Designations, unless otherwise

provided herein, such notice must be in writing and shall be given

in accordance with Section 5.4 of the Purchase Agreement. Without

limiting the generality of the foregoing, the Company shall give

written notice to each Holder (i) promptly following any adjustment

of the Conversion Price, setting forth in reasonable detail, and

certifying, the calculation of such adjustment and (ii) at least

fifteen (15) days prior to the date on which the Company closes its

books or takes a record (A) with respect to any dividend or

distribution upon the Common Stock, (B) with respect to any grant,

issuances, or sales of any Options, Convertible Securities or

rights to purchase stock, warrants, securities or other property to

all holders of shares of Common Stock as a class or (C) for

determining rights to vote with respect to any dissolution or

liquidation, provided, in each case, that such information shall be

made known to the public prior to, or simultaneously with, such

notice being provided to any Holder.

|

|

|

16.

|

Preferred Shares Register. The

Company shall maintain at its principal executive offices (or such

other office or agency of the Company as it may designate by notice

to the Holders), a register for the Preferred Shares, in which the

Company shall record the name, address, E-mail address and

facsimile number of the Persons in whose name the Preferred Shares

have been issued, as well as the name and address of each

transferee. The Company may treat the Person in whose name any

Preferred Shares is registered on the register as the owner and

holder thereof for all purposes, notwithstanding any notice to the

contrary, but in all events recognizing any properly made

transfers.

|

|

17.

|

Stockholder Matters;

Amendment.

|

|

|

(a)

|

Stockholder Matters. Any

stockholder action, approval or consent required, desired or

otherwise sought by the Company pursuant to the DGCL, the

Certificate of Incorporation, this Certificate of Designations or

otherwise with respect to the issuance of Preferred Shares may be

effected by written consent of the Company’s stockholders or

at a duly called meeting of the Company’s stockholders, all

in accordance with the applicable rules and regulations of the

DGCL.

|

|

|

(b)

|

Amendment. This Certificate of

Designations or any provision hereof may be amended by obtaining

the affirmative vote at a meeting duly called for such purpose, or

written consent without a meeting in accordance with the DGCL, of

the Required Holders, voting separate as a single class, and with

such other stockholder approval, if any, as may then be required

pursuant to the DGCL and the Certificate of

Incorporation.

|

|

|

18.

|

Certain Defined Terms. For

purposes of this Certificate of Designations, the following terms

shall have the following meanings:

|

|

|

(a)

|

“1934 Act” means the

Securities Exchange Act of 1934, as amended.

|

|

|

(b)

|

“Bloomberg” means Bloomberg,

L.P.

|

|

|

(c)

|

“Business Day” means any day other

than Saturday, Sunday or other day on which commercial banks in The

City of New York are authorized or required by law to remain

closed.

|

|

|

(d)

|

“Closing Bid Price” and

“Closing Sale

Price” means, for any security as of any date, the

last closing bid price and last closing trade price, respectively,

for such security on the Principal Market, as reported by

Bloomberg, or, if the Principal Market begins to operate on an

extended hours basis and does not designate the closing bid price

or the closing trade price (as the case may be) then the last bid

price or last trade price, respectively, of such security prior to

4:00:00 p.m., New York time, as reported by Bloomberg, or, if the

Principal Market is not the principal securities exchange or

trading market for such security, the last closing bid price or

last trade price, respectively, of such security on the principal

securities exchange or trading market where such security is listed

or traded as reported by Bloomberg, or if the foregoing do not

apply, the last closing bid price or last trade price,

respectively, of such security in the over-the-counter market on

the electronic bulletin board for such security as reported by

Bloomberg, or, if no closing bid price or last trade price,

respectively, is reported for such security by Bloomberg, the

average of the bid prices, or the ask prices, respectively, of any

market makers for such security as reported in the “pink

sheets” by OTC Markets Group Inc. (formerly Pink Sheets LLC).

If the Closing Bid Price or the Closing Sale Price cannot be

calculated for a security on a particular date on any of the

foregoing bases, the Closing Bid Price or the Closing Sale Price

(as the case may be) of such security on such date shall be the

fair market value as mutually determined by the Company and the

applicable Holder. If the Company and such Holder are unable to

agree upon the fair market value of such security, then such

dispute shall be resolved in accordance with the procedures in the

Purchase Agreement. All such determinations shall be appropriately

adjusted for any stock dividend, stock split, stock combination or

other similar transaction during such period.

|

|

|

(e)

|

“Common Stock” means (i) the

Company’s shares of common stock, $0.0001 par value per

share, and (ii) any capital stock into which such common stock

shall have been changed or any share capital resulting from a

reclassification of such common stock.

|

|

|

(f)

|

“Common Stock Equivalents” means

any securities of the Company or its Subsidiaries which would

entitle the holder thereof to acquire at any time Common Stock,

including, without limitation, any debt, preferred stock, right,

option, warrant or other instrument that is at any time convertible

into or exercisable or exchangeable for, or otherwise entitles the

holder thereof to receive, Common Stock.

|

|

|

(g)

|

“Conversion Amount” means, with

respect to each Preferred Share, as of the applicable date of

determination, the Stated Value thereof.

|

|

|

(h)

|

“Conversion Price” means, with

respect to each Preferred Share, as of any Conversion Date or other

applicable date of determination, $0.72, subject to adjustment as

provided herein.

|

|

|

(i)

|

“Convertible Securities” means any

stock or other security (other than Options) that is at any time

and under any circumstances, directly or indirectly, convertible

into, exercisable or exchangeable for, or which otherwise entitles

the holder thereof to acquire, any shares of Common

Stock.

|

|

|

(j)

|

“Eligible Market” means The New

York Stock Exchange, the NYSE American, the Nasdaq Global Select

Market, the Nasdaq Global Market or the Principal

Market.

|

|

|

(k)

|

“Initial Issuance Date” means

December 6, 2019.

|

|

|

(l)

|

“Liquidation Event” means, whether

in a single transaction or series of transactions, the voluntary or

involuntary liquidation, dissolution or winding up of the Company

or such Subsidiaries the assets of which constitute all or

substantially all of the assets of the business of the Company and

its Subsidiaries, taken as a whole.

|

|

|

(m)

|

“Options” means any rights,

warrants or options to subscribe for or purchase shares of Common

Stock or Convertible Securities.

|

|

|

(n)

|

“Person” means an individual, a

limited liability company, a partnership, a joint venture, a

corporation, a trust, an unincorporated organization, any other

entity or a government or any department or agency

thereof.

|

|

|

(o)

|

“Principal Market” means the Nasdaq

Capital Market.

|

|

|

(p)

|

“Purchase Agreement” means that

certain Securities Purchase Agreement, dated as of December 6,

2019, by and among the Company and the purchasers signatory

thereto.

|

|

|

(q)

|

“Required Holders” means the

holders of at least 2/3rds of the outstanding Preferred

Shares.

|

|

|

(r)

|

“Securities” means, collectively,

the Preferred Shares and the shares of Common Stock issuable upon

conversion of the Preferred Shares.

|

|

|

(s)

|

“Shareholder Approval” means such

approval as may be required by the applicable rules and regulations

of the Nasdaq Stock Market (or any successor entity) from the

shareholders of the Company with respect to the transactions

contemplated by the Transaction Documents, including the inclusion

of Section 4(b).

|

|

|

(t)

|

“SPA Warrants” means, collectively,

the Common Stock purchase warrants delivered pursuant to the

Purchase Agreement.

|

|

|

(u)

|

“Stated Value” shall mean $72.00

per share, subject to adjustment for stock splits, stock dividends,

recapitalizations, reorganizations, reclassifications,

combinations, subdivisions or other similar events occurring after

the Initial Issuance Date with respect to the Preferred

Shares.

|

|

|

(v)

|

“Subsidiary” means any Person in

which the Company, directly or indirectly, (i) owns a majority of

the outstanding capital stock or holds a majority of equity or

similar interest of such Person or (ii) controls or operates all or

any part of the business, operations or administration of such

Person.

|

|

|

(w)

|

“Trading Day” means any day on

which the Common Stock is traded on the Principal Market, or, if

the Principal Market is not the principal trading market for the

Common Stock, then on the principal securities exchange or

securities market on which the Common Stock is then traded,

provided that “Trading Day” shall not include any day

on which the Common Stock is scheduled to trade on such exchange or

market for less than 4.5 hours or any day that the Common Stock is

suspended from trading during the final hour of trading on such

exchange or market (or if such exchange or market does not

designate in advance the closing time of trading on such exchange

or market, then during the hour ending at 4:00:00 p.m., New York

time) unless such day is otherwise designated as a Trading Day in

writing by the Required Holders.

|

|

|

(x)

|

“Transaction Documents” means this

Certificate of Designations, the Purchase Agreement and each of the

other agreements and instruments entered into or delivered by the

Company or any of the Holders in connection with the transactions

contemplated thereby, all as may be amended from time to time in

accordance with the terms hereof or thereof.

|

|

|

19.

|

Disclosure. Upon receipt or

delivery by the Company of any notice in accordance with the terms

of this Certificate of Designations, unless the Company has in good

faith determined that the matters relating to such notice do not

constitute material, non-public information relating to the Company

or any of its Subsidiaries, the Company shall simultaneously with

any such receipt or delivery publicly disclose such material,

non-public information on a Current Report on Form 8-K or

otherwise. In the event that the Company believes that a notice

contains material, non-public information relating to the Company

or any of its Subsidiaries, the Company so shall indicate to each

Holder contemporaneously with delivery of such notice, and in the

absence of any such indication, each Holder shall be allowed to

presume that all matters relating to such notice do not constitute

material, non-public information relating to the Company or its

Subsidiaries.

|

[signature page follows]

IN WITNESS WHEREOF,

the Corporation has caused this Certificate of Designations of

Series H-5 Convertible Preferred Stock of DropCar, Inc. to be

signed by its Chairman of the Board of Directors on this 6th day of

December, 2019.

|

|

DROPCAR, INC.

|

|

|

|

|

|

|

By:

|

/s/ Joshua

Silverman

|

|

|

|

Name:

|

Joshua

Silverman

|

|

|

|

Title:

|

Chairman of the

Board

|

[Signature Page to Certificate of Designations

of Series H-5 Convertible Preferred Stock]

EXHIBIT I

DROPCAR INC.

CONVERSION NOTICE

Reference is made

to the Certificate of Designations, Preferences and Rights of the

Series H-5 Convertible Preferred Stock of DropCar, Inc. (the

“Certificate of

Designations”). In accordance with and pursuant to the

Certificate of Designations, the undersigned hereby elects to

convert the number of shares of Series H-5 Convertible Preferred

Stock, $0.0001 par value per share (the “Preferred Shares”), of DropCar,

Inc., a Delaware corporation (the “Company”), indicated below into

shares of common stock, $0.0001 value per share (the

“Common Stock”),

of the Company, as of the date specified below.

|

|

Number of Preferred

Shares to be converted:

|

|

|

|

Share certificate no(s).

of Preferred Shares to be converted:

|

|

|

|

Tax ID Number (If

applicable):

|

|

|

|

Number of shares of

Common Stock to be issued:

|

|

Please issue the

shares of Common Stock into which the Preferred Shares are being

converted in the following name and to the following

address:

|

|

Account Number (if

electronic book entry transfer):

|

|

|

|

|

Transaction Code Number

(if electronic book entry transfer):

|

|

|

EXHIBIT II

ACKNOWLEDGMENT

The Company hereby

acknowledges this Conversion Notice and hereby directs [ ] to issue

the above indicated number of shares of Common Stock in accordance

with the Irrevocable Transfer Agent Instructions dated __________,

20____ from the Company and acknowledged and agreed to by [

].

|

|

DROPCAR, INC.

|

|

|

|

|

|

|

By:

|

|

|

|

Name:

|

|

|

|

Title:

|

|

AMENDMENT TO THE

CERTIFICATE OF DESIGNATIONS, PREFERENCES AND RIGHTS

OF THE SERIES H-4 CONVERTIBLE PREFERRED STOCK OF DROPCAR,

INC.

This Amendment to the Certificate of Designation

of Preferences, Rights and Limitations of the Series H-4

Convertible Preferred Stock (this “Amendment”) is dated as of December 20,

2019.

WHEREAS, the board of directors

(“Board of

Directors”) of DropCar,

Inc., a Delaware corporation (the “Company”), pursuant to authority granted to it by

the certificate of incorporation of the Company, has previously

fixed the rights, preferences, restrictions and other matters

relating to a series of the Company’s preferred stock,

consisting of 30,000 authorized shares of preferred stock,

classified as Series H-4 Convertible Preferred Stock (the

“Series H-4 Preferred

Stock”) and the

Certificate of Designations, Preferences and Rights of the Series

H-4 Convertible Preferred Stock (the “Certificate of

Designation”) was filed

with the Secretary of State of the State of Delaware on March 8,

2018, evidencing such terms;

WHEREAS, the holders (the

“Holders”) are the record and beneficial owners of

certain shares of Series H-4 Preferred Stock, issued pursuant to

that certain (a) Securities Purchase Agreement, dated as of March

8, 2018, by and between the Company and the purchasers party

thereto and (b) the Certificate of Designation;

WHEREAS, pursuant to Section 17(b) of the

Certificate of Designation, any of the rights, powers, preferences

and other terms of the Series H-4 Preferred Stock may be waived or

amended on behalf of all holders of Series H-4 Preferred Stock by

the affirmative written consent or vote of the holders of at least

two-thirds of the shares of Series H-4 Preferred Stock then

outstanding (the “Required

Holders”);

WHEREAS, the Holders constitute the Required

Holders pursuant to the Certificate of Designation and have

consented in writing, in accordance with Section 228 of the General

Corporation Law of the State of Delaware (the

“DGCL”), on December 20, 2019, to this Amendment

on the terms set forth herein;

WHEREAS,

the Board of Directors has duly adopted resolutions proposing to

adopt this Amendment and declaring this Amendment to be advisable

and in the best interest of the Company and its stockholders;

and

WHEREAS, the Holders have agreed to convert their

shares of Series H-4 Preferred Stock into shares of common stock,

par value $0.0001 per share, of the Company (the

“Common Stock”) pursuant to Section 3 of the Certificate

of Designation, as amended by this Amendment, upon receipt of

Shareholder Approval (as defined below).

NOW,

THEREFORE, this Amendment has been duly adopted in accordance with

Section 242 of the DGCL and has been executed by a duly authorized

officer of the Company as of the date first set forth above to

amend the terms of the Certificate of Designation as

follows:

1. Capitalized

Terms. Unless otherwise

specified in this Amendment, all terms herein shall have the same

meanings ascribed to them in the Certificate of

Designation.

2. Amendment to Section

18(h). Section 18(h) of the

Certificate of Designation is hereby amended and restated in its

entirety as follows:

“Conversion

Price” shall initially

mean, with respect to each Preferred Share, as of any conversion

date or other applicable date of determination, $2.355, subject to

adjustment as provided herein, but shall be amended to be equal to

$0.50, upon receipt of shareholder approval pursuant to Nasdaq

Listing Rule 5635(a) (“Shareholder

Approval”). Such

Conversion Price, and the rate at which the Preferred Shares may be

converted into shares of Common Stock, shall be subject to

adjustment as provided herein. For the avoidance of doubt, any

adjustments made to the Conversion Price after December 20, 2019

but prior to receipt of Shareholder Approval shall be made

equitably and proportionately to the Conversion Price following

Shareholder Approval.”

3. Amendment to Section

3(f). Section 3(f) of the

Certificate of Designation is hereby amended and restated in its

entirety to add a new Section 3(f) as follows:

“3(f) Each

Preferred Share shall, automatically and without further action on

the part of any holder thereof, be converted effective upon,

subject to, and concurrently with, the receipt of the Shareholder

Approval, into a number of fully paid and nonassessable shares of

Common Stock calculated based on the then-applicable Conversion

Rate (after giving effect to the amendment thereto occurring upon

receipt of the Shareholder Approval as provided in Section 18(h)).

Each holder of any Preferred Shares converted pursuant to this

Section 3(f) shall deliver to the Company during regular business

hours at the office of any transfer agent of the Company for the

Preferred Shares, or at such other place as may be designated by

the Company, the certificate or certificates for the shares so

converted, duly endorsed or assigned in blank or to the Company. As

promptly as practicable thereafter, the Company shall issue and

deliver to such holder, at the place designated by such holder, a

certificate or certificates for the number of full shares of the

Common Stock to be issued and such holder shall be deemed to have

become a stockholder of record of Common Stock on the date of

receipt of the Shareholder Approval unless the transfer books of

the Company are closed on that date, in which event he, she or it

shall be deemed to have become a stockholder of record of Common

Stock on the next succeeding date on which the transfer books are

open.”

4. No Other

Amendment. Except for the

matters set forth in this Amendment, all other terms of the

Certificate of Designation and the Preferred Shares shall remain

unchanged and in full force and effect.

[REMAINDER

OF PAGE INTENTIONALLY LEFT BLANK]

IN

WITNESS WHEREOF, each of the parties has caused this Amendment to

be executed by its duly authorized representatives.

DROPCAR, INC.

|

By:

|

/s/ Joshua

Silverman

|

|

|

Name:

|

Joshua

Silverman

|

|

|

Title:

|

Chairman of the

Board

|

|

CERTIFICATE

OF DESIGNATIONS, PREFERENCES AND RIGHTS OF THE

SERIES

H-6 CONVERTIBLE PREFERRED STOCK OF

DROPCAR,

INC.

I, Spencer

Richardson, hereby certify that I am the Chief Executive Officer of

DropCar, Inc. (the “Company”), a corporation organized

and existing under the Delaware General Corporation Law (the

“DGCL”), and

further do hereby certify:

That pursuant to

the authority expressly conferred upon the Board or Directors (the

“Board”) by the

Company’s Certificate of Incorporation, as amended (the

“Certificate of

Incorporation”), the Board on January 29, 2020 adopted

the following resolutions creating a series of 50,000 shares of

Preferred Stock designated as Series H-6 Convertible Preferred

Stock, none of which shares have been issued:

RESOLVED, that the

Board designates the Series H-6 Convertible Preferred Stock and the

number of shares constituting such series, and fixes the rights,

powers, preferences, privileges and restrictions relating to such

series in addition to any set forth in the Certificate of

Incorporation as follows:

TERMS

OF SERIES H-6 CONVERTIBLE PREFERRED STOCK

1.

Designation and

Number of Shares. There shall hereby be created and established a

series of preferred stock of the Company designated as

“Series H-6 Convertible Preferred Stock” (the

“Preferred Shares

”). The authorized number of Preferred Shares shall be 50,000

shares. Each Preferred Share shall have a par value of $0.0001.

Capitalized terms not defined herein shall have the meaning as set

forth in Section 18 below.

2.

Ranking. Except

with respect to any current series of preferred stock of senior

rank to the Preferred Shares in respect of the preferences as to

dividends, distributions and payments upon the liquidation,

dissolution and winding up of the Company (collectively, the

“Senior Preferred

Stock ”) and any current or future series of preferred

stock of pari passu rank to the Preferred Shares in respect of the

preferences as to dividends, distributions and payments upon the

liquidation, dissolution and winding up of the Company, which, as

of the date hereof, consists of Series H Convertible Preferred

Stock, Series H-3 Convertible Preferred Stock, Series H-4

Convertible Preferred Stock and Series H-5 Convertible Preferred

Stock (collectively, the “Parity Stock”), all shares of

capital stock of the Company shall be junior in rank to all

Preferred Shares with respect to the preferences as to dividends,

distributions and payments upon the liquidation, dissolution and

winding up of the Company (collectively, the “Junior Stock”). The rights of all

such shares of capital stock of the Company shall be subject to the

rights, powers, preferences and privileges of the Preferred Shares.

In the event of the merger or consolidation of the Company with or

into another corporation, the Preferred Shares shall maintain their

relative rights, powers, designations, privileges and preferences

provided for herein and no such merger or consolidation shall

result inconsistent therewith. For the avoidance of doubt, in no

circumstance will a Preferred Share have any rights subordinate or

otherwise inferior to the rights of shares of Parity Stock or

Common Stock (as defined below).

3.

Conversion. Each

Preferred Share shall be convertible into validly issued, fully

paid and non-assessable shares of Common Stock on the terms and

conditions set forth in this Section 3.

(a)

Holder’s

Conversion Right. Subject to the provisions of Section 3(e)), at

any time or times on or after the Initial Issuance Date, each

holder of a Preferred Share (each, a “Holder ” and collectively, the

“Holders”) shall

be entitled to convert any whole number of Preferred Shares into

validly issued, fully paid and non-assessable shares of Common

Stock in accordance with Section 3(c) at the Conversion Rate (as

defined below).

(b)

Conversion Rate.

The number of validly issued, fully paid and non-assessable shares

of Common Stock issuable upon conversion of each Preferred Share

pursuant to Section 3(a) shall be determined according to the

following formula (the “Conversion Rate ”):

Conversion Amount

Conversion

Price

No fractional

shares of Common Stock are to be issued upon the conversion of any

Preferred Shares. If the issuance would result in the issuance of a

fraction of a share of Common Stock, the Company shall round such

fraction of a share of Common Stock up to the nearest whole

share.

(c)

Mechanics of

Conversion. The conversion of each Preferred Share shall be

conducted in the following manner:

(i)

Holder’s

Conversion. To convert a Preferred Share into validly issued, fully

paid and non-assessable shares of Common Stock on any date (a

“Conversion Date

”), a Holder shall deliver (whether via electronic mail,

facsimile or otherwise), for receipt on or prior to 11:59 p.m., New

York time, on such date, a copy of an executed notice of conversion

of the share(s) of Preferred Shares subject to such conversion in

the form attached hereto as Exhibit

I (the “Conversion

Notice”) to the Company. If required by Section

3(c)(vi), within five (5) Trading Days following a conversion of

any such Preferred Shares as aforesaid, such Holder shall surrender

to a nationally recognized overnight delivery service for delivery

to the Company the original certificates representing the share(s)

of Preferred Shares (the “Preferred Share Certificates”) so

converted as aforesaid.

(ii)

Company’s

Response. On or before the first (1st ) Trading Day

following the date of receipt of a Conversion Notice, the Company

shall transmit by electronic mail or facsimile an acknowledgment of

confirmation, in the form attached hereto as Exhibit II, of receipt of such

Conversion Notice to such Holder and the Company’s transfer

agent (the “Transfer

Agent”), which confirmation shall constitute an

instruction to the Transfer Agent to process such Conversion Notice

in accordance with the terms herein. On or before the second

(2nd)

Trading Day following the date of receipt by the Company of such

Conversion Notice, the Company shall (1) provided that (x) the

Transfer Agent is participating in the Depository Trust Company

(“DTC”) Fast

Automated Securities Transfer Program and (y) Common Stock shares

to be so issued are otherwise eligible for resale pursuant to Rule

144 promulgated under the Securities Act of 1933, as amended,

credit such aggregate number of shares of Common Stock to which

such Holder shall be entitled to such Holder’s or its

designee’s balance account with DTC through its

Deposit/Withdrawal at Custodian system, or (2) if either of the

immediately preceding clauses (x) or (y) are not satisfied, issue

and deliver (via reputable overnight courier) to the address as

specified in such Conversion Notice, a certificate, registered in

the name of such Holder or its designee, for the number of shares

of Common Stock to which such Holder shall be entitled. If the

number of Preferred Shares represented by the Preferred Share

Certificate(s) submitted for conversion pursuant to Section

3(c)(vi) is greater than the number of Preferred Shares being

converted, then the Company shall if requested by such Holder, as

soon as practicable and in no event later than three (3) Trading

Days after receipt of the Preferred Share Certificate(s) and at its

own expense, issue and deliver to such Holder (or its designee) a

new Preferred Share Certificate representing the number of

Preferred Shares not converted.

(iii)

Record

Holder. The Person or Persons entitled to receive the shares of

Common Stock issuable upon a conversion of Preferred Shares shall

be treated for all purposes as the record holder or holders of such

shares of Common Stock on the Conversion Date.

(iv)

Company’s

Failure to Timely Convert. If the Company shall fail, for any

reason or for no reason, to issue to a Holder within three (3)

Trading Days after the Company’s receipt of a Conversion

Notice (whether via electronic mail, facsimile or otherwise) (the

“Share Delivery

Deadline ”), a certificate for the number of shares of

Common Stock to which such Holder is entitled and register such

shares of Common Stock on the Company’s share register or to

credit such Holder’s or its designee’s balance account

with DTC for such number of shares of Common Stock to which such

Holder is entitled upon such Holder’s conversion of any

Preferred Shares (as the case may be) (a “Conversion Failure”), then, in

addition to all other remedies available to such Holder, such

Holder, upon written notice to the Company, may void its Conversion

Notice with respect to, and retain or have returned (as the case

may be) any Preferred Shares that have not been converted pursuant

to such Holder’s Conversion Notice, provided that the voiding

of a Conversion Notice shall not affect the Company’s

obligations to make any payments which have accrued prior to the

date of such notice pursuant to the terms of this Certificate of

Designations or otherwise. In addition to the foregoing, if within

three (3) Trading Days after the Company’s receipt of a

Conversion Notice (whether via electronic mail, facsimile or

otherwise), the Company shall fail to issue and deliver a

certificate to such Holder and register such shares of Common Stock

on the Company’s share register or credit such Holder’s

or its designee’s balance account with DTC for the number of

shares of Common Stock to which such Holder is entitled upon such

Holder’s conversion hereunder (as the case may be), and if on

or after such third (3rd) Trading Day such

Holder (or any other Person in respect, or on behalf, of such

Holder) purchases (in an open market transaction or otherwise)

shares of Common Stock to deliver in satisfaction of a sale by such

Holder of all or any portion of the number of shares of Common

Stock, or a sale of a number of shares of Common Stock equal to all

or any portion of the number of shares of Common Stock, issuable

upon such conversion that such Holder so anticipated receiving from

the Company, then, in addition to all other remedies available to

such Holder, the Company shall, within three (3) Business Days

after such Holder’s request, which request shall include

reasonable documentation of all broker fees, costs and expenses and

in such Holder’s discretion, either (i) pay cash to such

Holder in an amount equal to such Holder’s total purchase

price (including brokerage commissions and other reasonable out of

pocket expenses related to the Buy-In, if any) for the shares of

Common Stock so purchased (including, without limitation, by any

other Person in respect, or on behalf, of such Holder) (the

“Buy-In Price”),

at which point the Company’s obligation to so issue and

deliver such certificate or credit such Holder’s balance

account with DTC for the number of shares of Common Stock to which

such Holder is entitled upon such Holder’s conversion

hereunder (as the case may be) (and to issue such shares of Common

Stock) shall terminate, or (ii) promptly honor its obligation to so

issue and deliver to such Holder a certificate or certificates

representing such shares of Common Stock or credit such

Holder’s balance account with DTC for the number of shares of

Common Stock to which such Holder is entitled upon such

Holder’s conversion hereunder (as the case may be) and pay

cash to such Holder in an amount equal to the excess (if any) of

the Buy-In Price over the product of (A) such number of shares of

Common Stock multiplied by (B) the sale price of the Common Stock

at which the sell order giving rise to such purchase obligation was

executed.

(v)

Pro

Rata Conversion; Disputes. In the event the Company receives a

Conversion Notice from more than one Holder for the same Conversion

Date and the Company can convert some, but not all, of such

Preferred Shares submitted for conversion, the Company shall

convert from each Holder electing to have Preferred Shares

converted on such date a pro rata amount of such Holder’s

Preferred Shares submitted for conversion on such date based on the

number of Preferred Shares submitted for conversion on such date by

such Holder relative to the aggregate number of Preferred Shares

submitted for conversion on such date. In the event of a dispute as

to the number of shares of Common Stock issuable to a Holder in

connection with a conversion of Preferred Shares, the Company shall

issue to such Holder the number of shares of Common Stock not in

dispute and resolve such dispute in accordance with Section 6 of

the Exchange Agreement.

(vi)

Book-Entry.

Notwithstanding anything to the contrary set forth in this Section

3, upon conversion of any Preferred Shares in accordance with the

terms hereof, no Holder thereof shall be required to physically

surrender the certificate representing the Preferred Shares to the

Company following conversion thereof unless (A) the full or

remaining number of Preferred Shares represented by the certificate

are being converted (in which event such certificate(s) shall be

delivered to the Company as contemplated by this Section 3(c)(vi)

or (B) such Holder has provided the Company with prior written

notice (which notice may be included in a Conversion Notice)

requesting reissuance of Preferred Shares upon physical surrender

of any Preferred Shares. Each Holder and the Company shall maintain

records showing the number of Preferred Shares so converted by such

Holder and the dates of such conversions or shall use such other

method, reasonably satisfactory to such Holder and the Company, so

as not to require physical surrender of the certificate

representing the Preferred Shares upon each such conversion. In the

event of any dispute or discrepancy, such records of such Holder

establishing the number of Preferred Shares to which the record

holder is entitled shall be controlling and determinative in the

absence of manifest error. A Holder and any transferee or assignee,

by acceptance of a certificate, acknowledge and agree that, by

reason of the provisions of this paragraph, following conversion of